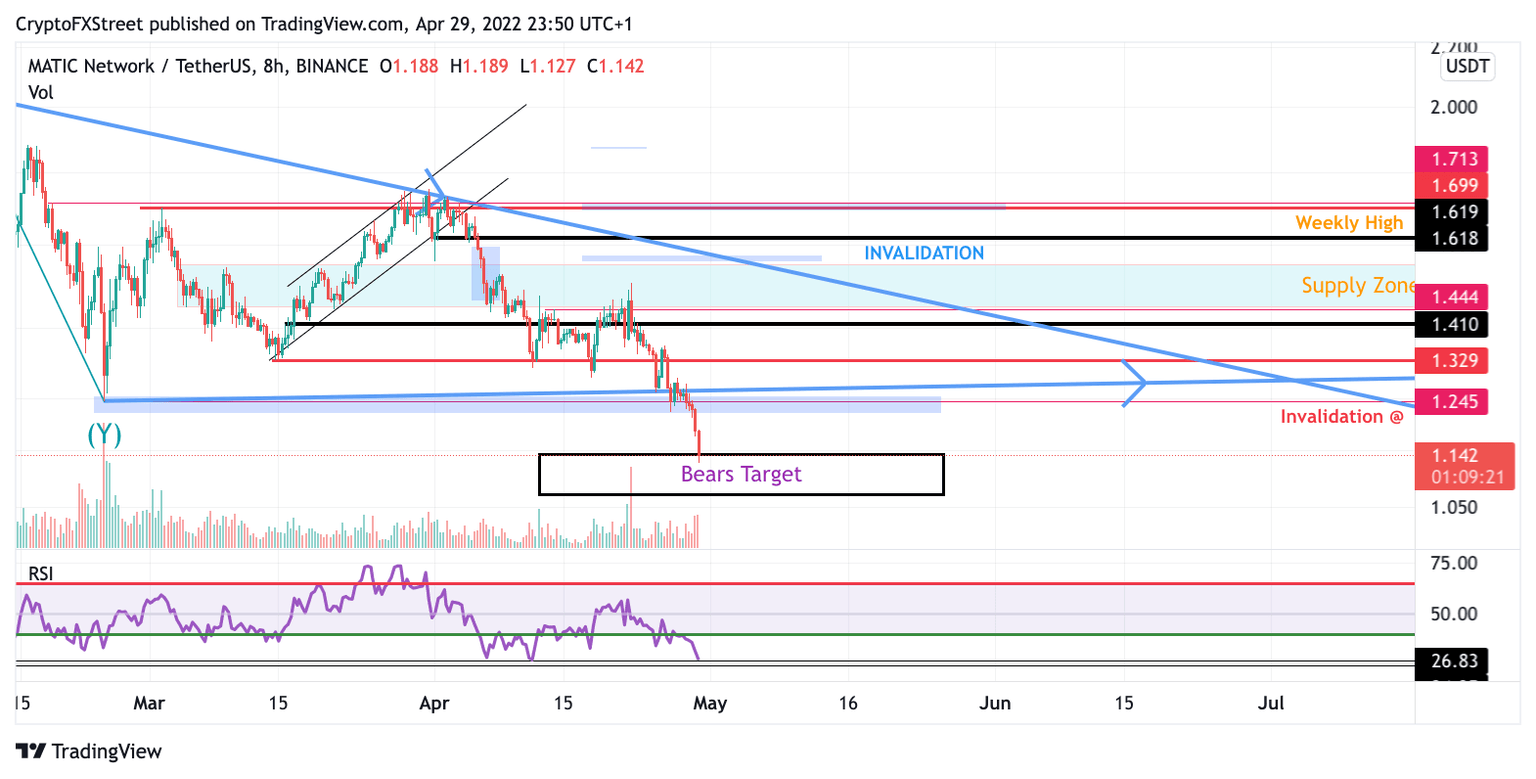

Matic price plummets as bears breach $1.12

- Matic price has validated last week's bearish target.

- Polygon price volume is still low.

- Invalidation of the downtrend scenario is a touch at $1.32

MATIC has seen better days as the bears have managed to invalidate short-term bullish ideas. Traders should consider MATIC price in a downtrend until further chart evidence is displayed.

MATIC price plummets

MATIC price is currently trading at $1.12, a bearish target zone mentioned in several previous articles.MATIC price is likely to stay in this zone for a few more days, so being an early buyer is not yet advised. The steep decline accompanied by oversold charting on the Relative Strength Index hints at a countertrend pullback. Still, the risk attached to this scenario is too much to deem this article as a bullish thesis.

Traders should let early buyers do what they will, and if they can manage to breach $1.32, there could be a potential for a good uptrend scenario to unfold. Currently, the idea for a good countertrend rally is purely a gamble and, if it does occur, a lucky guess. However, it is worth noting that the volume profile is still significantly low during this sell-off, which gives confluence to the ending of the current downslide eventually.

MATIC/USDT 8-Hour Chart

As mentioned above, the invalidation of the downtrend is now a close above $1.32. If the bulls can manage to pull off said price action, Analysts will wait for the chart to display evidence of a countertrend rally which could potentially land in the $1.50 zone resulting in a 35% increase from the current MATIC price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.