Solana secures $500M investment, analyst predicts when SOL could reach $400

- Solana price rises 5% on Wednesday, breaching $150 for the first time in April.

- SOL Strategies announced a $500M convertible note facility aimed at Solana staking.

- Analysts expect Solana to consolidate before a breakout, forecasting a $400–$600 target in Wave 5 of the Elliott Wave cycle.

Solana’s price climbed 5% to hit $150 on Wednesday. A $500 million investment from SOL Strategies emerges as the latest catalyst, emphasizing a growing trend of institutional capital rotating from ETH towards SOL.

Solana rallies as institutional investors show preference for SOL over ETH

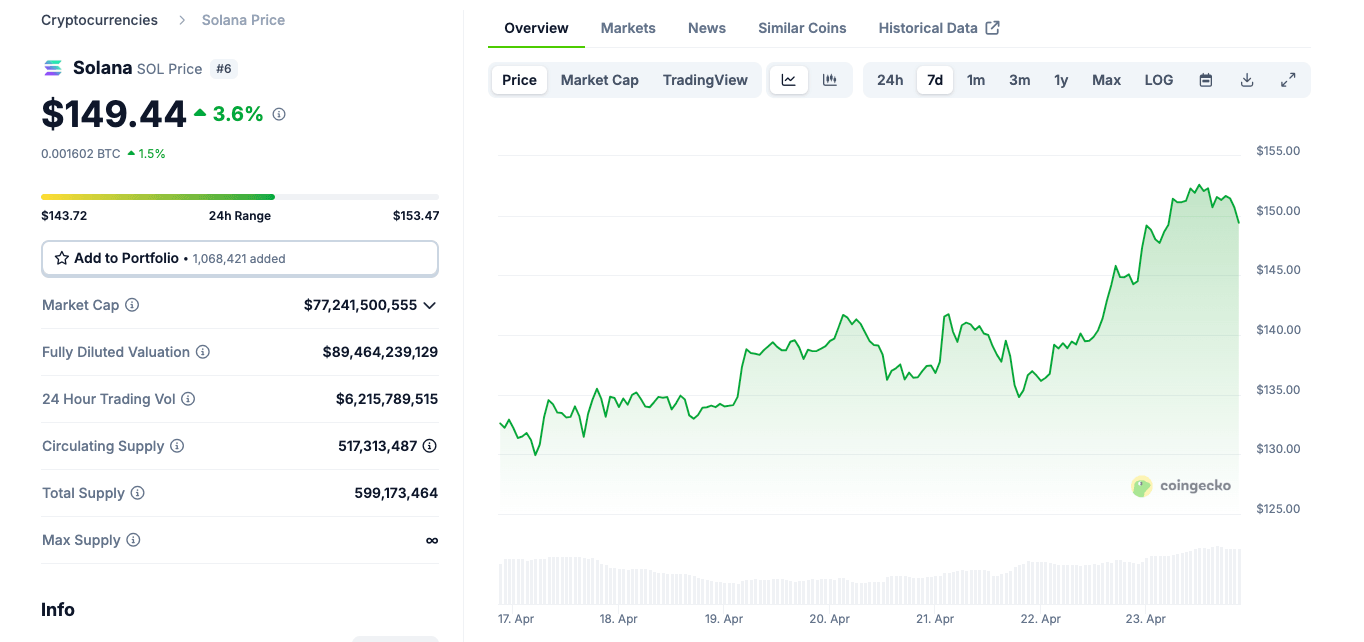

Solana rose 5% on Wednesday, reaching $150.22. The price advance marks the highest level for SOL in over a month. The rally follows growing institutional interest, with capital shifting into Solana-linked assets as part of a broader bullish trend across the crypto sector.

Solana (SOL) Price Action, April 23 | Source: Coingecko

Over the past two weeks, Galaxy Digital reallocated over $106 million from Ethereum into Solana. The firm cited operational efficiency and network throughput as drivers of its strategy.

Additional corporate investors entered the Solana market midweek, contributing to continued upward momentum.

The performance comes as altcoin markets rally behind Bitcoin’s gains. Zooming out, Solana’s weekly timeframe gains of 20% far outpace Ethereum’s 15%, signaling that SOL continues to encroach ETH market share, as it is fast-emerging as one of the strongest beneficiaries of the current crypto recovery cycle.

SOL Strategies issues $500M convertible notes facility for Solana staking deposits

SOL Strategies has finalized a $500 million convertible notes issuance agreement with ATW Partners. The investment facility is exclusively dedicated to acquiring and staking Solana (SOL) tokens through the firm’s validator operations.

The proceeds will be used to accumulate native tokens and deploy them across the Solana network for staking purposes.

The facility is designed to capture staking yield, which will be distributed between SOL Strategies and ATW under the terms of the agreement. This transaction represents one of the largest staking-tied financing deals in the blockchain sector in 2025. According to SOL Strategies, the capital will support validator infrastructure and network participation.

This initiative follows a series of similar structured investments aimed at increasing validator diversity and reinforcing long-term token lock-up. The deal adds to the growing narrative that institutional investors are showing preference for Solana over Ethereum.

Details of the note structure have not been disclosed, but the firm confirmed that the instruments are non-public and privately placed.

Analyst hints when Solana price could hit $400

While SOL’s recent rally has reignited bullish sentiment, some analysts advise patience.

According to pseudonymous crypto strategist CryptoBullet on an X post, Solana price has completed a motive Wave (3) and is currently entering a corrective Wave (4) phase based on Elliott Wave theory in the chart below.

Solana price forecast | Source: X.com/CryptoBullet1

Drawing insights from the Elliot Wave indicators, the analyst predicts that Solana price will now enter a prolonged consolidation between $100 and $200 over the next few months, before testing new all-time highs between the $400 and $ 600 level.

The projected move aligns with strong Bitcoin price performance and imminent $500 million staking deposits from SOL Strategies —factors that could reinforce the bullish SOL price prediction if the crypto recovery cycle advances further.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.