Polygon’s MATIC could dip below $1 for these reasons

- Polygon price dips sharply during ASIA PAC as dollar strength erases positive sentiment.

- MATIC price sees investors worrying about earnings and more Chinese lockdowns to come.

- Expect a further drop to the downside with no FED officials present to provide support or guidance.

Polygon (MATIC) price is set to drop 12% as price fades further under the scrutiny of dollar strength and investors worrying about Covid spreading in Beijing and Shanghai. Not only is that last element a worry – that lockdowns can swing back into effect in Europe and the US – but it also adds to pressure again on the already troubled supply chains, potentially resulting in higher inflation. With that correlation, investors are pulling more funds out of equities and cryptocurrencies and fleeing into cash and safe havens this morning. This is causing a drop in MATIC price towards $1.20 and possibly lower going into the trading week as big tech is set to report its earnings.

MATIC price sees one tail risk being replaced by six others

Polygon price was expected to see bulls storming out of the gates on Monday as Macron secured another term, and with that, more support for the euro and the eurozone should have translated into the markets. But instead, investors quickly replaced the tail risk of the French elections, with six other tail risks. These included rising Covid cases in Asia and earnings from Microsoft, Alphabet, Meta, Apple and Amazon all out this week. With Netflix already triggering a massive sell-off and restraints for equity markets, expect one alarm signal from one of these five to trigger another massive sell-off. Nasdaq is the most prominent victim, triggering a spillover to cryptocurrencies.

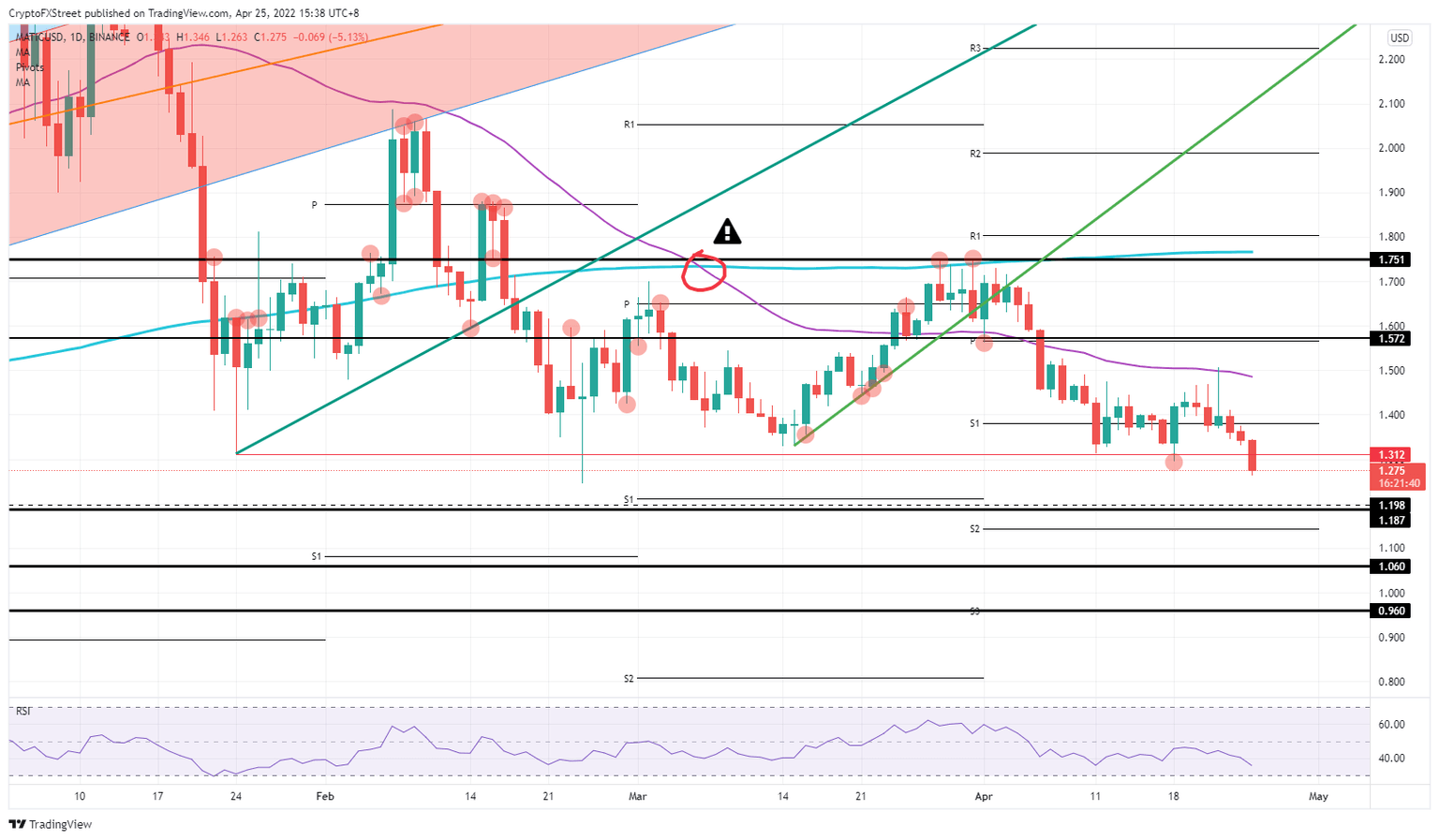

MATIC price is thus far from out of the woods yet this week, as currently, the dollar’s strength is causing a 5% drop in ASIA PAC trading. Expect more nervous investors to join this reshuffle into the US session with MATIC price to test $1.19. Going further into the week, the price could possibly slip below $1.00 to $0.96 if $1.06 does not hold. This could come from a combination of several earnings warnings or higher prices due to persistent inflation, which could trigger a 30% nosedive.

MATIC/USD daily chart

Any support will be more than welcomed should, for example, earnings come out better than expected, with NASDAQ then on the front foot, and creating a mild tailwind instead. In such a scenario, MATIC price would reverse the 5% incurred current loss and possibly see an intraday close that is flat before trading higher into the week, with first $1.40 in foresight and next $1.50, with the 55-day Simple Moving Average (SMA) back in play. If investors can crackdown on the 55-day SMA, expect $1.57 to be set as a profit target, at which level a fade and profit-taking will be triggered.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.