Litecoin price set for a profitable week in a battered quarter

- Litecoin price prints green numbers during the European trading session.

- LTC price could be set for a breakout trade which could be positive for bulls.

- Overall sentiment remains bearish, however, in the long term towards December.

Litecoin (LTC) price is set to jump higher this week as markets see bulls storming out of the gate this Monday morning. After a very volatile two weeks where the world seemed to be on fire again and the apocalypse was near, it was time for decompression, providing traders with opportunities to recoup some of their incurred losses. Expect to see some modest gains this week, but it must be underlined that the overall downtrend is still very much at play, with $40 as the price target to the downside.

LTC price set to provide small gains within overall downtrend

Litecoin price is set to print some gains for this week as last week's overblown tail risks steadily deflate. The analogy of the markets being an elastic band is apt in this case: after getting stretched last week it is time for some detention. On the back of that, expect some dollar weakness, hand in hand with higher equities, and cryptocurrencies in a sweet spot.

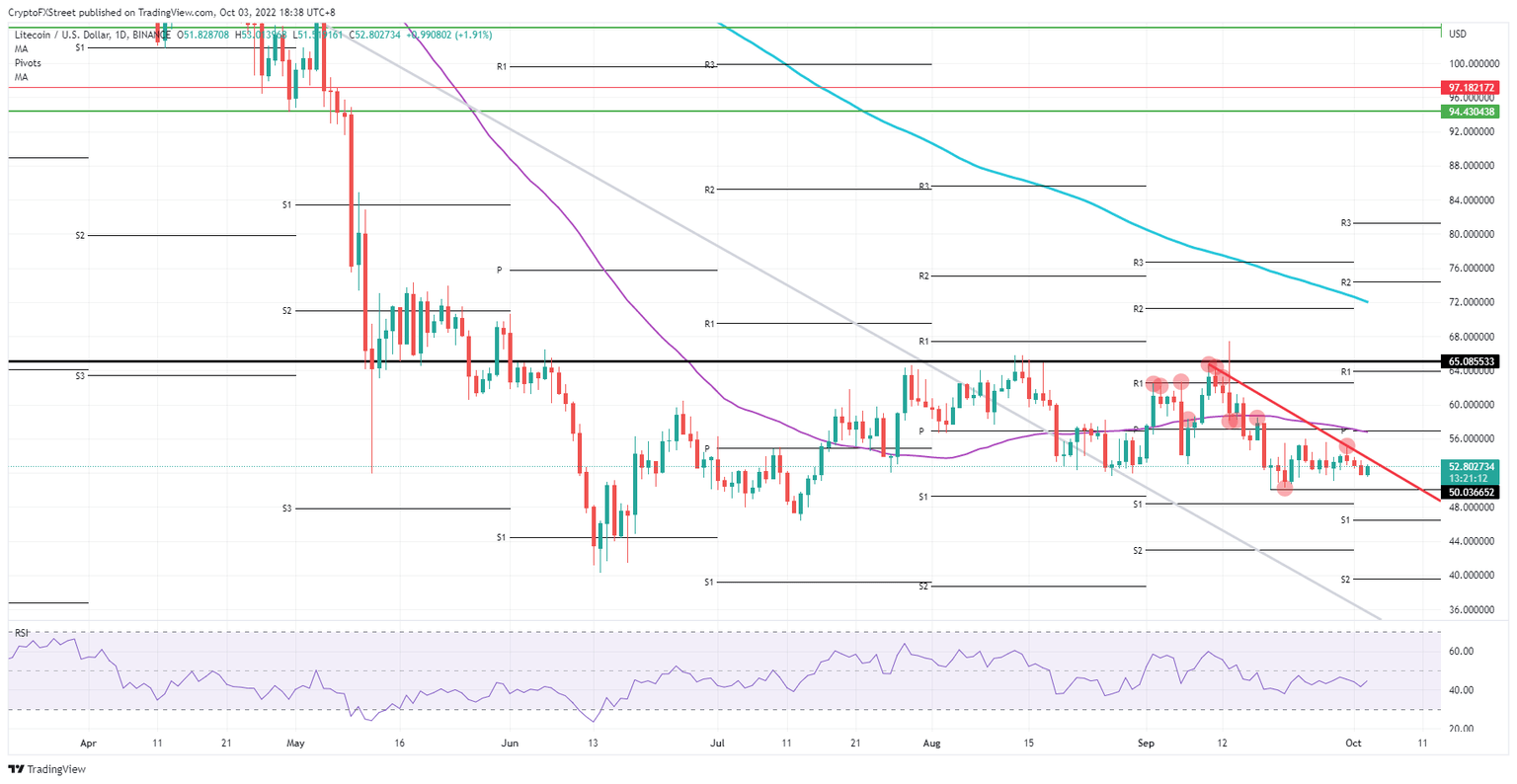

LTC price will see bulls brushing against the red descending trend line either today or Tuesday on the back of markets looking for a silver lining. Once that trend line breaks, a quick and sharp rally higher will probably follow, with bulls jumping to get in. The price target set forth is $57 with the 55-day Simple Moving Average and the monthly pivot as a double plateau at which to stop and take profit before support fades towards the end of the week.

LTC/USD Daily chart

The risk is that there could be a technical rejection at the red descending trend line. This might happen on the back of something eventful happening in the markets with, for example, a central bank intervention or some more escalation of violence in the region between Ukraine and Russia. A quick drop to $50 would happen with some follow-through towards $46.50 and the monthly S1. As the Relative Strength Index is still trading below 50, the oversold area will quickly be reached in case of another downturn, probably limiting further deterioration.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.