Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptos flash green as BTC blasts through $30,000

- Bitcoin price has breached the $30,000 level for the first time since June 2022, but momentum indicators suggest a looming correction.

- Ethereum price could rise 5% to tag the $2,000 resistance level ahead of Shanghai/Capella upgrade.

- Ripple price could rally almost 10% if buyer momentum takes it above the $0.51 resistance level.

Bitcoin price (BTC) is trading with a positive bias after bulls flocked to the market to breach a key barrier. However, a pullback seems near sight. Nevertheless, altcoins seem to conform to the BTC dominance with Ethereum price (ETH) and Ripple price (XRP) flashing green ahead of positive network developments.

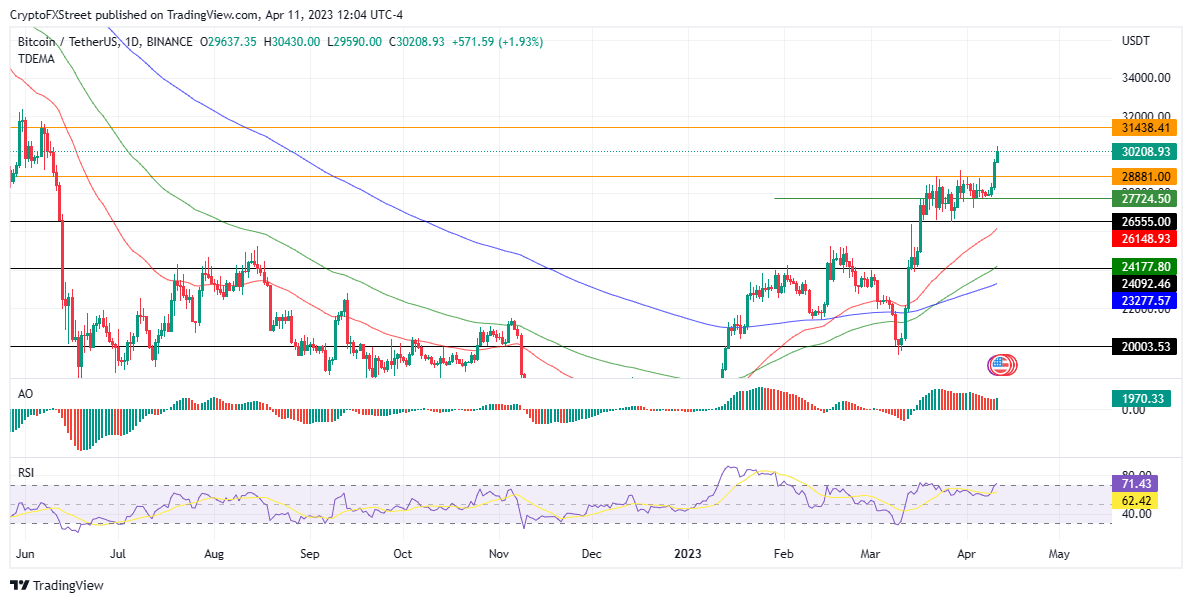

Bitcoin price could pullback before a steadfast uptrend

Bitcoin price breached the $30,000 level on April 11 to exchange hands for $30,208 at the time of writing. The king crypto boasts four consecutive green bars on the daily chart as bulls take the lead. However, based on the position of the Relative Strength Index (RSI) at 71, it appears BTC is overbought and a correction may be due.

If this happens, Bitcoin price could retrace south, losing the support at $28,881 before another leg down to the $27,724 support level. A pullback to this area could spark fear among investors, causing them to hedge their positions to avoid further losses.

An increase in selling pressure from the aforementioned position could send Bitcoin price lower to the $26,555 support level right before confronting the 50-day Exponential Moving Average (EMA) at $26,148.

In the dire case, Bitcoin price could plunge to tag the support confluence due to the horizontal line and the 100-day EMA at $24,177. This would be the ideal turnaround point for bulls to kickstart a northbound move.

BTC/USDT 1-day chart

Conversely, if buyer momentum increases above the current price of $30,208, Bitcoin price could ascend to breach the immediate barrier at $30,487. In highly bullish cases, the king crypto could reach up to tag the $31,438 barricade. A tactical use of this supplier congestion zone could pave the way for a continuation toward the psychological $34,000.

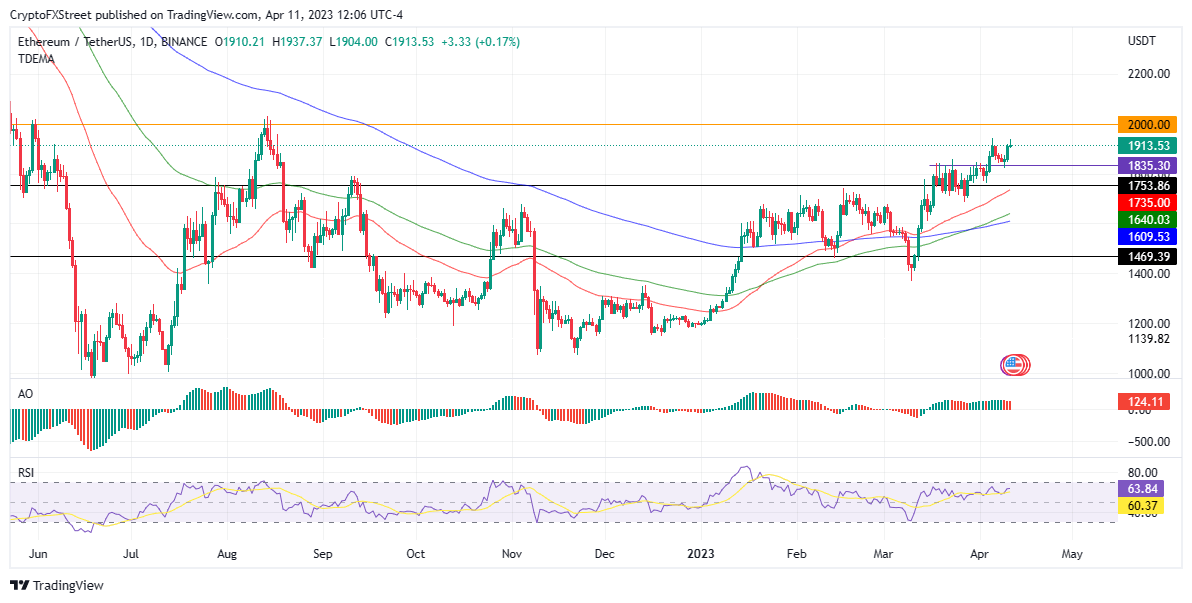

Ethereum price could rise 5% in the days leading to the Shanghai Upgrade

Ethereum price identified a pivot on April 9, using the $1,835 support level as the turnaround point for a recovery rally. The uptick came as the countdown to the Shanghai/Capella upgrade continues, with investors presumably hoping to benefit from the “sell the news” event.

Accordingly, with the upgrade scheduled for April 12, investors should expect more gains for Ethereum price, potentially rising 5% to tag the $2,000 level. The position of the RSI at 63 also adds credence to this thesis, indicating there was still more room for the upside before the largest altcoin was overbought.

ETH/USDT 1-day chart

Nevertheless, if smart traders already anticipate a similar price action to what was witnessed before and after The Merge, early profit takers could start booking theirs soon. If this happens, the Ethereum price could drop toward the $1,835 support level.

An increase in selling momentum below this level could see Ethereum price find support at the $1,753 level, around where the April rally started.

Ripple price readies for a bullish breakout

Ripple price could explode almost 10% if bulls breach the $0.51 resistance level. A decisive candlestick close above this critical barrier could lead to a notable surge, pushing XRP to new local highs around $0.59.

To get there, however, XRP bulls must overcome the $0.55 resistance level, a move that could trigger a significant surge in buying activity, potentially leading to a rally that could solidify the uptrend for the remittance token.

XRP/USDT 1-day chart

Nevertheless, the future for XRP remains at the balance given the pending summary judgment by Judge Analisa Torres on the Ripple versus SEC case. A ruling in favor of the regulator could trigger a sell-off among XRP holders, causing Ripple price to dive south.

In such a motion, Ripple price could revisit the $0.48 support level or, in the dire case, plunge towards the support confluence due to the horizontal line and the 50-day EMA at $0.44.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.