Taproot Wizards launches script so haters can now reject Ordinals on Bitcoin

In a bizarre game of consensus chicken, a contributor to Taproot Wizards — an art collection inscribed by Bitcoin Ordinals — says he's come up with a way for Bitcoiners to reject Ordinals inscriptions.

However, he doesn’t expect many will take up the offer.

“Merry Christmas, ord disrespectoors! I have a gift just for you! This [script] will rid your node of inscriptions,” wrote Rijndael, the firm’s pseudonymous chief technology officer, in a Dec. 26 post.

Merry Christmas, ord disrespectoors! I have a gift just for you!

— Rijndael (@rot13maxi) December 26, 2023

This will rid your node of inscriptions. You can run it, or not. It's your computer, you can run whatever software you want on it.

Relay filtering doesn't work. This has teethhttps://t.co/ONfKQRgUyF

The script was designed to cause nodes to reject any blocks that include inscriptions, explained Rijndael.

"If the economic majority of nodes does that, the miners will choose to build on a chain tip that doesn't have inscriptions, or they sell into a smaller market," he added.

Break this down to me like I’m 5. Am I looking at a fork? If majority of economical nodes actually ran this, what would happen?

— ₿ugsy (@BitcoinBugsy) December 26, 2023

“Go run the script or admit that you’re just virtue signaling on twitter and are uninterested in stopping inscriptions,” he added in response to X user “GhostOfPashka.”

I handed you the solution. If you choose not to use it, you have nobody to blame but yourself.

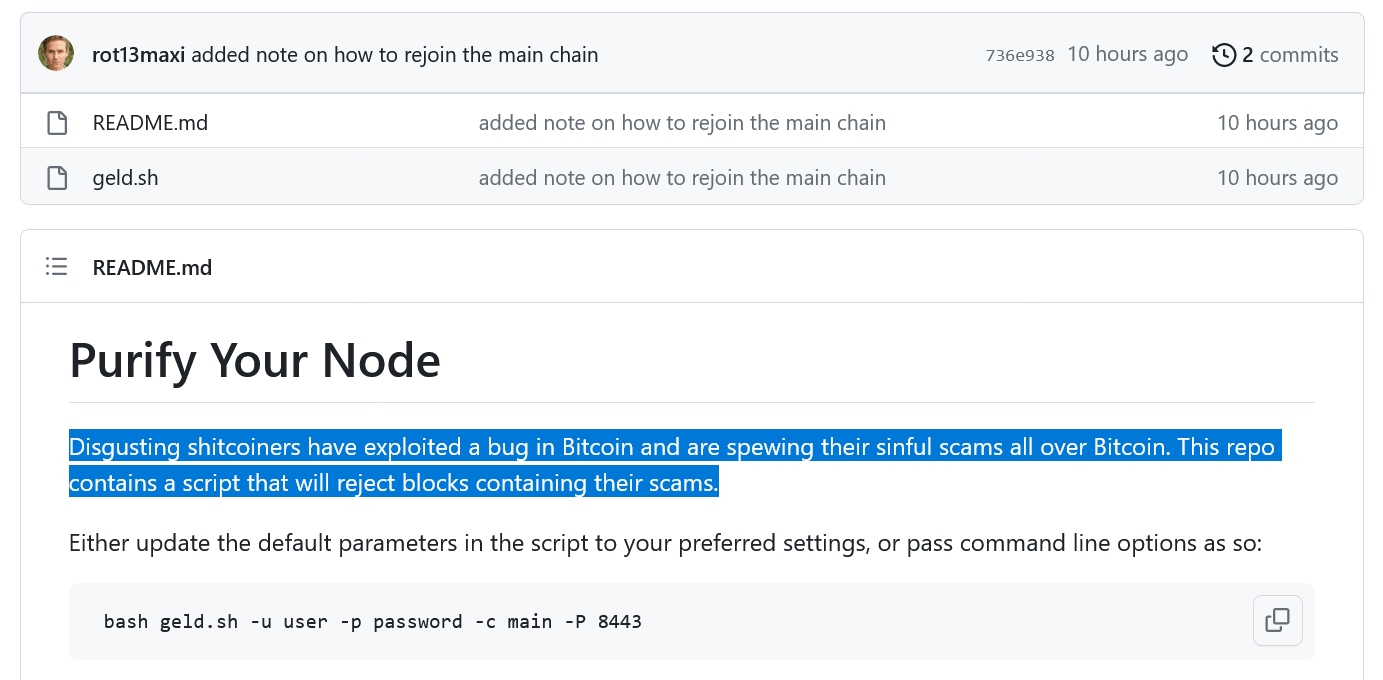

Rijndael further teased Ordinals critics by making an over-the-top mockery of Ordinals on the GitHub repository page.

Rijndael's description of the node operator tool that censors Ordinals inscriptions. Source: GitHub

Glassnode’s lead analyst James Check, known as “Checkmate” on X, says it’s unlikely the software will gain traction despite some vocal critics of Ordinals.

“It is purely to demonstrate that most folks who are complaining about Ordinals, are in the minority. The software is now available to invalidate them on their node, but one would automatically realize it essentially just bricks your node as they are valid transactions,” Check explained in a note to Cointelegraph.

“It is a demonstration of the mexican stand-off that Bitcoin governance is all about,” Check added.

Rijndael said it took him around 15 minutes to create the software and seemingly admitted that the script can also be easily circumvented by changing an Ordinal fingerprint anyway.

Ordinals debate continues to simmer

The Ordinals censorship debate resurfaced last month when Bitcoin mining firm OCEAN — led by Bitcoin Core developer Luke Dashjr — began rejecting Ordinals transactions, citing risks of denial-of-service attacks and increased mempool congestion.

We are happy to announce testing of Bitcoin Knots v25.1 has completed successfully, and is now deployed to production. Among other improvements, this upgrade fixes this long-standing vulnerability exploited by modern spammers. As a result, our blocks will now include many more… https://t.co/II3y0B6Pu4

— OCEAN (@ocean_mining) December 6, 2023

Others believe there are potential benefits or shortfalls, depending on the situation.

For example, Ordinals-inflicted mempool congestion, if stable and predictable, could benefit Lightning transactions and its users, according to a Bitcoin Core developer, who spoke with Cointelegraph but asked not to be named.

“Lightning users benefit from stable mempool congestion cycles enabling them to allocate more liquidity off-chain,” they said.

On the flip side, if Ordinals transaction volumes aren’t predictable, it could cause future problems for Lightning users.

Ordinal inscriptions [...] might be driven on short marketing cycles, provoking unpredictable mempools congestion — and downgrading Lightning UX by the same effect.

With Bitcoin Core scheduled to be updated to its 27th version sometime in 2024, a solution could be implemented to tone down Ordinals volumes.

“Maybe Ordinals users will have to pay a higher base min relay fee to keep some CPU/ bandwidth resources consumption in equilibrium for full-nodes operator," said the developer.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.