The Graph Price Forecast: GRT on the brink of another leg up to $5

- The Graph nears a breakout despite the resistance at $2.5.

- A bull flag pattern on the 12-hour chart adds credence to the bullish outlook.

- GRT’s declining network growth may hinder the expected breakout.

The Graph has corrected from the all-time high, close to $3, and is seeking support, slightly above $2. On the downside, support at $1.6 came in handy, stopping the token from dropping further. The 12-hour chart illustrates the formation of a bull flag pattern, likely to put GRT back on the trajectory toward $5.

Bulls intensify the fight for recovery

Price action has been limited under $2.5, hence the need for higher support, preferably above $2. The bull flag pattern mainly occurs in shorter timeframes and suggests that the asset will continue with its previous trend. After the trend resumes, price action is usually rapid hence the need to time the breakout position for entry.

GRT/USD 12-hour chart

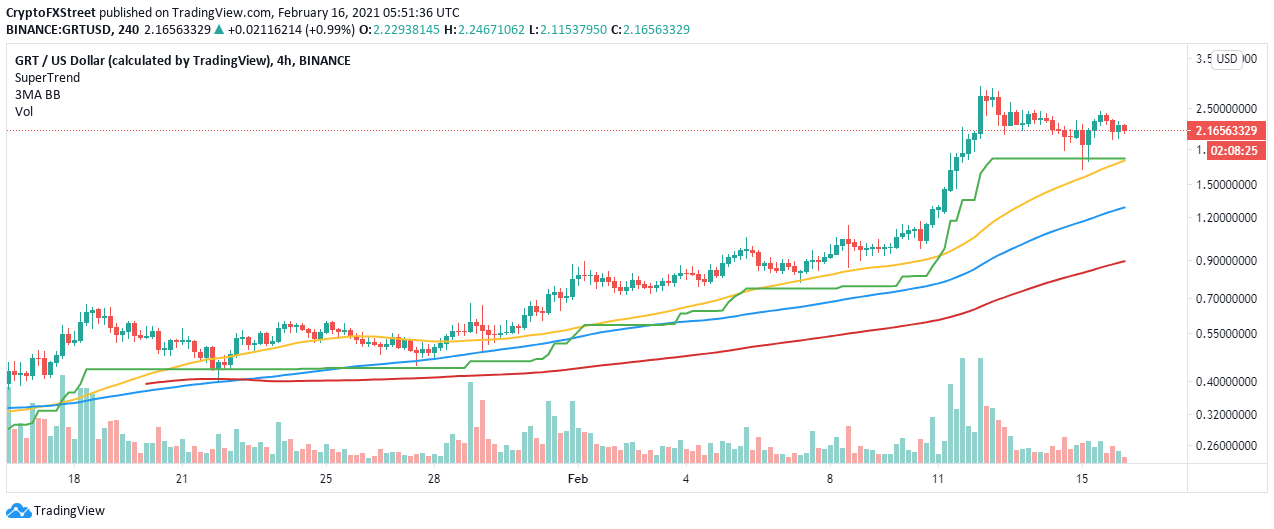

The 4-hour SuperTrend indicator shows that The Graph is still in the bulls’ hands. The bullish impulse is likely to catapult the token past the hurdles at $2.5 and $3. Moreover, The GRT is trading above all the three applied moving averages, including the 50 Simple Moving Average (SMA), the 100 SMA, and the 200 SMA. The wide gap made by the 50 SMA above the other two indicators reinforces the buyers’ increasing influence over the price.

GRT/USD 4-hour chart

Looking at the other side fence

According to the “Daily Active Addresses” model by IntoTheBlock, the ongoing selling pressure might have come to the picture amid a declining network growth. The number of newly-created addresses on the network recently dropped from roughly 4,400, recorded on February 12 to 913 on February 15.

The Graph new addresses chart

It is worth noting that a declining network growth is a bearish signal, showing the token is losing traction. Mainstream adoption of the project is also impacted and may lead to further losses in the future while invalidating the anticipated upswing.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637490524792428001.png&w=1536&q=95)