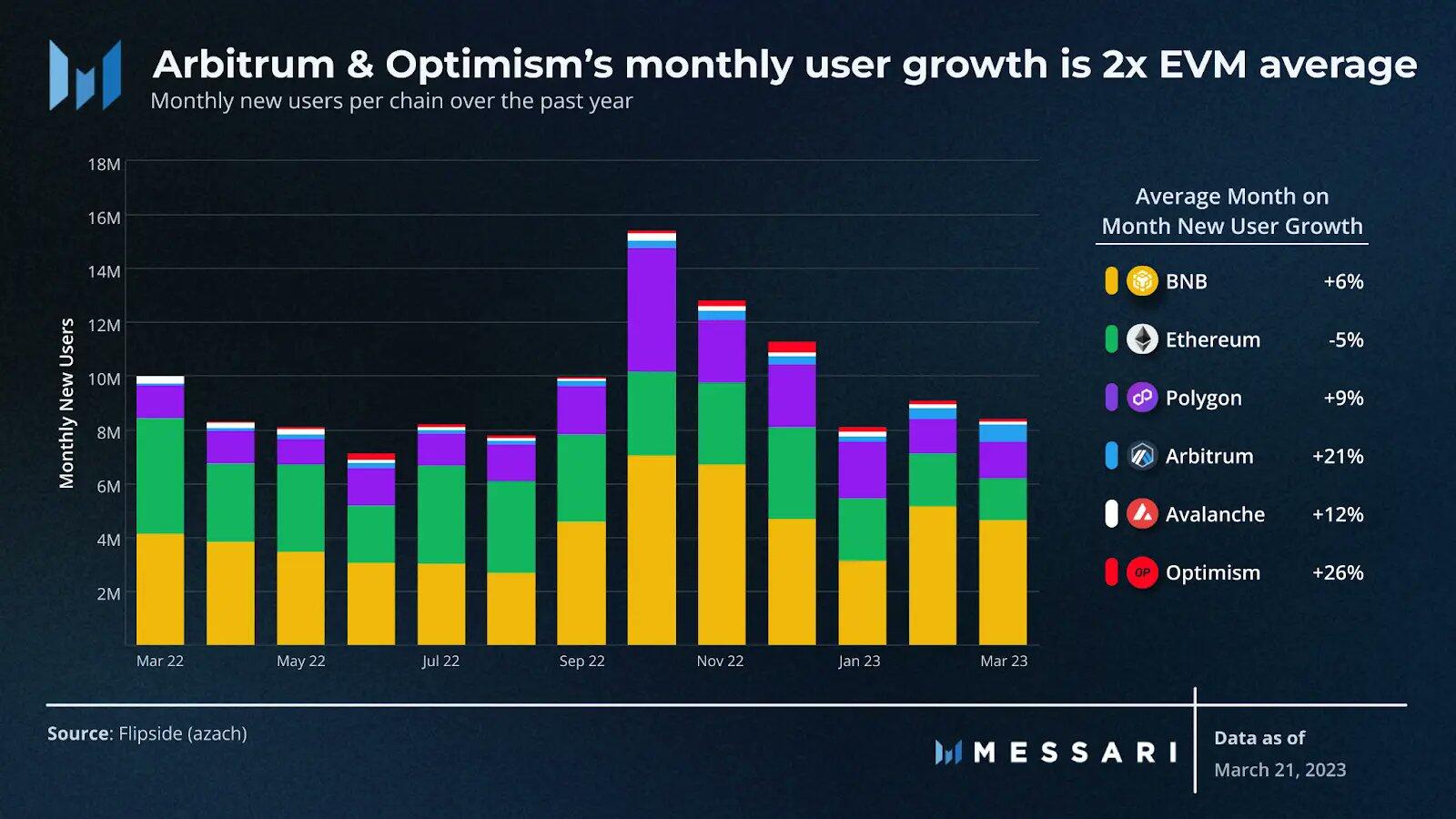

- Arbitrum and Optimism are noting twice the monthly user growth than the Ethereum Virtual Machine (EVM) average.

- Ethereum dominates DeFi, but the growing Layer-2 narrative boosts platforms like Arbitrum, challenging its dominance.

- Further facilitating Arbitrum’s growth was the native ARB token launch that put the chain at par with other L2.

Arbitrum became the highlight of the month as the Layer-2 (L2) blockchain launched its native token, ARB. Since then, the L2 narrative that was once the talking point of 2022 has exploded again, with users now jumping to these alternatives over the likes of Layer-1 chains like Ethereum.

Ethereum losses are L2’s gains

Over the last few weeks, L2 blockchains have noted a lot of attention, but the growth in their presence goes back to last year. At the same time, Ethereum, despite having the largest user base, has been noting a decrease in monthly user growth. Binance’s BNB Chain has been reaping the benefits from this as the declining Ethereum user base moved over.

However, the reason behind Ethereum’s declining user base goes back to the rise of L2 demand, which has been enjoyed by Arbitrum and Optimism, the leading Layer-2 blockchains. Over the last 12 months, the average month-on-month new users on Arbitrum have increased to 21%, while for Optimism, the figure stands at 26%. The growth for BNB Chain and Ethereum fell to 6% and -5%, respectively.

Monthly user base growth over the last year

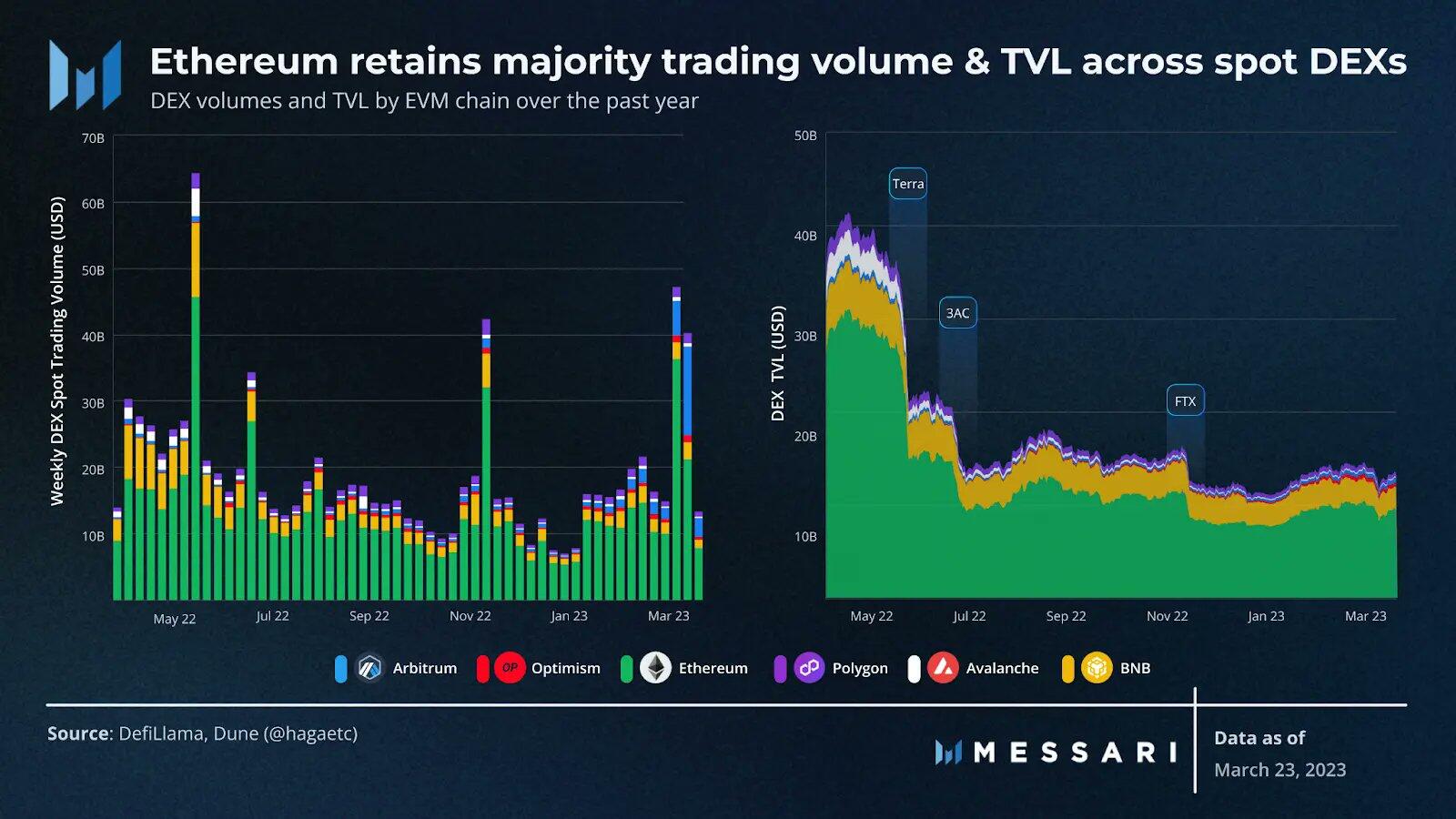

Nevertheless, despite having lower user base growth, Etheruem holds far better user retention. Considering Ethereum is known as the home of Decentralized Finance (DeFi) with over 720 on-chain protocols, and in the DeFi sector, the network has a far better grip than other L1 or L2 chains.

Etheruem monthly user retention (DEXes)

In the Decentralized Exchange (DEX) sector alone, Ethereum has a 5% higher long-term user retention among the likes of BNB Chain and Arbitrum. DEXes is the largest sector in the DeFi space, with over $18 billion locked in total value over 750 protocols. The reason behind Ethereum’s sustained user base here is the deeper liquidity that it offers among its native DEXes.

L2s Arbitrum and Optimism are also catching up by maintaining above-average long-term user retention. This is primarily due to the DeFi space expanding rapidly, providing higher incentives to investors.

ARB token could help Arbitrum’s case

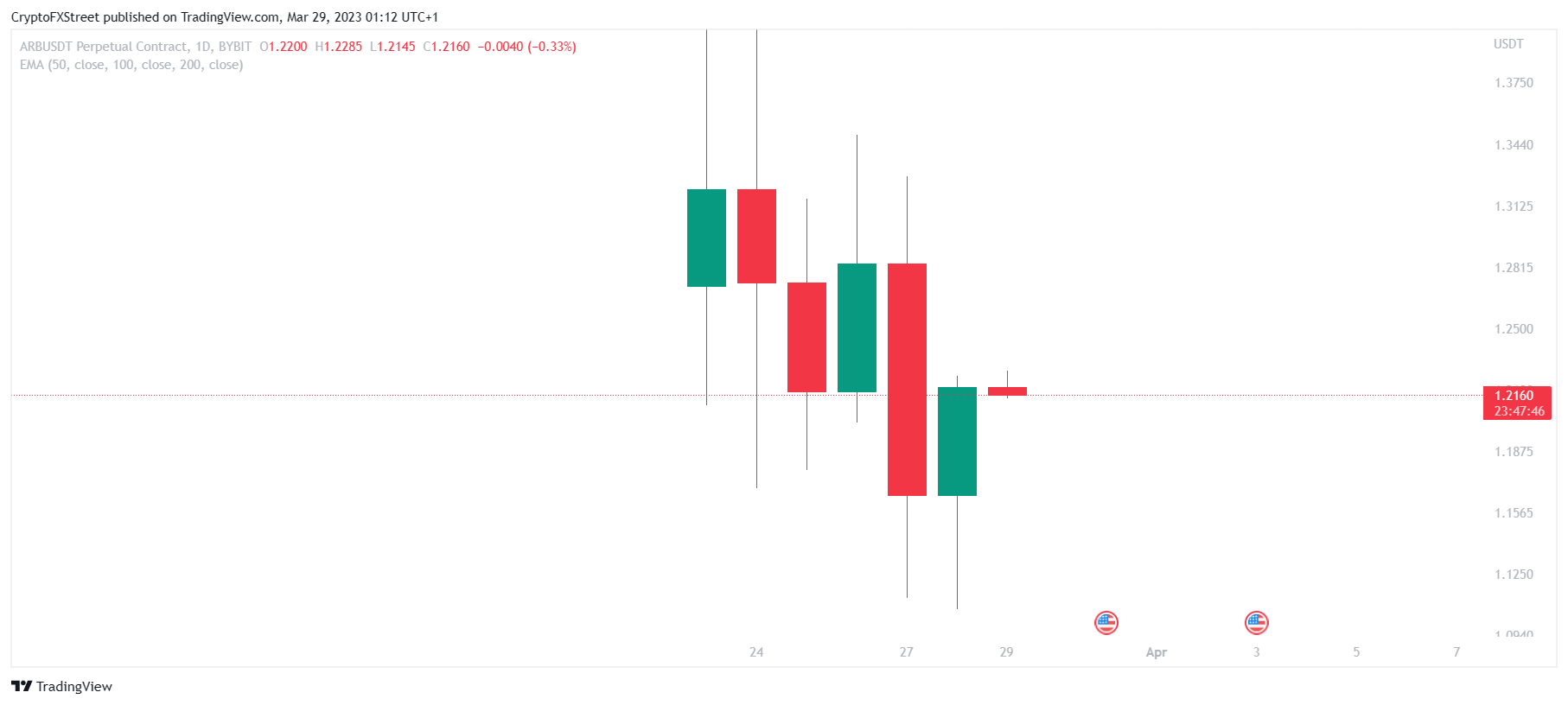

The recent launch of the token was met with mixed reactions as the cryptocurrency noted significant selling immediately after the airdrop first took place. In the week since then, ARB has been maintaining a bearish outlook, with the altcoin falling by 9.2% 24 hours ago.

ARB/USD 1-day chart

For ARB to help Arbitrum’s case, it needs to initiate and sustain a rally that could be achieved with the help of sincere buyers. Although considering the current market conditions, securing profits appears to be the primary motivation of investors, which could change to a long-term bullish stance if the crypto market shows some sustained growth.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin price reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum price holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple price coils up for a move north as XRP bulls defend $0.5000.

Jack Dorsey's Block is under investigation by US Prosecutors for crypto lapses, says NBC

According to a report from NBC on Wednesday, former Twitter CEO Jack Dorsey's company, Block, is under investigation by the US federal government. The allegations against the company are charges of processing transactions linked to sanctioned countries and even terrorists.

Ethereum attempts comeback after Fed decision not to tamper with rates

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana (SOL) price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.