Polygon price underpinned at $1.00 with MATIC bulls taking over

- Polygon price tanked further on Saturday, shedding almost 10% of its value.

- MATIC price got caught by bulls just above $1.00, however, stabilising the selloff.

- On Sunday and in the ASIA PAC this morning price bounced higher, helped by RSI.

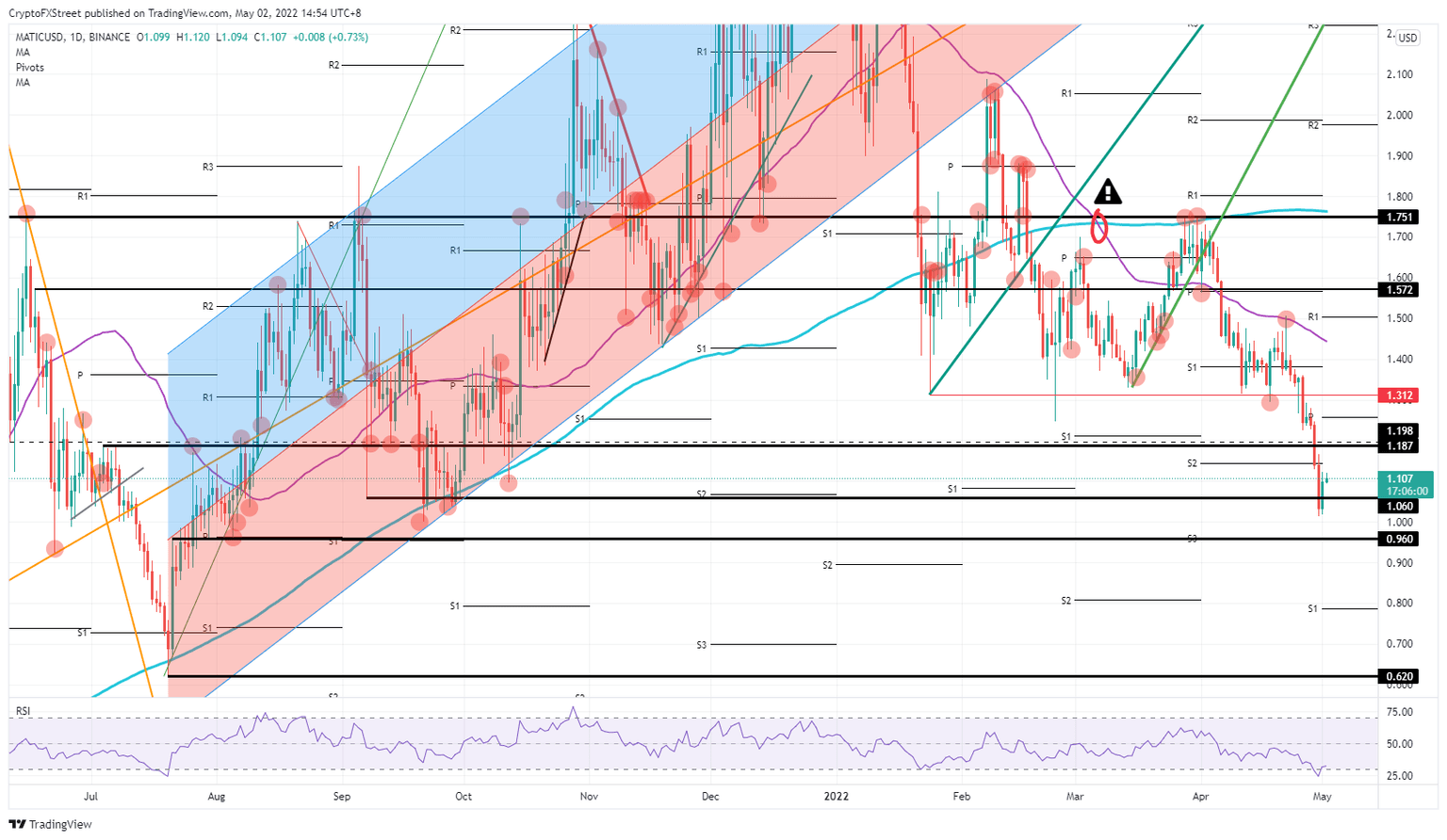

Polygon (MATIC) price has been on a risky drop towards $1.00 over the weekend. Although it was expected that on Saturday, a turnaround would occur, traders instead saw a continuation of the dollar strength squeeze, and investors turning their backs on risk assets. A turnaround got triggered on Sunday, however, as the Relative Strength Index (RSI) dropped into oversold territory and made bears take their profit and close their short positions, spelling a turnaround in MATIC price back up to $1.312.

MATIC price set to regain 28% of the value

Polygon price has been on the back foot last week and finally saw a turnaround on Sunday. Although cryptocurrencies were the only tradeable asset over the weekend, it was strange to see MATIC price lose 10% on Saturday while dollar strength paused and no actual headlines came out of any corner. In this pure technical squeeze, bears went in for the final push, locking in their profit and closing their short levels with the RSI trading in oversold before climbing back above.

MATIC price could see bears handing over the keys to bulls now as $1.00 is relatively low and takes us back to July of last year. Time for a turnaround, as the bulls have the RSI entirely in their corner and a lot of ground to cover to the upside. Expect a break above $1.187 before hitting that fundamental level of $1.312, which holds 28% of value.

MATIC/USD daily chart

Risk to the downside comes from another eventful week with three major central banks coming out with possible further tightening of their monetary policy. This means that investment conditions are fading and are becoming less attractive. This will trigger a headwind in cryptocurrencies as investors turn away from risk assets, with MATIC possibly breaking below $1.00, and only $0.96 can prevent MATIC price from a nosedive of 40% to $0.62.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.