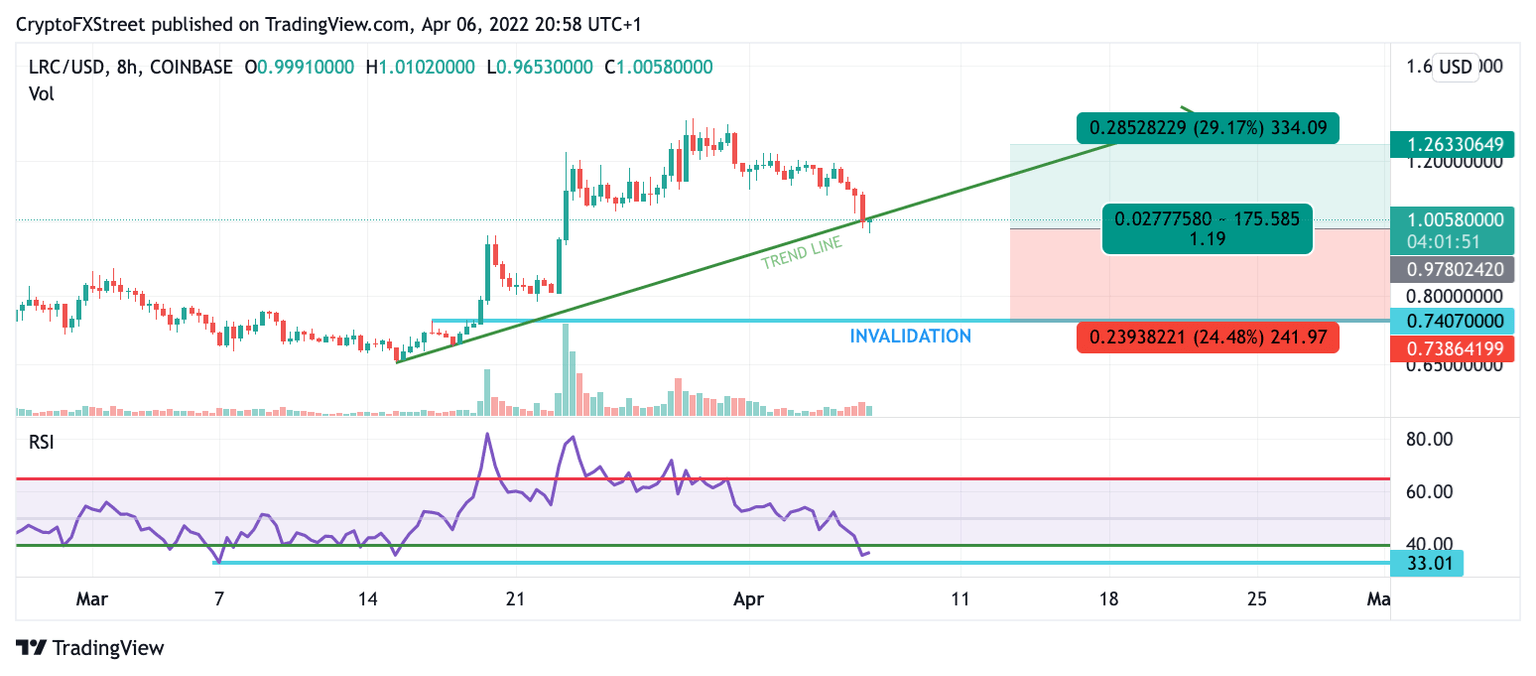

Loopring price could bounce and rally to $1.20

- Loopring price is testing a daily upward trend line.

- LRC price is oversold on the Relative Strength Index.

- Invalidation for the bullish trade setup will be a touch at $0.735.

Loopring price could have a countertrend rally of up to 30%. The LRC price action at these levels could provide significant buy signals.

Loopring price is one to watch

Loopring price has fallen more than 20% since last week's thesis. Analysts at FXStreet gave a clear warning not to participate in any bullish trades unless $1.27 was breached. Consolidation was also forecasted with the potential of retesting a distant ascending trend line. Today the LRC price at $0.98 has validated last week's bearish thesis as the price is having its first interaction with the daily trend line. Traders should keep their eye on digital asset closely.

LRC price could strongly bounce at current levels as first encounters with distant trend lines are usually catalysts to large countertrend rallies. The Relative Strength Index is currently falling into the oversold 30 levels, commonly known amongst professional traders as "Gamblers Terrain." Riskier traders could begin buying at the current levels, aiming for a 30% rally back up into the broken support level at $1.16 and $1.20.

LRC/USDT 8-Hour Chart

Loopring price provides a 1-1 setup for a risky countertrend scalp.

Invalidation for the short-term bullish thesis will be a touch at $0.735. If this were to occur, the entire bullish trend would be void. The bears would likely send prices to $0.70 and $0.63, resulting in a 36% correction from the current LRC price.

Author

FXStreet Team

FXStreet