These on-chain metrics suggest Chainlink price will fall hard again

- Chainlink price shows an uptick in transaction volume.

- LINK price has lost 30% of market value during August.

- Invalidation of the bearish thesis is a closing candle above $10.

-637336005550289133_XtraLarge.jpg)

On-chain analysis of Chainlink price hints at a bearish stronghold.

Chainlink price is highly risky

Chainlink price shows bearish signals underneath the hood that investors should be aware of. Since August 15, the Ethereum-based decentralized blockchain oracle token has fallen 36%. During the final trading week of August, the bulls have managed to recoup 6% of those losses.

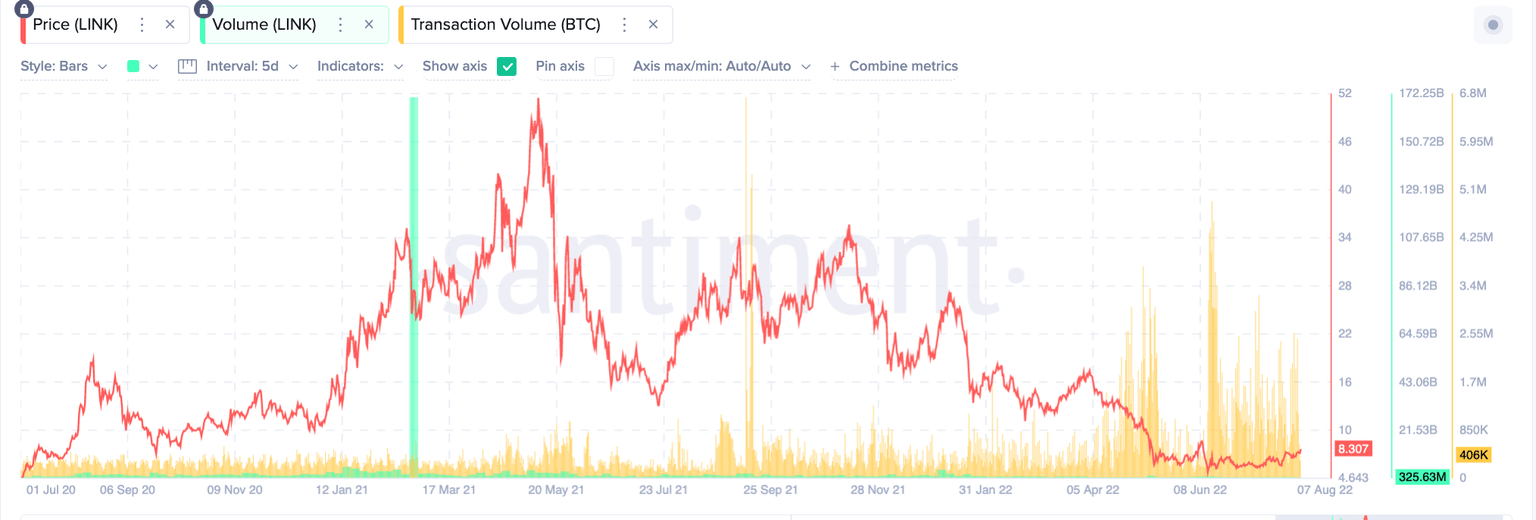

Chainlink price currently trades at $6.60. Although many traders would like to see a larger pullback, counterscaping the Chain Link price would be extremely risky. Santiment's Transaction Volume shows a significant uptick. Historically, since inception, large transaction spikes have resulted in cataclysmic sell-offs.

Santiment’s Price, Volume & Transaction Volume Indicators

Additionally, the overall trading volume is relatively sparse on all exchanges. In theory, retail traders may be the only ones buying Chain Link right now as smart money's influence is not present on the Volume Profile indicator.

Chainlink price seems extremely risky based on the on-chain analysis. Traders may want to consider a reactionary response to the next big move rather than buying early. Invalidation of the bearish thesis is a breach above $!0. A breach above$10 with an uptick in volume could prompt the next Chainlink Bullrun to target $18 in the midterm.

In the following video, our analysts deep-dive into Chainlink's price action, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.