Mt. Gox sees $3.2B BTC in outflows in just two hours

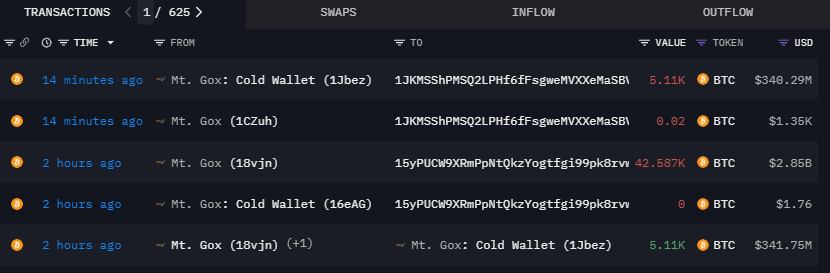

Mt. Gox again began shifting funds on July 23, moving over 47,500 Bitcoin worth almost $3.2 billion to two unknown addresses at 5:05 am and 6:27 am UTC.

According to Arkham Intelligence data, Mt. Gox holds 90,344 Bitcoin (BTC $66,839) worth $6.02 billion, but this is outdated, and its current holdings now stand at around 42,744 BTC worth $2.85 billion.

Following the defunct exchange’s repayments statement on July 5, it established plans to “promptly” carry out repayments to creditors that seem well underway.

Arkham Intelligence data depicting around 47,600 BTC leaving the Mt. Gox address. Source: Arkham Intelligence

Mt. Gox outflow destinations

The Mt. Gox wallet labeled “Mt. Gox: Cold Wallet (1Jbez)” sent 5,110 BTC worth around $340 million to an unknown wallet and the cryptocurrency exchange Bitstamp.

Of the 5,110 BTC, 2,871 BTC, worth around $191 million, was sent to an unknown address starting with 1JKMS, while the remaining funds, worth $149 million, landed on Bitstamp.

The preceding 42,587 BTC, worth $2.85 billion, was sent out earlier to another unknown address starting with 15yPU.

Preparations for Bitstamp repayments

On July 22, Mt. Gox began preparing to repay creditors through Bitstamp, according to onchain fund holding movements.

According to Arkham Intelligence, Mt. Gox addresses “deposited $1” to four separate Bitstamp deposit addresses. “Bitstamp is 1 of 5 exchanges working with the Mt. Gox Trustee.”

Despite finance analyst Jacob King speculating in an X post on July 4 that 99% of creditors would sell their coins “the moment” they get them, a Reddit poll says otherwise.

Over $12 billion offloaded

With the latest $3.2 billion in BTC shifted out of the Mt. Gox address, the tally amounts to over $12 billion offloaded to creditors since July 16.

On July 16, the defunct exchange saw outflows of over 140,000 BTC in a significant move after two weeks of onchain inactivity.

With a volume of almost 190,000 BTC moved in just three hours, Mt. Gox fund outflows contributed to over $12 billion in volume movements as repayments proceeded as promised.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.