Polkadot price signals a severe sell-off into $14.50

- Polkadot prints the lowest price this month.

- DOT price volume says bears are in control.

- Invalidation of the bearish case is a close above $18.75.

Polkadot price is showing significant sell signals. Traders should avoid trying to catch the lows for now.

Polkadot price suggests the bears are back

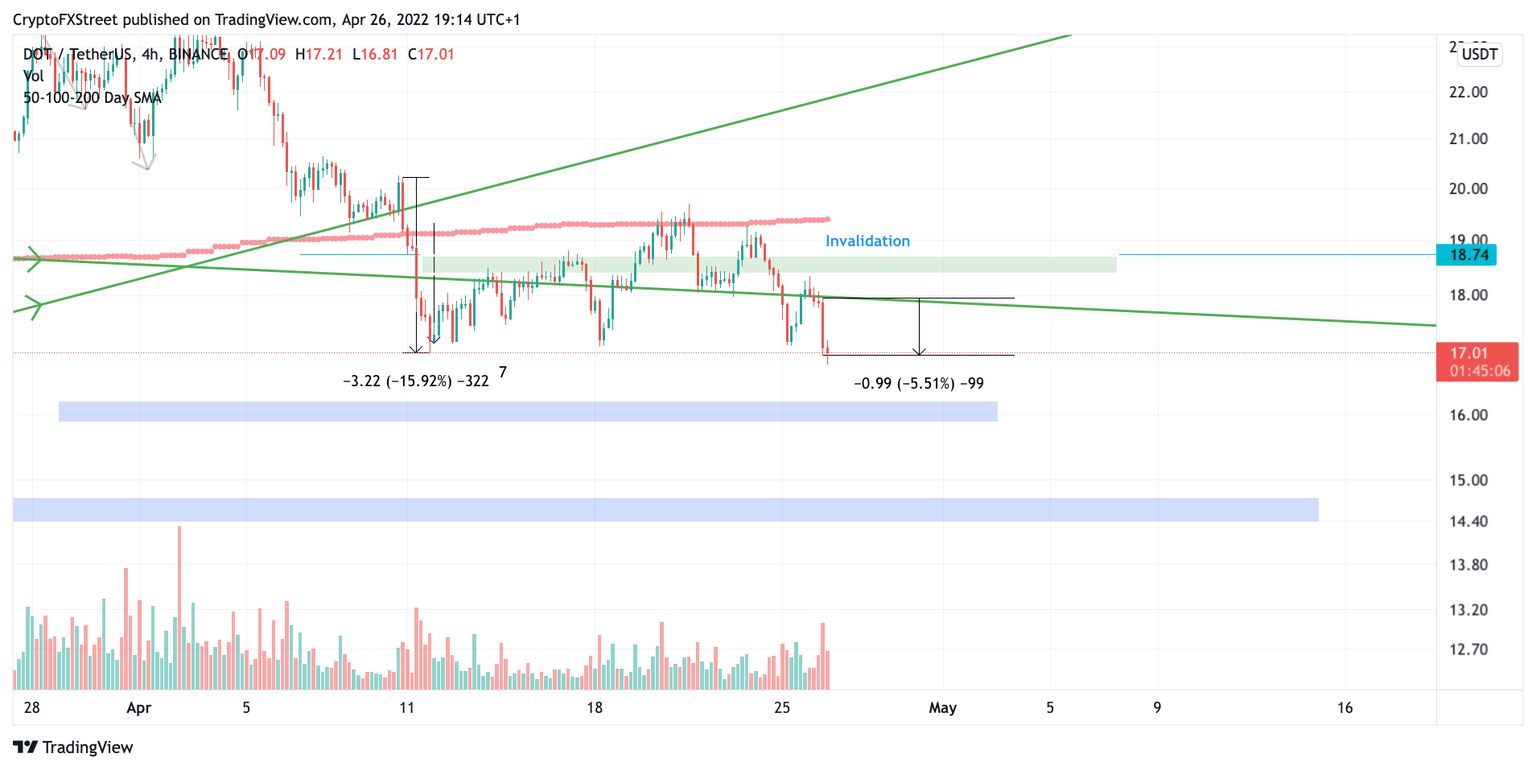

Polkadot price has made a new April low as the digital asset is currently trading at $16.90. The bearish outlook on Polkadot price has always been maintained since the bulls failed to find support on a triangle trend line earlier this month. The doji candle on the 4-hour chart could be smart money’s attempt to entice traders to go long. As of now, there has been no evidence to support a strong bullish reversal.

Polkadot price is displaying a classical ramping pattern on the volume indicator. Additionally, the bears have printed a large bearish engulfing candle that mirrors the strength displayed within the 15% decline between April 10th and April 12th. An additional 15% decline from the current price would target $14.50.

DOT/USDT 4-Hour Chart

Invalidation of the bearish scenario is a close above $18.75. If this bullish event happens, the Polkadot price could climb back to $22, resulting in a 30% increase from the current DOT price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.