Pi Network Price Forecast: Whale activity, bullish RSI divergence oppose the risk of further losses

- Pi edges lower to retest a crucial support level as it decouples from the broader market recovery.

- PI token unlocks and increasing balance on CEXs boost selling pressure.

- A large investor acquired PI worth over $2 million in the last three days.

Pi Network (PI) edges lower by 2% at press time on Tuesday, failing to join the bandwagon of altcoins fueled by Bitcoin (BTC) reaching record high levels. The increasing supply pressure on Centralized Exchanges (CEXs) and the token unlocks fuel the declining trend in PI token, resulting in a retest of the $0.4460 support level. A confident, large investor adds over $2 million in PI tokens amid the declining trend, while technicals signal a bullish divergence.

Pi Network’s rising selling pressure

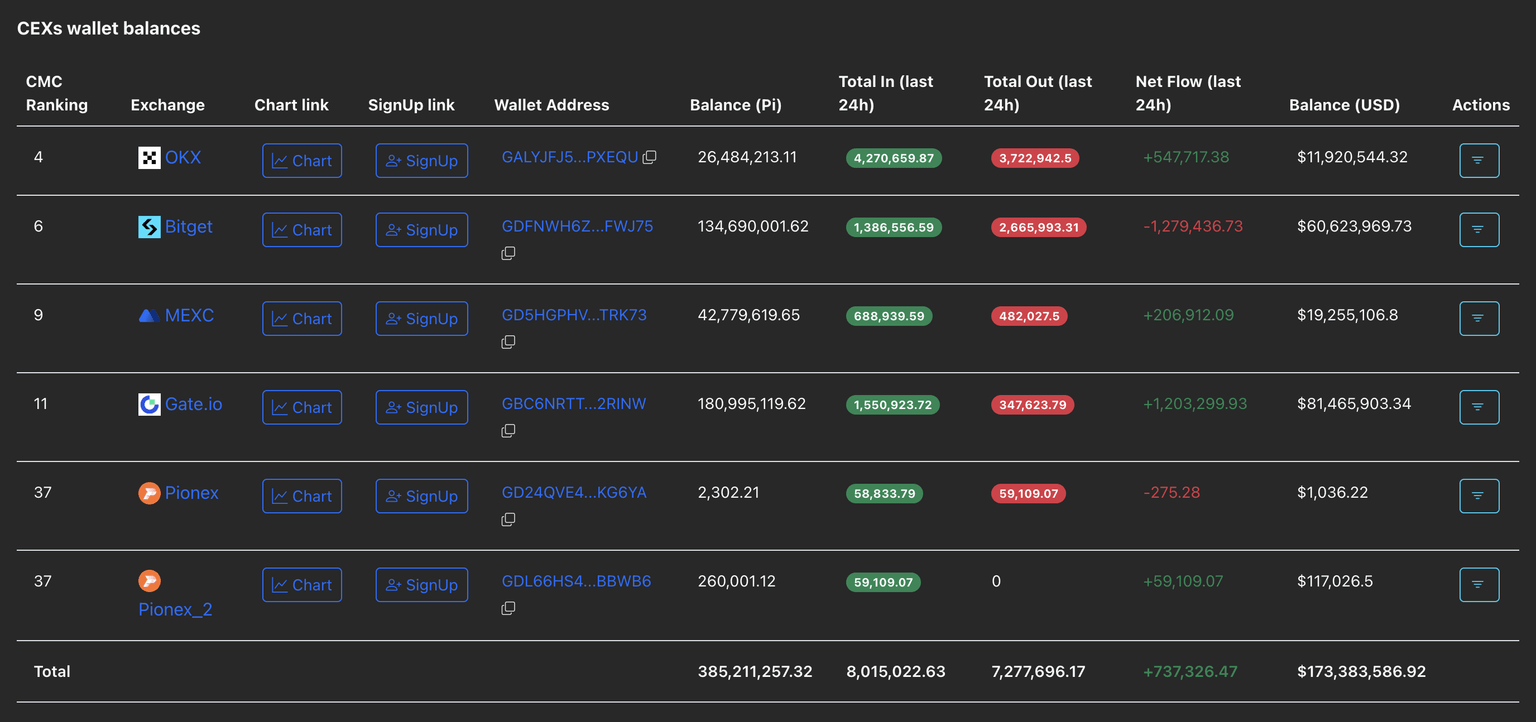

CEXs' wallet balances of Pi Network refer to the amount of PI tokens deposited on exchanges, which could be set to be sold. An increase in the CEXs' balances highlights increased deposits as selling pressure rises.

PiScan data shows a net increase of 737,326 PI tokens over the last 24 hours, while the total PI available on listed exchanges amounts to 385.21 million PI.

CEXs wallet balances. Source: PiScan

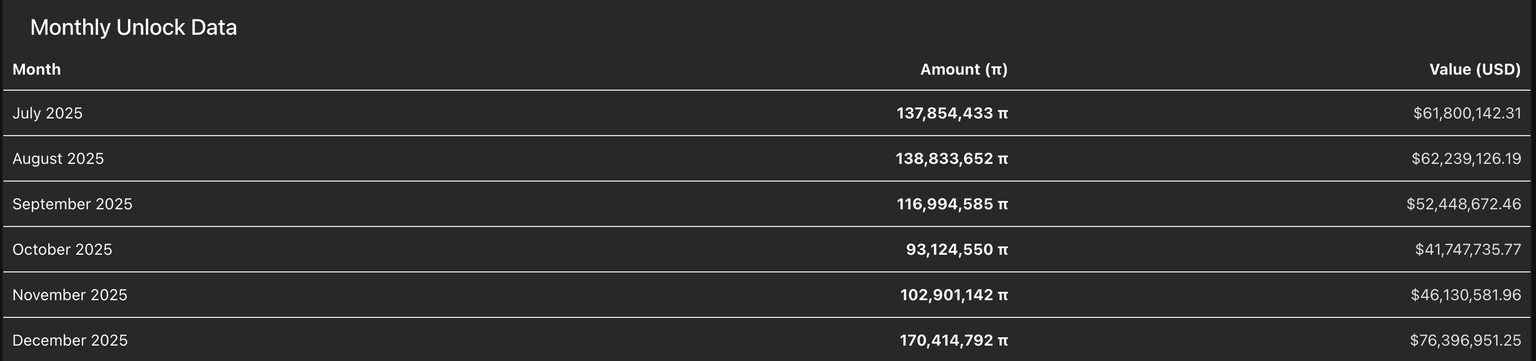

Amid this, the PI token unlocks in July are the largest until October 2027, as previously reported by FXStreet. The data shows 137.85 million PI tokens to be unlocked in the rest of July, almost equal to the August monthly unlock of 138.83 million PI tokens.

PI token unlock statistics. Source: PiScan

As selling pressure grows, a bearish domination over the Pi Network is possible.

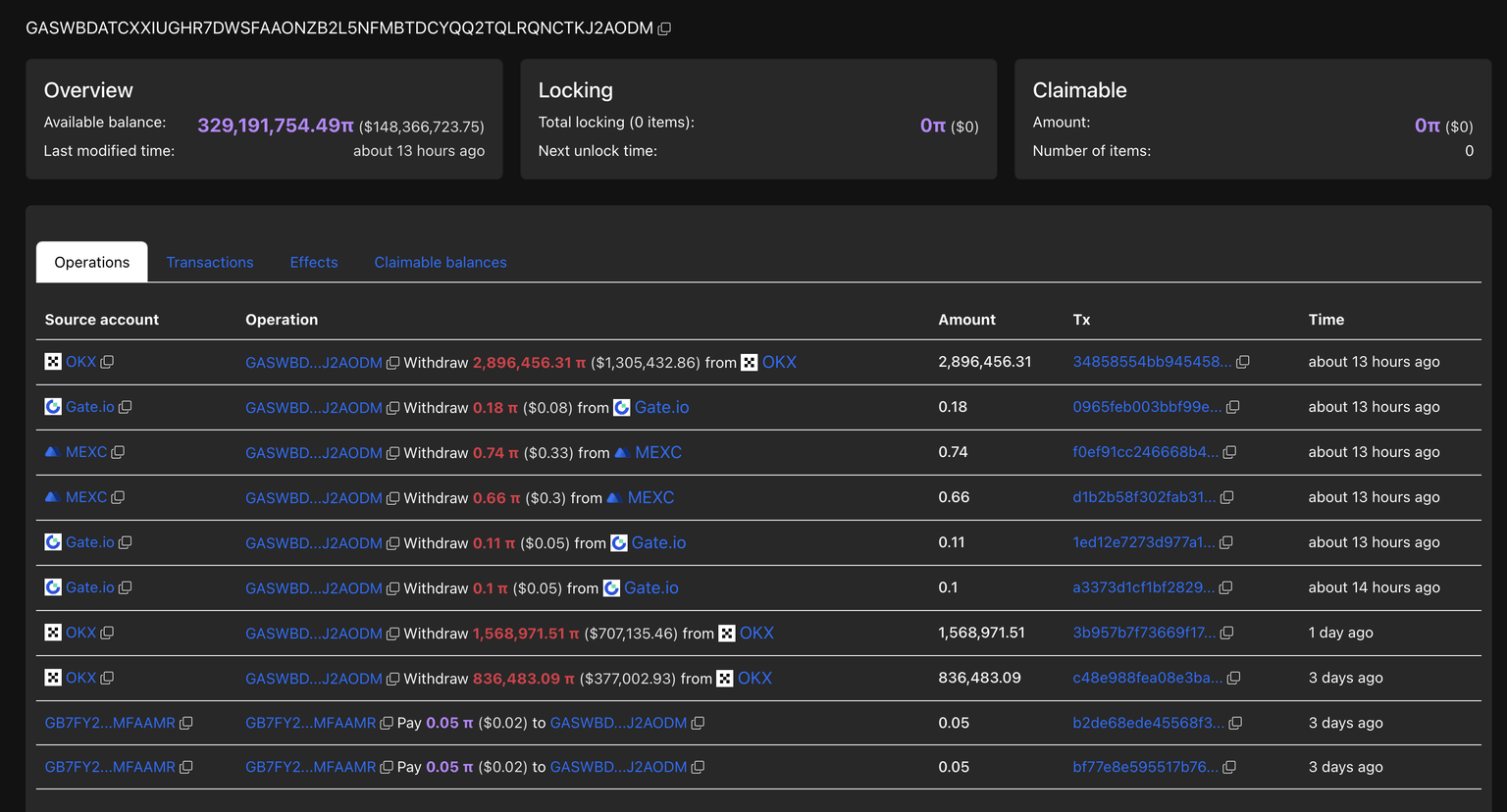

Large investor remains confident in Pi Network

Amid the overhead pressure, a confident whale has acquired 5.30 million PI tokens for $2.38 million over the last three days. Typically, large investors acquire undervalued coins at discounted prices, anticipating a reversal, while retail investors offload them.

Whale account balance. Source: PiScan

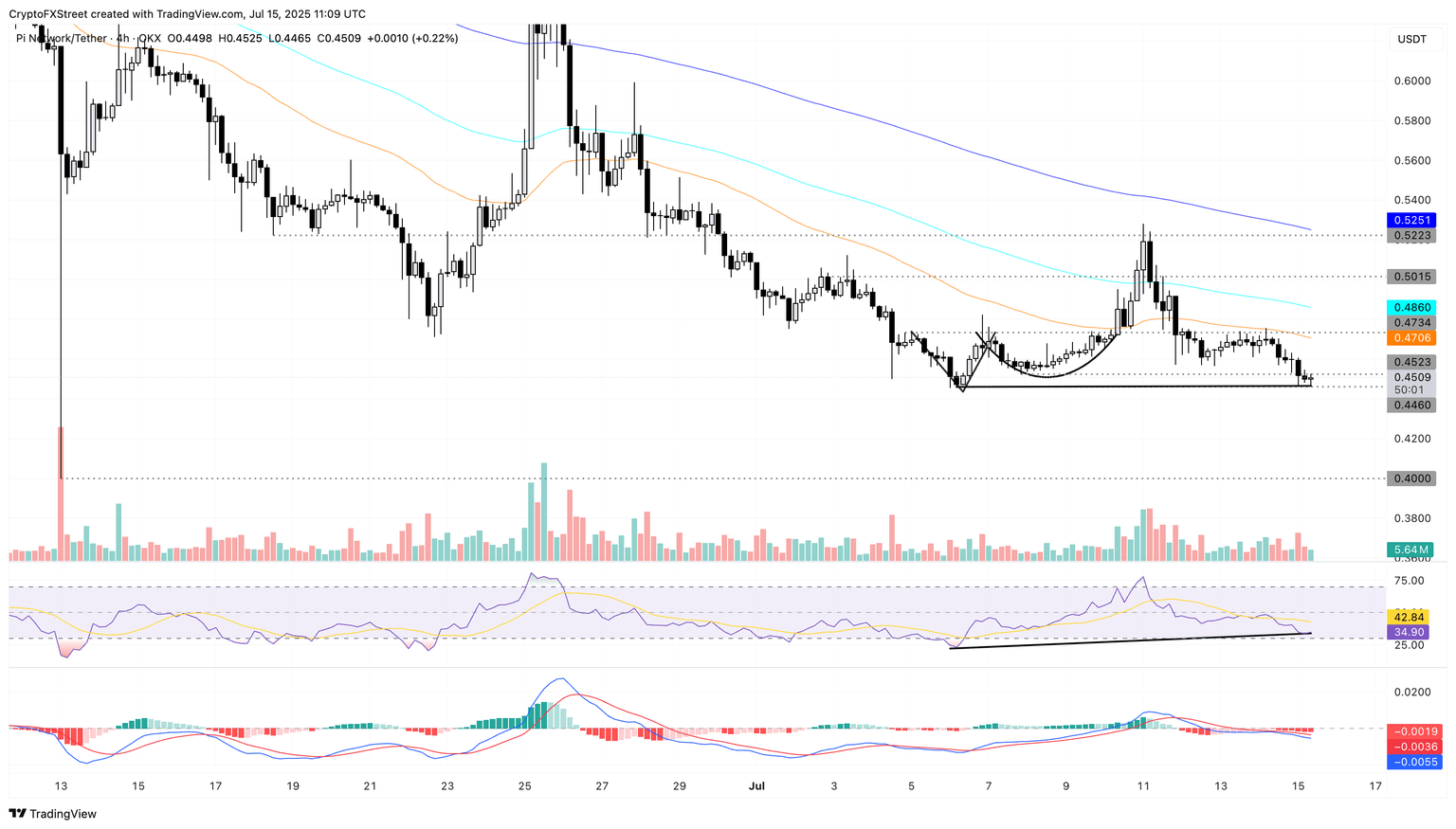

Pi Network risks further losses as pressure builds over a crucial support level

Pi Network drops below the $0.500 psychological level after briefly reclaiming it last week with an Adam and Eve pattern breakout on the 4-hour price chart. The declining trend hits the $0.446 support level on Tuesday, last tested on July 6, while a lower shadow candle displays the bullish effort to avoid further losses.

If PI marks a 4-hour candle close below this level, it could extend the declining trend to the $0.400 round figure last tested on June 13.

The Relative Strength Index (RSI) on the 4-hour chart reads 34, showing a divergence with the price action from the July 6 drop to 23.

Still, the Moving Average Convergence/Divergence (MACD) and its signal line cross below the zero line, indicating a bearish trend. The rising red histogram bars indicate increasing bearish momentum.

PI/USDT daily price chart.

To reinforce a bullish trend, Pi Network must reclaim the $0.473 resistance level, last tested on Monday. A clean push above this level could extend the recovery run to the $0.500 psychological level.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.