Terra Luna Classic Price Prediction: Capitulation followed by a rebound?

- Luna Classic price wipes nine weeks of liquidity during the recent 25% downswing.

- LUNC could retest the range high near $0.000019500.

- Invalidation of the countertrend idea would come from a breach of the daily low at $0.000012956.

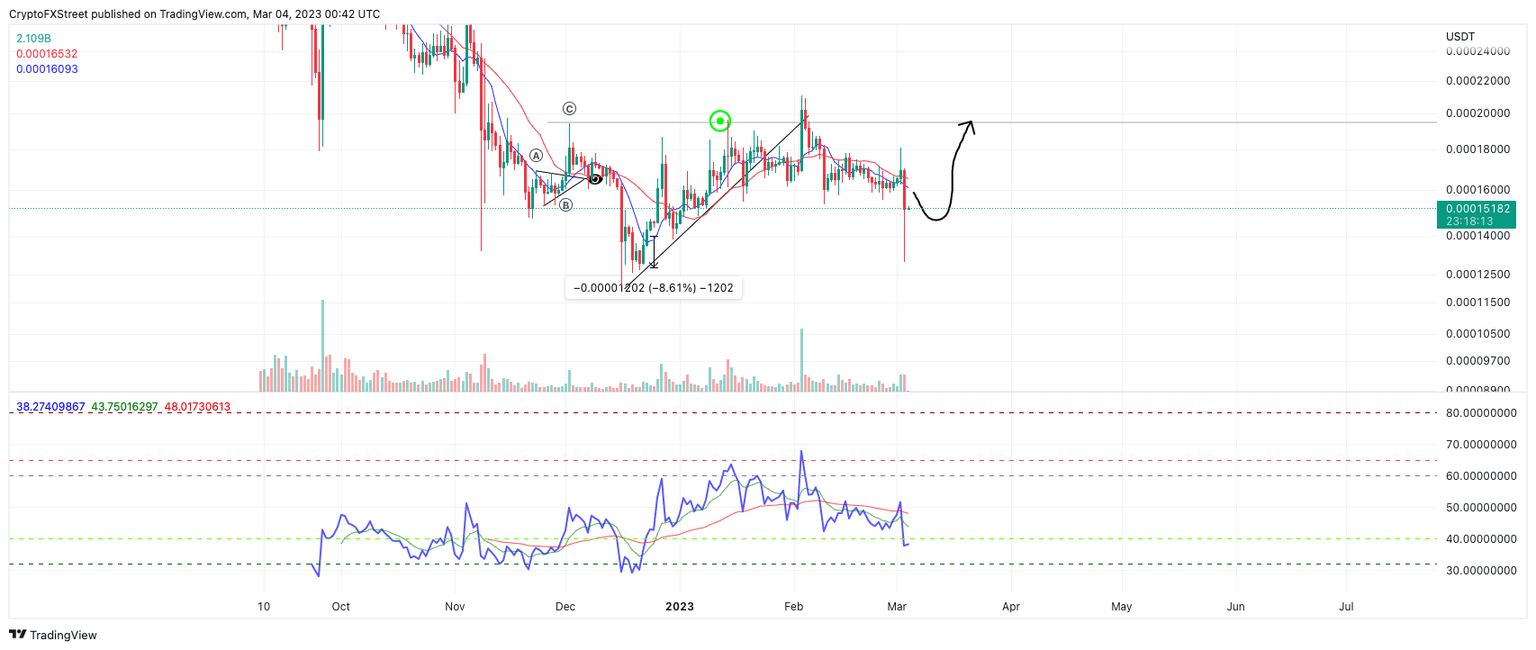

Luna Classic price displays a capitulation event as the bears have induced a 20% liquidity hunt during the first week of March. At the time of writing, the LUNC price shows a rebounding surge on smaller time frames as short-term bulls have recovered 17% of losses since the spike of the $0.00012956 level occurred. Nonetheless, the bears have won a significant battle as the daily candlestick has settled at a 10% loss from March 3's opening price.

Luna Classic price currently auctions at $0.00015182. The large downswing was catalyzed by a rejection of the 8-day exponential moving average and 21-day simple moving averages. The move south is likely to induce significant volatility as the breach wiped out nine weeks of established liquidity, breaching the December 23 low at $0.00012848.

The Relative Strength Index (RSI)shows the recent decline as testing the last level of support near 40. So long as support is maintained, the bulls could reroute north to retest the upper levels of the nine-week trading range near $0.00019500. The countertrend pump would result in a 30% increase from LUNC’s current market value.

LUNC/USDT 1-Day Chart

As mentioned, the bullish thesis is a highly speculative and risky countertrend idea. A breach below the recent swing low at $0.00012956 would invalidate the bullish potential and likely induce a decline toward the all-time lows at $0.00012100. LUNC would decline by 22% if the bears were to succeed.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.