Polkadot Price Prediction: Patience is a virtue for DOT at $16.94

- Polkadot price had a solid recovery after the sell-off in major cryptocurrencies.

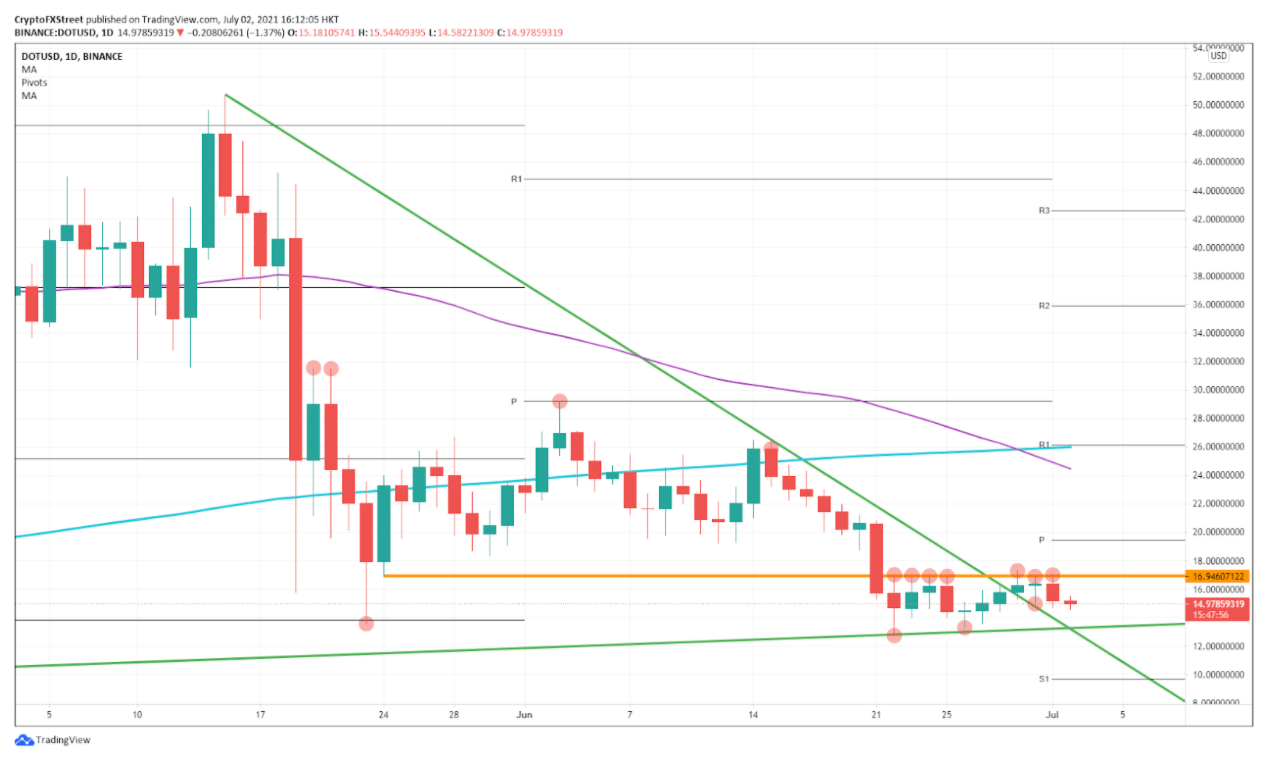

- Although Polkadot broke a crucial bearish trend line, the upside looks very limited.

- A bounce off the descending trend line to the upside looked promising, but DOT could not break $16.94

Polkadot price set a good run of five consecutive days of gains before not closing above $16.94. This level has now been tested over seven times since June.

Polkadot price rises slowly but surely

Usually, price action in the crypto space has a certain speed. Technical setups are often completed within hours or days. But the technical play that is going on in Polkadot price looks likely to be one for the long haul. Patience looks to be critical for traders who want to profit from the upside potential in DOT.

After the dip below $13 on June 22, DOT started looking for upside potential but got rejected four days in a row at $16.94, and it did not stop there. Buyers came back in on the green ascending trend line and pushed the price back up toward $16.94 after breaking the bearish green trend line to the downside. But even then, $16.94 was held, and Polkadot price could not break above again for three consecutive days.

Expect Polkadot price to dip lower again to find support from buyers on that green ascending trend line around $13.40. Once that level of $16.94 has been taken out, DOT can see upside potential to $19.45, which is the monthly pivot.

DOT/USD daily chart

Polkadot price looks like it will take its time before breaking higher above $16.94. But for the moment, buying power is still there as to the downside; we still see higher lows. Slowly but surely, DOT will be squeezed against that $16.94 level.

Should the green ascending trend line break to the downside in the absence of buyers, expect a test of $10 as a psychological level. Just below DOT has its first monthly support coming in.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.