Polkadot price at risk of printing new lows for 2022

- Polkadot price has seen bulls trying to break the bear trend.

- DOT price underwent firm rejection even before the actual breakout test was going to happen.

- Expect a new low for 2022 if the British pound has another meltdown or if Putin ramps up the war rhetoric.

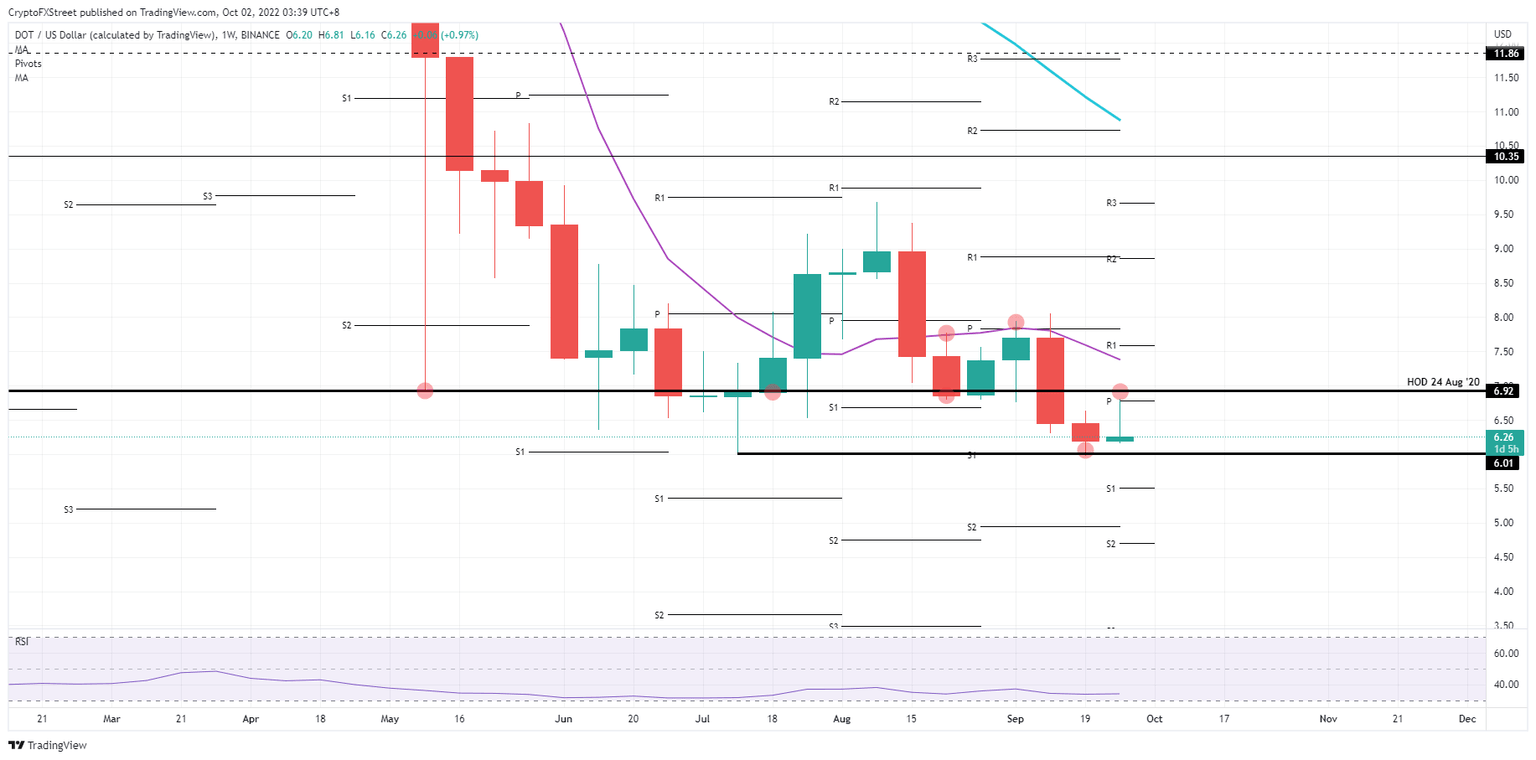

Polkadot (DOT) price action has been on the cusp of breaking the chains of the bear market as, at one point this week, bulls tried to make a run for $6.92. Instead, they were cut short in their tracks by a straightforward technical cap. Expect to see some possible gains being eked out this evening for the week, but risk looms for next week.

DOT price is unable to get away and remains captive

Polkadot price saw bulls finally break out of the negative sentiment and try to break above the critical price tag at $6.92. However, a few events have cut the legs from under the bulls' chairs and saw their attempt stranding at the monthly pivots just a few cents below that high level. Reasons enough, as the British pound had a meltdown and forced the BOE to step in and calm the markets, the BOJ stood ready to intervene yet again, and Putin ramped up the war talk while the demand for the use of nuclear weapons enlarges by the day in Russia.

DOT price could see a new low for 2022 as the above-mentioned tail risks are only broadening. Headlines at the end of this week from the IMF demanding the UK to wind down its tax cut program are not what you would want right now to stabilize your currency and economy. Expect another plunge lower to probably $5 between this month's monthly S1 and S2 support levels.

DOT/USD Weekly chart

After all the turmoil last week, some radio silence from Russia or smaller headlines making smaller waves could be a welcome calm moment for the markets. That would open up the window for some movements to the upside in the wake of that tranquillity. Expect a jump towards $7.50 around the 55-day Simple Moving Average (SMA).

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.