Polkadot price is in a critical spot as the DOT price has fallen to $18.

- Polkadot price has breached a critical supply zone at $18.60

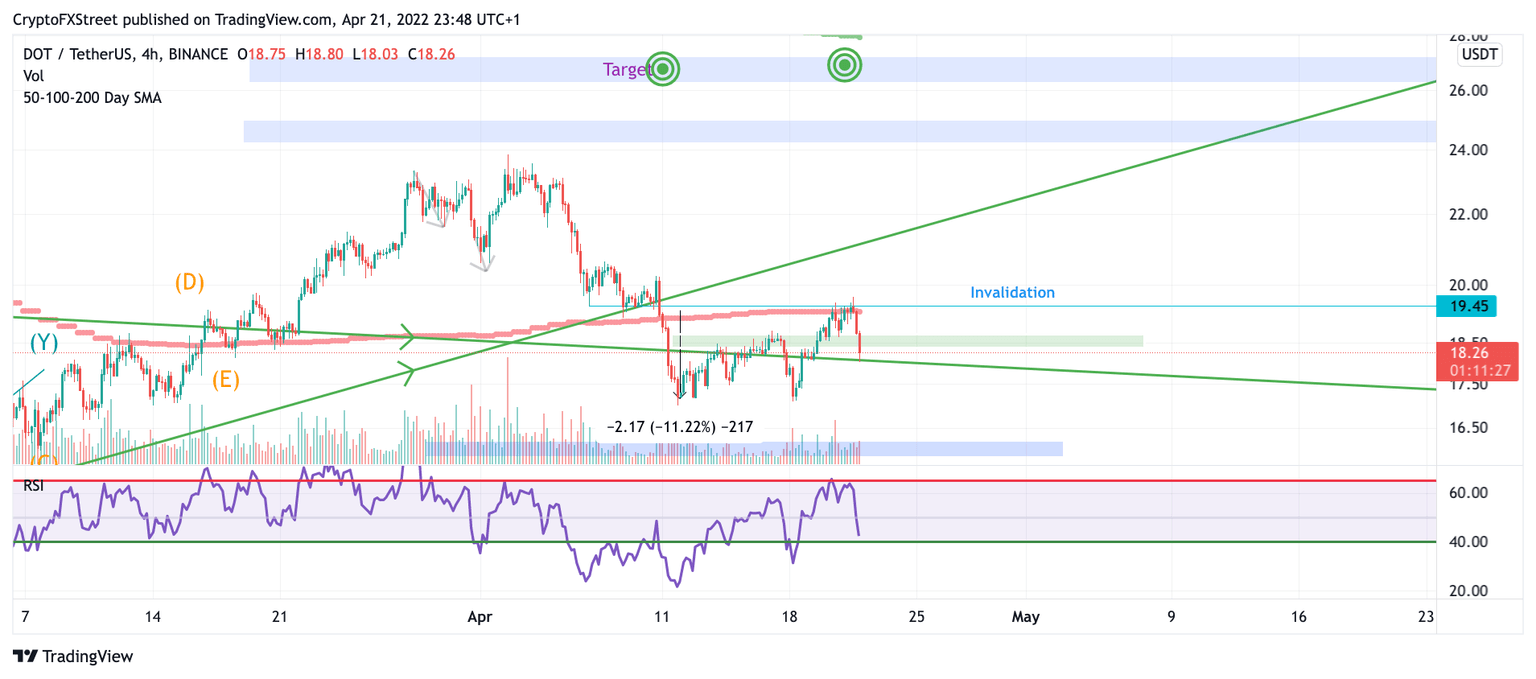

- DOT price failed to close above the bearish invalidation level.

- Invalidation of the bearish thesis is a break at $19.45.

Polkadot price hints at bearish power, as the price has failed to close above the invalidation level.

Polkadot price is at a critical point

Polkadot price has interesting signals as the bulls not have breached this week’s invalidation level. It was mentioned in last week’s bearish-neutral thesis that the bulls would need to close above the $19.45 level. Unfortunately, the bulls fell just short of doing so, printing a close just below $19.30 on the 4-hour chart.

Polkadot price has since sold off considerably as price trades at $18.. Polkadot price optimism may have been decimated as the bears pushed through a crucial $18.60 support zone. The zone that the DOT price has just breached is vital for the bulls to establish support.

DOT/USDT-4-Hour Chart

Traders should still look for other opportunities in the crypto market. Invalidation of the downtrend will be a break and close above $19.45. The DOT price could rally towards $26, resulting in a 50% increase from the current ALGO price.

Author

FXStreet Team

FXStreet