Raydium drops 35% on speculation of PumpFun’s Automated Market Maker development

- Raydium’s price hovers around $3 on Tuesday after dropping almost 35% the previous day.

- The price drop was mostly caused by the rumors of a competing Automated Market Maker being developed by PumpFun.

- RAY loses $334 million in market capitalization, and exchange supply increases.

Raydium (RAY) price trades around $3 on Tuesday after dropping almost 35% the previous day. This price crash was due to the rumors of a competing Automated Market Maker (AMM) being developed by PumpFun and losing $334 million in market capitalization, leading to increased exchange supply.

Raydium gets hit hard as PumpFun develops its Automated Market Maker

Raydium's price dropped almost 35% on Monday at the start of this week amid rumors of a competing Automated Market Maker being developed by PumpFun.

This news brings Fear, Uncertainty and Doubt (FUD) among RAY investors, leading to panic selling as the development of AMM by PumpFun may move liquidity away from Raydium, impacting its position in the Solana ecosystem. The first test token, CRACK, is already in the liquidity pool.

Raydium loses $344 million in market capitalization

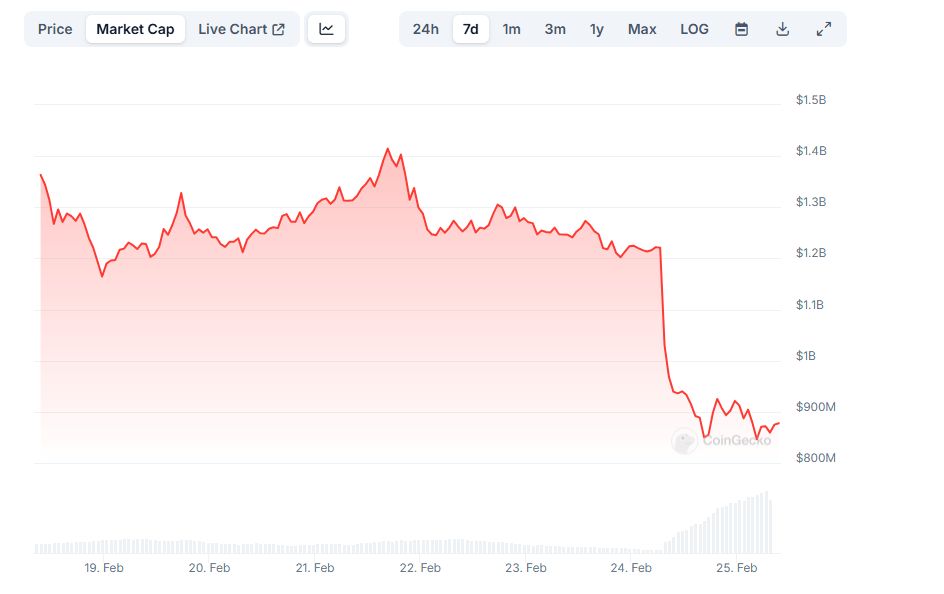

Raydium's price dropped from Monday’s high of $4.27, reaching a low of $2.81, wiping out $344 million in its market capitalization from $1.22 billion to $876 million during the same period, according to CoinGecko data.

RAY market capitalization chart. Source: Coinglass

Santiment data shows that RAY’s supply on exchanges metric also rose from 4,364 on Saturday to 6,345 on Tuesday, indicating increased selling pressure.

%2520%5B08.47.52%2C%252025%2520Feb%2C%25202025%5D-638760535911530227.png&w=1536&q=95)

RAY Supply on Exchanges chart. Source: Santiment

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.