Litecoin Price Prediction: LTC stuck between tough resistance and support – Confluence Detector

- Litecoin settles the dust between critical resistance and support following a 23% surge in two days.

- The standoff between the bulls and the bears could end if LTC/USD closes the day above $73.8.

Litecoin has slowed down the uptrend that saw it outshine other major altcoins this week. As reported, the 23% spike hit a barrier at $77. A reversal saw LTC embrace critical support around $70 while its immediate upside is capped under $75.

Litecoin could hold in consolidation longer than expected

As discussed earlier, Litecoin tends to lead the altcoin rally in the market by rallying first. If history repeats, LTC might settle for consolidation before breaking out in massive price action, targeting $100.

The 4-hour chart shows the sixth-largest digital asset trading at $72.8 after a minor rejection from $74 (immediate resistance). Support at $70 is likely to sabotage the gradually building bearish momentum. The Relative Strength Index emphasizes the growing sellers’ grip as it dives toward the midline.

LTC/USD 4-hour chart

Note that the stalemate will be broken if Litecoin closes the day above $75. In the event the price soars towards the monthly high at $77, the $4.8-billion token may rally above $80.

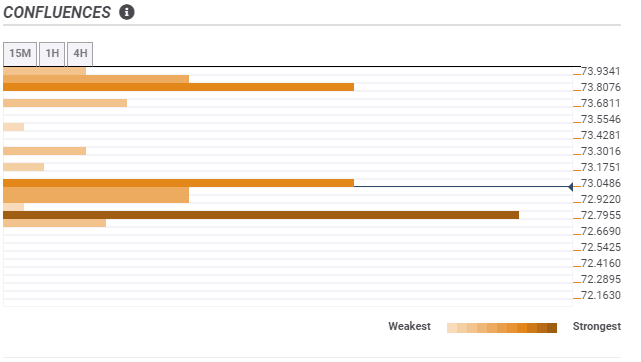

According to the confluence detector tool, Litecoin is sitting on an area with immense support, precisely $73. Various indicators meet here, including the previous 15-minute chart low and the pivot point one-week resistance two.

On the upside, the most robust confluence resistance holds the position at $73.8. This region is home to the Bollinger Band 15-minutes middle curve, the SMA 10 4-hour, and the Fibonacci 61.8% one-day. Trading above this crucial level might ignite another bull-run above $80.

Litecoin will likely hold in the range between the confluences a longer before a breakout comes into the picture. Meanwhile, the most robust support lies at $72.8 and hosts the previous low 15-minutes and the second one-week resistance pivot point.

LTC/USD confluence chart

It is worth mentioning that closing below the accelerated trendline (broken line) may encourage more sellers to join the market. In doing so, Litecoin could flip the above support areas into resistance and explore the zone under $70. The 50 SMA on the 4-hour is to provide support and prevent losses to the main trendline (continuous line).

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20(9)-637413697511127627.png&w=1536&q=95)