XRP edges lower as bearish indicators weigh heavily on outlook

- XRP edges lower below $1.90 amid technical weakness and increasing macroeconomic uncertainty.

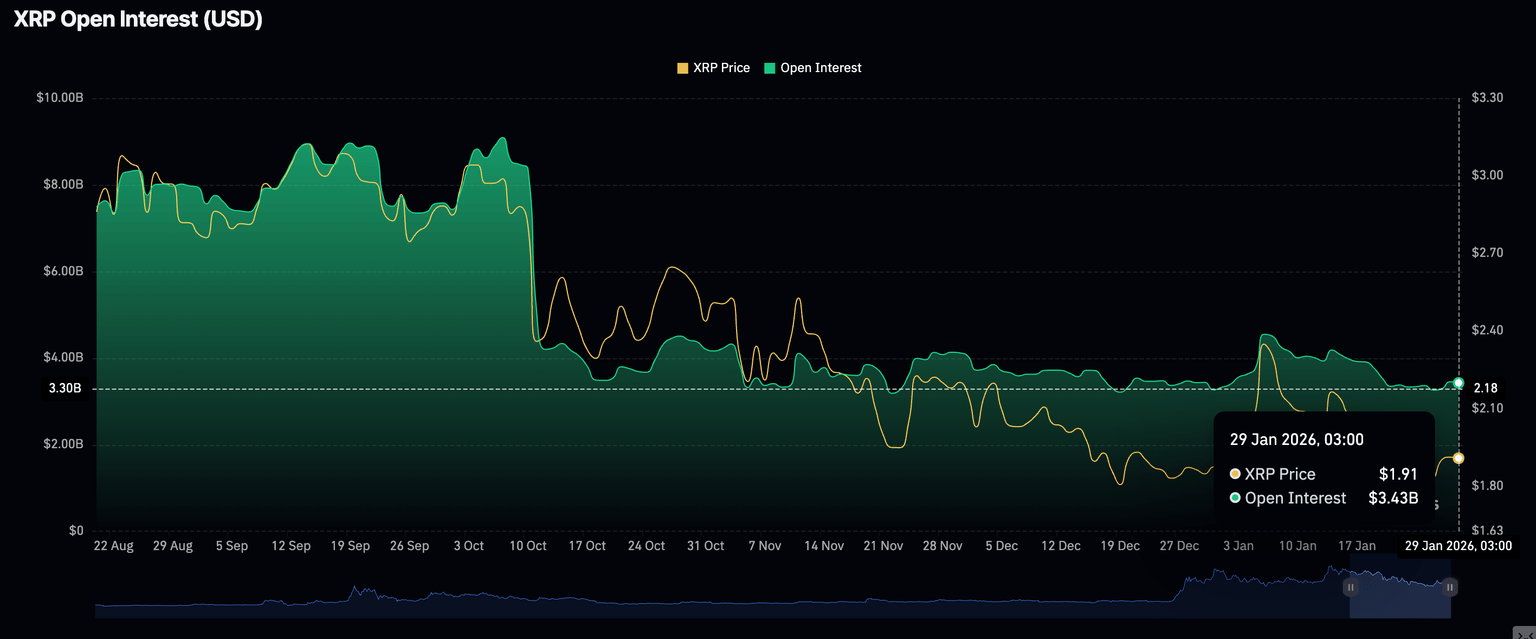

- Retail interest in XRP stalls, with futures Open Interest holding steady at $3.43 billion on Thursday.

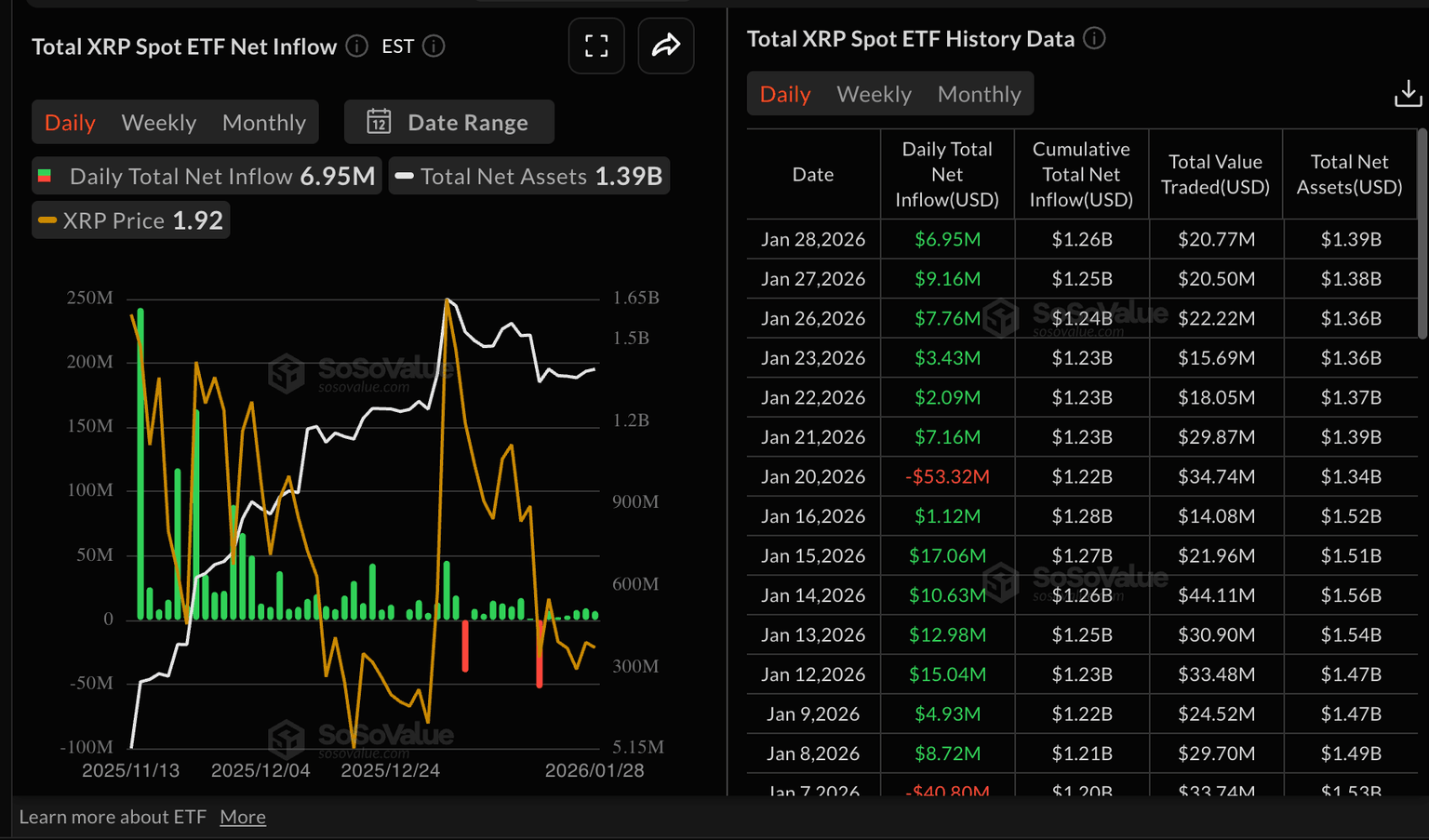

- XRP ETFs extend their inflow streak to six consecutive days, with assets under management reaching $1.39 billion.

Ripple (XRP) is trading below the $1.90 mark at the time of writing on Thursday, extending its recent decline as bearish technical signals converge with broader macroeconomic headwinds.

The Federal Reserve (Fed) left interest rates unchanged in the range of 3.50%-3.75% at the end of its monetary policy meeting on Wednesday, potentially limiting liquidity into high-risk assets like XRP.

Mixed signals as retail interest slows while XRP ETFs extend inflows

The cross-border remittance token faces increasing pressure from diminishing retail participation, evidenced by stagnant futures Open Interest (OI). CoinGlass data shows OI averaging $3.43 billion on Thursday, down from $3.45 billion the previous day.

OI tracks the notional value of outstanding futures contracts; hence, low retail activity indicates that investors lack confidence in the token’s ability to sustain an uptrend. Investors are closing positions rather than opening new ones, depriving XRP of the tailwind to keep its uptrend intact.

Meanwhile, XRP boasts unwavering institutional support through US-listed Exchange-Traded Funds (ETFs), which recorded nearly $7 million in inflows on Wednesday. The cumulative total inflow stands at $1.26 billion, and assets under management at $1.39 billion.

XRP has sustained six consecutive days of inflows, underscoring the growing demand for altcoin-based ETFs. This stands in stark contrast to broader crypto market weakness, which saw Bitcoin (BTC) ETFs record nearly $20 million in outflows on Wednesday.

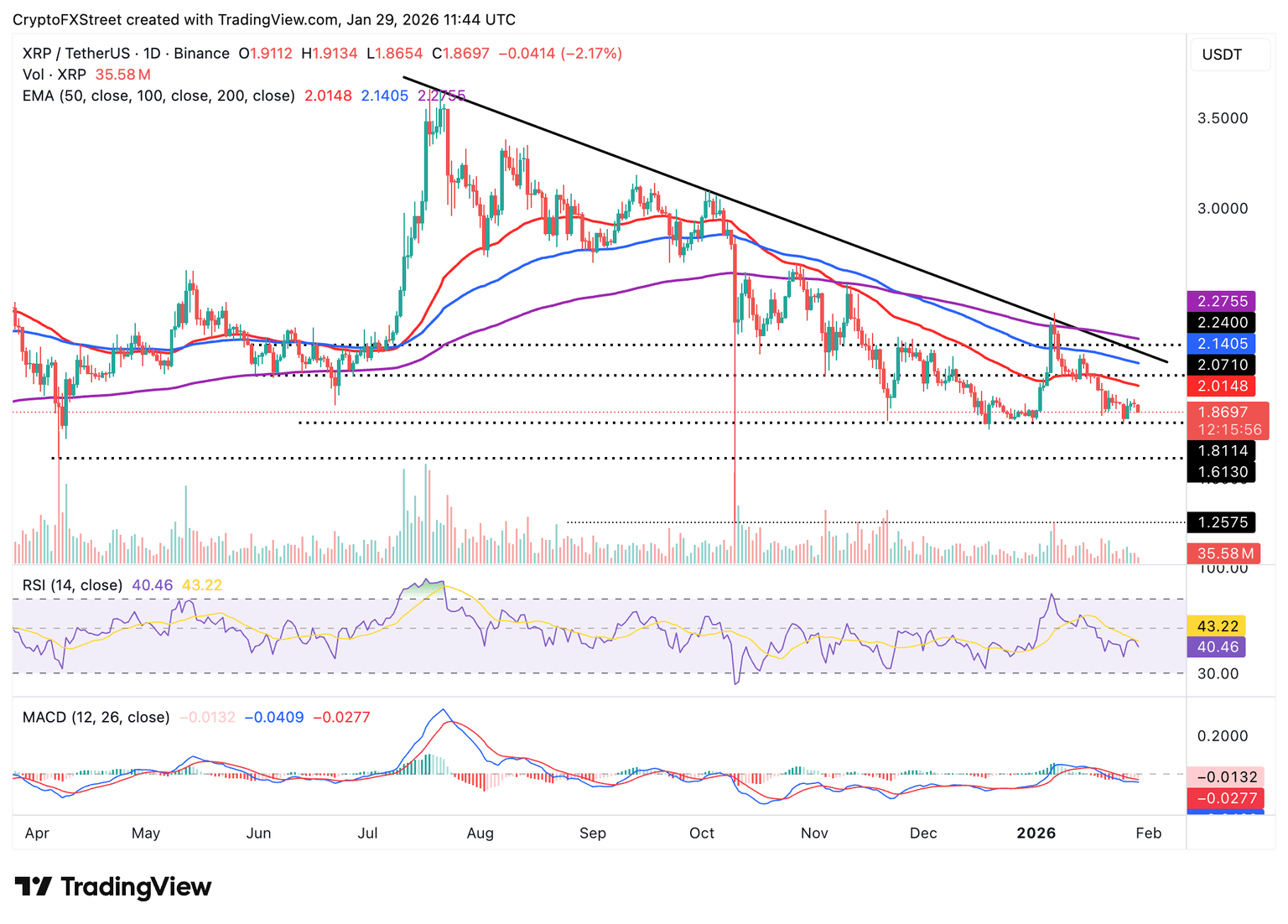

Technical outlook: XRP struggles as bearish signals weigh on price outlook

XRP is trading amid increasing downside risks, macroeconomic uncertainty and risk-off sentiment in the broader cryptocurrency market. The token remains below the 50-day Exponential Moving Average (EMA) at $2.01, the 100-day EMA at $2.14 and the 200-day EMA at $2.28, underpinning the overall bearish outlook.

Meanwhile, the Relative Strength Index (RSI) is falling to 40 on the daily chart, pointing to a buildup of bearish momentum. Further decline toward oversold territory would trigger an accelerated drop, targeting Sunday’s low at $1.81 and April’s support at $1.61.

The Moving Average Convergence Divergence (MACD) remains below its signal line on the daily chart, prompting traders to sell XRP to protect capital amid headwinds.

Any attempt to reverse the trend should be accompanied by high trading volume and push above the 50-day EMA resistance at $2.01. Even so, XRP could remain in bearish hands until bulls reclaim the 100-day EMA at $2.14 and the 200-day EMA at $2.28, thereby opening the door for a breakout toward $3.00.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren