Ethereum Price: On-chain metrics show why ETH is capped under $2,000

- Ethereum price has been trapped between the $1,800 and $1,900 range for the past week.

- Declining whale activity and flat exchange balances suggest a contemplative mood among ETH traders.

- ETH could struggle to breach the $2,000 resistance.

Ethereum price (ETH) has been unable to record more gains for weeks, with on-chain data revealing that Ether whales remain skeptical. Similarly, the easing supply of coins on exchanges indicates that investors could be looking to book short-term profits.

Ethereum price stagnation explained using on-chain metrics

Based on Santiment data, Ether transactions worth $100,000 and above have dropped significantly as the Shanghai/Capella upgrade countdown continues.

From the chart above, the ETH whale transaction count has dropped steadily over the past month, declining 84% from 14,655 transactions on March 11 to a meager 2,346 transactions as of the end of day April 10.

The whales’ activity often serves as a primary indicator of market sentiment, such that fewer transactions point to low confidence in the short-term price prospects of the token. Accordingly, retail investors could also grow less interested.

A flattening supply of Ether on exchanges also points to a negative short-term outlook for Ethereum. In this regard, as ETH witnessed a price uptick in late March, investors started moving tokens out of exchanges.

As shown, Ethereum outflows have flattened since the onset of April. Nevertheless, between March 31 and April 10, ETH Supply on Exchanges remained relatively fixed at 12.49 million coins.

The trend represented in the chart suggests that Ethereum investors are holding ETH on exchanges with hopes of cashing in on short-term trading opportunities instead of storing them in cold wallets. Notably, cold wallets, otherwise termed offline wallets, would position them for future profits.

As such, this leaves large supply volumes requisite for fulfilling buy orders without causing significant upward pressure.

Simply put, the drop in whale transactions and the steady supply of coins on exchanges are significant obstacles to the explosion in Ethereum price.

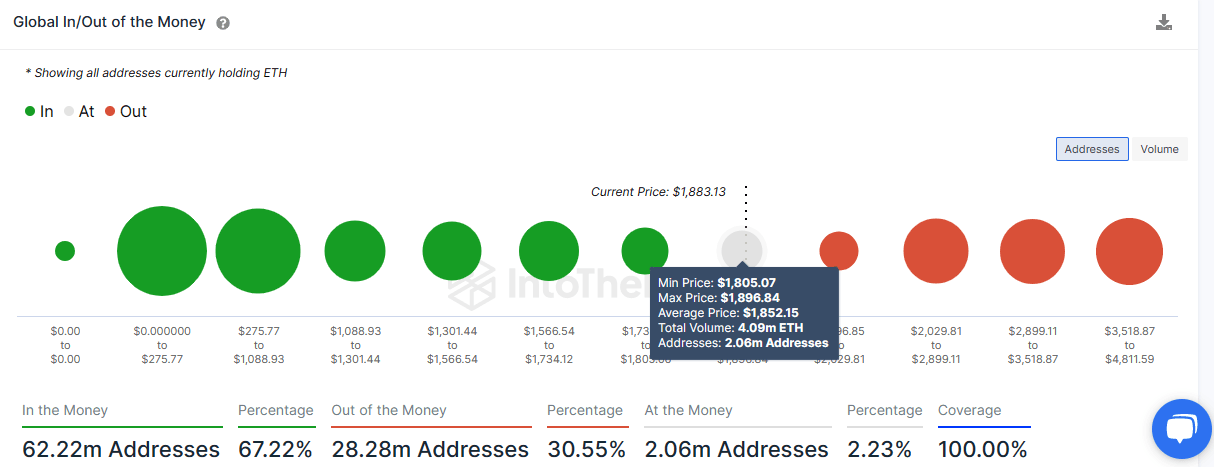

Ethereum price faces a major resistance level, IntoTheBlock data shows

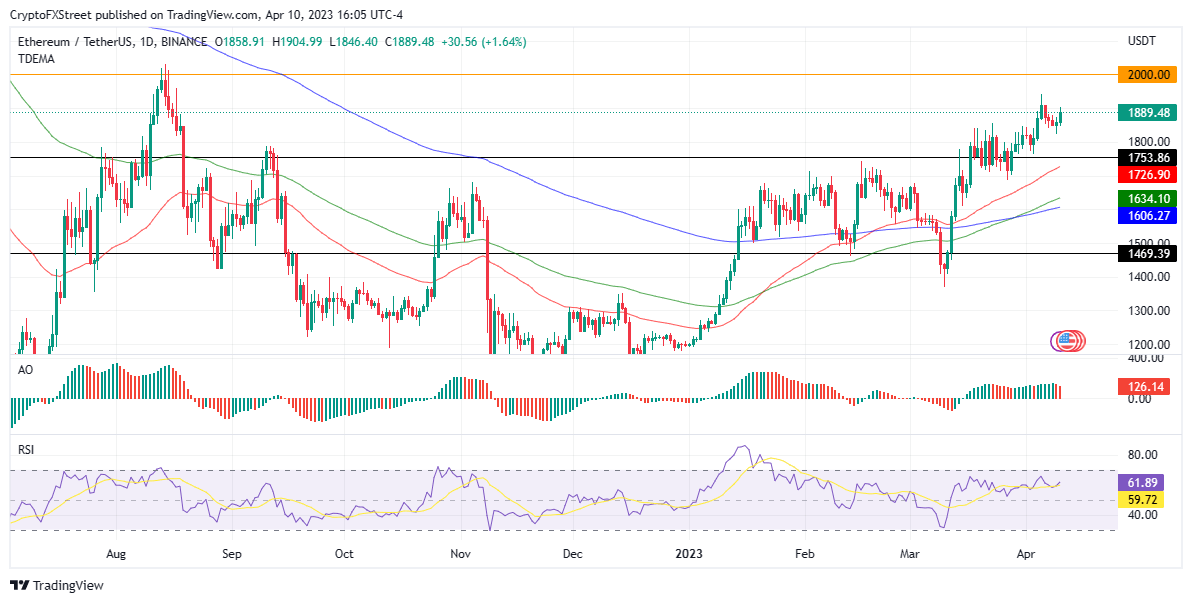

At the time of writing, Ethereum is auctioning for $1,889 after gaining almost 2% in the last 24 hours. Over the same timeframe, the altcoin’s trading volume is up almost 30% to $7.76 billion. However, the price has been unable to forge a path onward.

ETH/USDT 12-hour chart

Data from IntoTheBlock’s Global In/Out of Money Around Price (GIOMAP) indicates that if bulls show reluctance and Ethereum price drops below the $1,835 support level, bears could quickly take control.

Nevertheless, the 2.06 million addresses purchased up to 4.09 million ETH between the $1,805 to $1,896 price range will provide support. Failure of this support level to hold could see the PoS token plunge further to the $1,753 support level.

Conversely, Ethereum price could increase and break above the $2,000 barrier if sidelined investors jump in.

However, a cohort of around 1.7 million addresses that bought almost 1.84 million ETH tokens at prices just under $2,000 could look to sell after breaking even. In highly bullish cases, Ethereum price could ascend to the psychological $2,500 resistance level.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B22.32.10%2C%252010%2520Apr%2C%25202023%5D-638167571873632745.png&w=1536&q=95)

%2520%5B22.47.28%2C%252010%2520Apr%2C%25202023%5D-638167572167068896.png&w=1536&q=95)