Ripple price could drop 5% as XRP trading volume indicates a lack of initiative among bulls

- Ripple price continues to trade horizontally as trading volume shows a lack of initiative.

- XRP could drop 5% to the $0.48 support level before the end of the week.

- A daily candlestick close above $0.52 could invalidate the bearish thesis.

Ripple price continued to trade horizontally for almost two consecutive weeks as both bulls and bears showed a lack of initiative. The token's trading volume adds credence to the waning investor interest as it was only up by a meager value. Presumably, this lack of momentum comes as investors wait for the long-overdue ruling in Ripple's legal tussle with the Securities and Exchanges Commission (SEC).

Ripple price readies for a 5% downswing

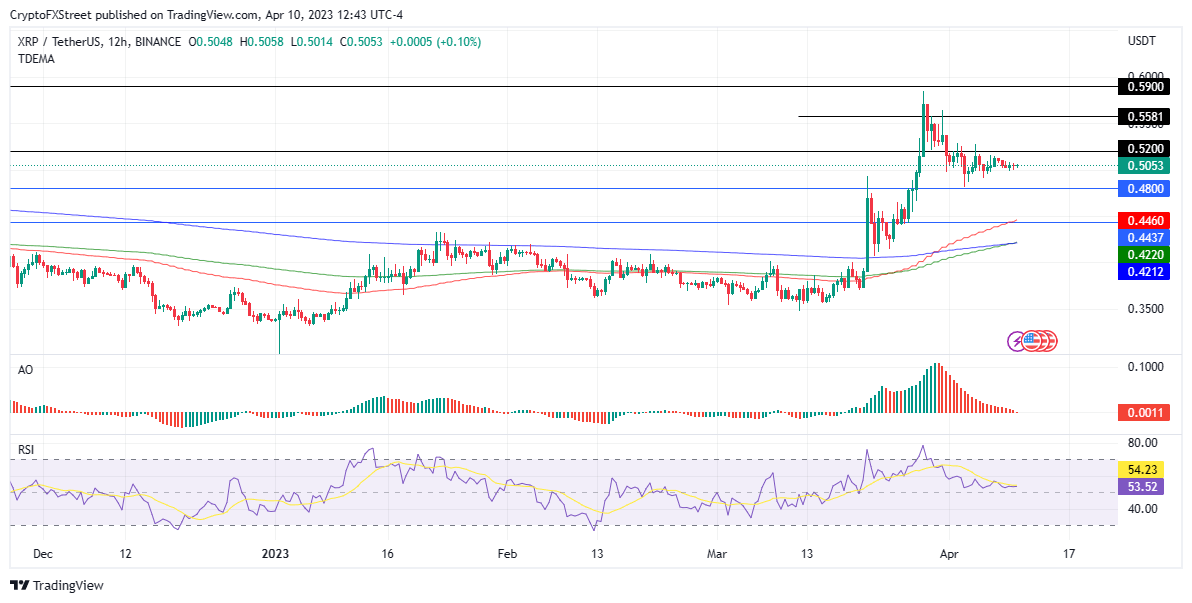

Ripple price has been trapped in a fixed supplier zone for weeks after a rejection from the $0.52 level on April 2. The $0.48 support level has been critical for the remittance token, preventing XRP from plunging in market value. The declining volume also confirms the waning interest among community members. At the time of writing, the altcoin is auctioning for $0.51 after losing almost 3% in the last 24 hours.

A look at the Ripple price trajectory on the lower timeframes indicates that the altcoin is readying for a downswing as bullish effort slowly wears down. If this continues, XRP could lose more ground as the price approaches the immediate support level at $0.48 within the week.

The $0.48 support level would be the ideal bouncing-off point where bulls could kickstart another rally north. Accordingly, investors should expect an uptrend once XRP retests this level.

However, if the critical support fails to hold, Ripple price could break through it and find the next base at $0.44 due to the 50-day Exponential Moving Average (EMA). In the dire case, the altcoin could descend to tag the confluence between the 200- and 100-day EMAs at $0.42.

XRP/USDT 12-hour chart

The bearish supposition for Ripple price is supported by the appearance of the Awesome Oscillator, which has been dropping and is about to flatten out along the mean line. This indicates that bears are steadily taking control.

The Relative Strength Index (RSI) also flattened out to show a lack of momentum in the XRP market.

On-chain metric shows volume drop for Ripple

Santiment data shows a drop in transaction volume for XRP, indicating that investors are hesitant to inject buy volume into Ripple.

As a result of the decreasing volume, the bears come back with more downside action or volume to the downside. This leads to further drops in Ripple price.

Conversely, if bullish momentum increases, the Ripple price could rise and shatter the immediate barricade at $0.52. A decisive flip of this roadblock into support would invalidate the bearish thesis.

Beyond $0.52, Ripple price could scale higher to tag the $0.55 resistance level, denoting a 10% climb from its current market rate of $0.51.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B20.57.26%2C%252010%2520Apr%2C%25202023%5D-638167484408921400.png&w=1536&q=95)