Aster Price Forecast: ASTER declines for fifth straight day despite buyback efforts

- Aster is down 3% on Thursday, extending the previous day's 10% decline to print its fifth straight day of losses.

- Aster's buyback program resumed on Wednesday, funded by the previous day's Stage 4 fee revenue, and will continue through the end of the same on Sunday.

- On-chain data shows steady dip-buying from large-wallet investors as retail demand falters.

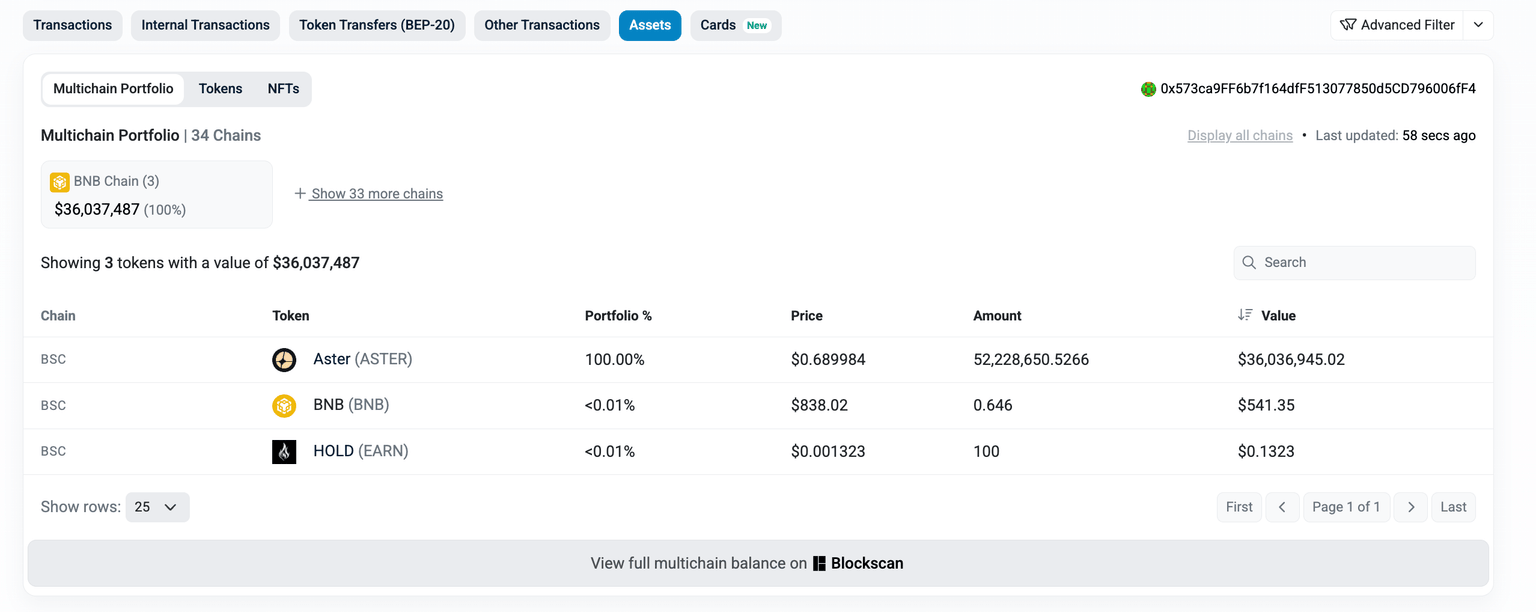

Aster (ASTER) trades under intense selling pressure, recording 3% loss at press time on Thursday. The perpetual-focused exchange resumed its Stage 4 buyback program on Wednesday and currently holds almost 52 million ASTER tokens. Additionally, on-chain data reveals that large-wallet investors, commonly referred to as whales, are buying the dip while retail demand in the derivatives market fluctuates.

The technical outlook for ASTER remains bearish, as indicators suggest intense overhead pressure.

Aster continues buyback after a single-day halt

Aster issued a clarification on its buyback program, driven by its Stage 4 daily revenue. The Binance-backed project revealed accelerated buying worth nearly $4 million per day between December 8 and 15, totaling almost $32 million.

However, the airdrop program paused the buyback schedule for a day on Tuesday, which was later resumed on Wednesday. The buybacks will continue throughout Stage 4, ending on Sunday, and afterward, it will remain a standing policy.

As of December 18, the Stage 4 buyback address holds over 52.22 million ASTER tokens and is likely to cross 70 million ASTER if buying pressure sustains.

Whales acquire ASTER amid mixed retail sentiment

Santiment data shows that large wallet investors are increasing their holdings, indicating a bottom-buying spree from whales. Whales holding 10-100 million ASTER hold 4.69% of the supply, up from 3.44% on December 1. Meanwhile, whales with 1-10 million ASTER hold 3.70%, up from 3.36% over the same period.

However, on the derivatives side, Aster struggles to retain retail demand amid volatile market conditions. CoinGlass data shows that the ASTER futures Open Interest (OI) is down almost 8% in the last 24 hours, to $385.29 million, indicating a drop in retail activity.

Meanwhile, the long liquidations during the same period account for $3.92 million, outpacing the short liquidations of $269,500.

Still, the funding rate of 0.0056% indicates short-term bullish interest that could fuel long liquidations.

Aster’s downfall picks up momentum, targeting $0.50

Aster trades below $0.70 at the time of writing on Thursday, incurring a 3% loss so far. The exchange token’s 13% decline on Monday triggered a sell signal when it crossed below the Supertrend indicator line at $0.88. So far, ASTER is down 25% this week and aims for the S2 Pivot Point at $0.50.

The technical indicators on the daily chart suggest that the Binance-backed token is under intense selling pressure. The Relative Strength Index (RSI) is at 27, crossing into the oversold zone, while the Moving Average Convergence Divergence (MACD) and signal line continue to fall after briefly converging last week.

Looking upside, ASTER should reclaim the $1.00 psychological level to reinstate a recovery run.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.