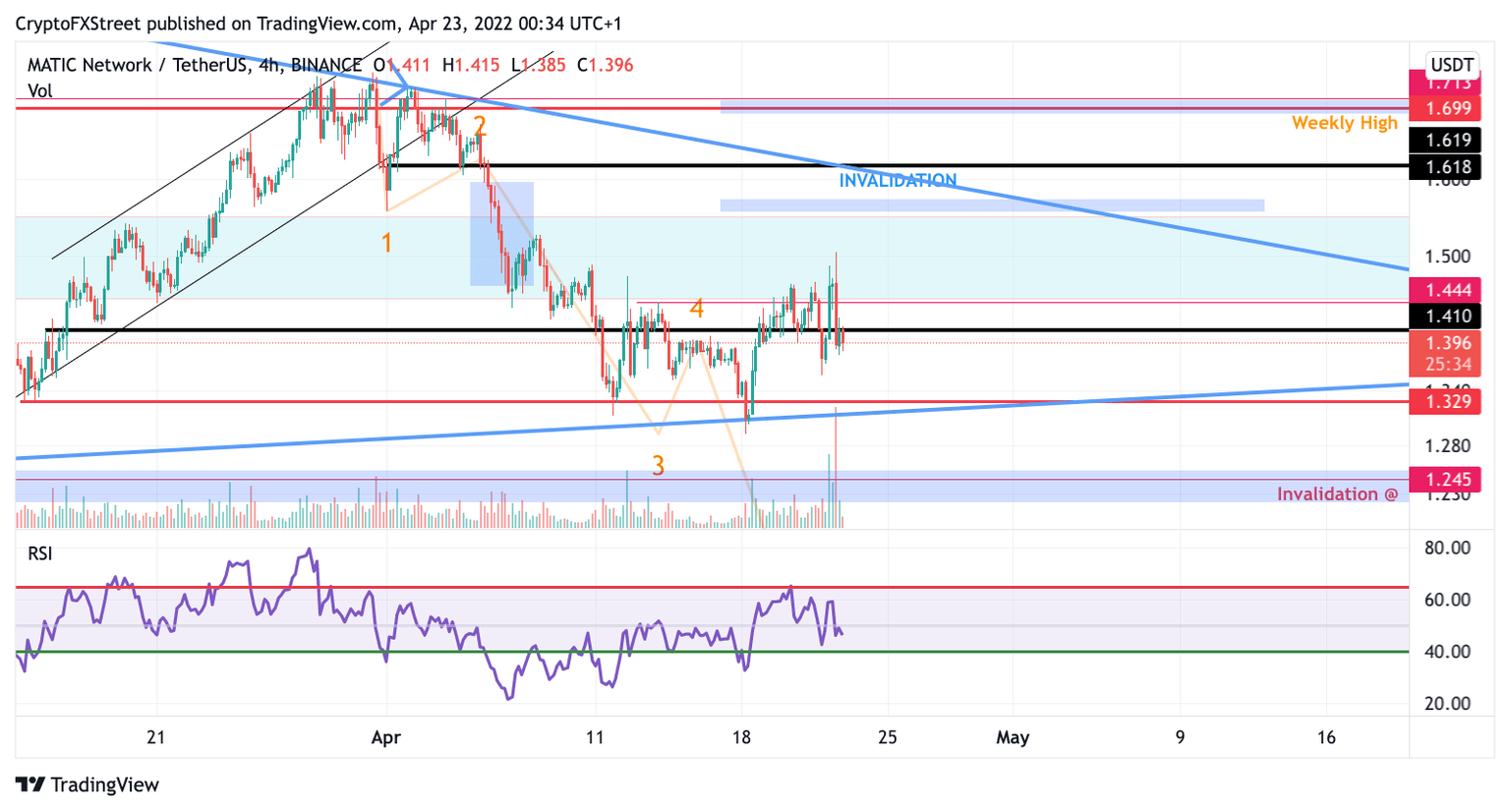

MATIC price bullish target gets halved amidst new revelations.

- MATIC price has rejected a supply zone.

- Polygon price volume has increased in bearish favor.

- Invalidation for the bullish thesis is a close above $1.70

MATIC price is displaying a change of direction. Traders should be looking to exit in profitable areas as the Bulls show signs of exhaustion.

MATIC price says, "the entry was good, but the exit is vital"

MATIC price bulls have halfway validated this Monday's thesis of an upswing into the $1.70 zone as the price managed to rally into $1.50 overnight. Unfortunately, the upswing was met with brute force from the bears as the Polygon price immediately fell back to the current price of $1.40. Analyzing the sell-off, it appears the bears have more strength than expected as the bearish engulfing candle decimated nearly 6% of gains in only 4 hours.

MATIC price now suggests the bulls are in a dicey situation thus, the target at $1.70 should be reduced to maximize profits and avoid a loss. An additional upswing can occur into the price target at $1.58, but afterward, the bears could show up again with equal or more force than the recent sell-off. Thus, this article is being documented as a bearish thesis warning traders to trail stops effectively and secure profits from this Monday's trade setup at $1.40. The counter-trend rally could be coming to a halt.

MATIC/USDT 4-Hour Chart

Invalidation of the bearish thesis is a close above $1.70. If the MATIC price conquers the $1.70 level, this bearish scenario will be invalid. The MATIC price could rise by 40% back to $2.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.