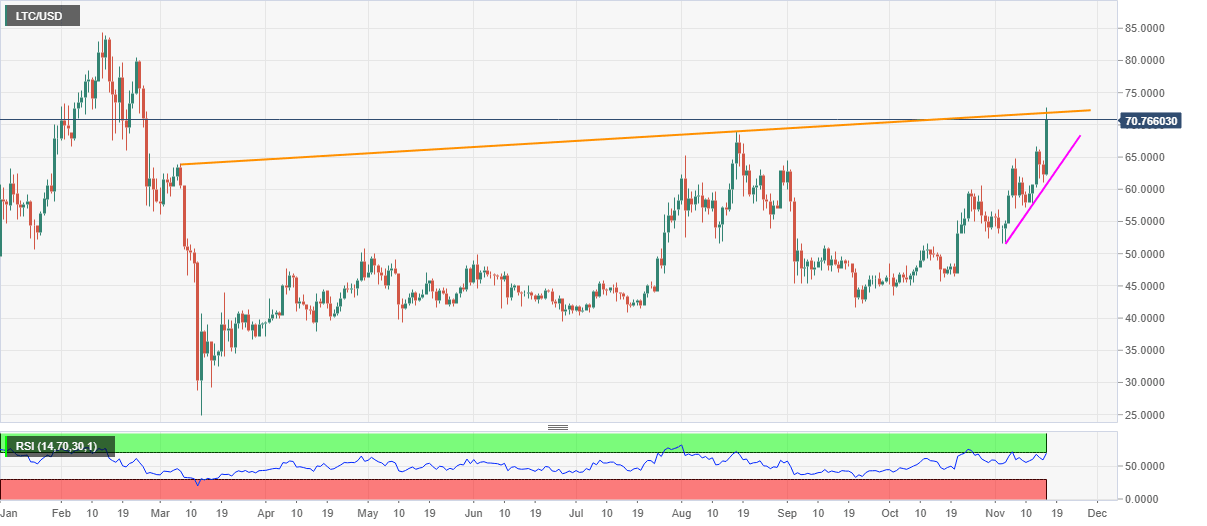

Litecoin Price Analysis: LTC bulls battle eight-month-old resistance line

- LTC/USD eases from the highest since late-February, keeps the 70.00 threshold.

- Overbought RSI, failures to cross the key resistance line lure high-risk sellers.

LTC/USD steps back from the multi-day high to 76.67 as buyers catch a breather by Monday’s end. Even so, the quote marks over 13.00% gains while stepping back from an upward sloping trend line from March 07, 2020.

Not only the failures to cross the key resistance line but overbought RSI conditions also push brakes on the crypto major’s further buying. Though, the quote stays above the 70.00 round-figure, which in turn serves as a trigger for the fresh short-term selling.

Should LTC/USD bears manage to keep the reins below the 70.00 threshold, Friday’s peak near 66.65 and the early-November high around 64.75 can entertain them ahead of highlighting a two-week-old support line, currently near 60.70.

On the contrary, a clear run-up past-71.85 level, comprising the stated resistance line, will escalate the trading momentum towards the 80.00 psychological magnet.

Though, February 23 peak and the yearly top, respectively around 80.50 and 84.40, can please the LTC/USD optimists afterward.

LTC/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.