Ondo Price Forecast: 20% ONDO unlock on January 18

- Ondo price continues to edge down on Monday after declining more than 21% in the previous week.

- Ondo Foundation tweeted that there will be a 20% ONDO unlock on January 18, 134% of the current circulating supply.

- On-chain data shows signs of weakness as ONDO daily active addresses are falling and funding rates are negative.

Ondo (ONDO) price continues to edge down, trading around $1.16 on Monday after declining more than 21% in the previous week. Ondo Foundation tweeted that there will be a 20% ONDO unlock on January 18, leading to 134% of the current circulating supply. Moreover, On-chain data shows signs of weakness as ONDO daily active addresses are falling and funding rates are negative, hinting at a further decline.

ONDO’s upcoming 20% token unlock

Ondo Foundation tweeted on Monday that there will be a variety of locked ONDO transfers in preparation for the first release from the Global Lock-Up. These transfers are primarily to lock token holders, diversify custody, take other security precautions, and release tokens from escrow. This event will unlock 20% of ONDO tokens on January 18, leading to 134% of the current circulating supply. Traders and investors should watch for this event, as it increases the circulating supply. If a significant portion of unlocked ONDO tokens is sold immediately, it can increase selling pressure, leading to a price drop.

Ondo Foundation would like to note in advance to the community that, in the coming days, there will be a variety of locked ONDO transfers in preparation for the first release from the Global Lock-Up.

— Ondo Foundation (@OndoFoundation) January 12, 2025

These transfers are primarily for the purpose of locked token holders…

Ondo’s on-chain metric shows signs of weakness

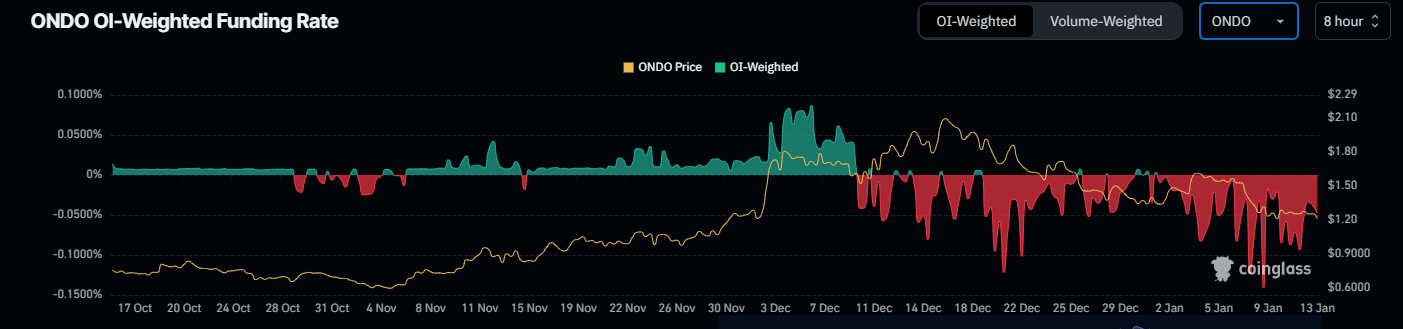

Coinglass’s OI-Weighted Funding Rate data shows that the number of traders betting that the price of Ondo will slide further is higher than that anticipating a price increase.

This index is based on the yields of futures contracts, which are weighted by their open interest rates. Generally, a positive rate (longs pay shorts) indicates bullish sentiment, while negative numbers (shorts pay longs) indicate bearishness.

In the case of ONDO, this metric stands at -0.047%, reflecting a negative rate since early January and indicating that shorts are paying longs. This scenario often signifies bearish sentiment in the market, suggesting potential downward pressure on Ondo’s price.

Ondo OI-Weighted Funding Rate chart. Source: Coinglass

Another bearish sign for Ondo is Santiment’s Daily Active Addresses index, which tracks network activity over time. A rise in the metric signals greater blockchain usage, while declining addresses point to lower demand for the network.

In ONDO’s case, Daily Active Addresses fell from 3,691 on December 16 to 1,929 on Monday, extending a downtrend that started in early December. This indicates that demand for ONDO’s blockchain usage is decreasing, which doesn’t bode well for Ondo price.

%2520%5B10.07.41%2C%252013%2520Jan%2C%25202025%5D-638723434621128627.png&w=1536&q=95)

Ondo Daily Active Addresses chart. Source: Santiment

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.