Institutions’ interest in crypto grew by 176% in 2023 but seems to be waning ahead of Bitcoin ETF

- Institutions poured billions of dollars into digital asset products, marking a 176% growth from $816 million in 2022 to $2.22 billion.

- Bitcoin inflows grew the most, rising by 400% in anticipation of the ETF approval.

- However, block trades are starting to see active put buying, with options market data suggesting that institutional investors are not very bullish on the ETF market.

The upcoming spot Bitcoin ETF approval is set to be the biggest catalyst witnessed by the crypto market in a long time. The year 2023, in anticipation of the approval, observed millions of dollars flowing into digital asset investment products, which seem to have placed Bitcoin way above the home of DeFi Ethereum.

What crypto institutions did in 2023

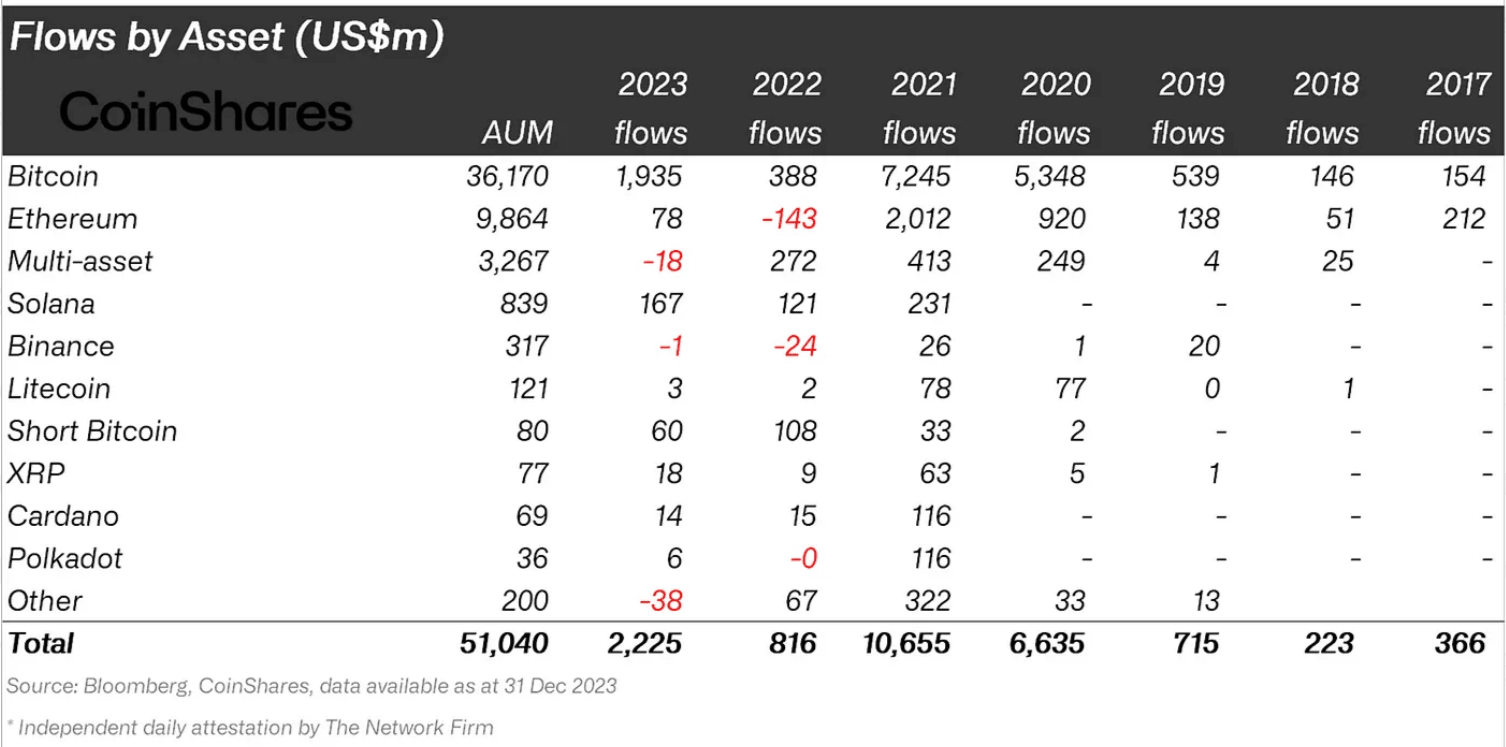

According to CoinShare’s weekly fund flow report, institutional investors’ interest in Bitcoin appears to have been magnanimous. Since the beginning of the year, digital asset investors have been favoring Bitcoin over Ethereum, and this is evident in the total flows for 2023.

Bitcoin recorded inflows of over $1.93 billion in 2023, which is a nearly 400% increase from the $388 million noted in 2022. Ethereum, on the other hand, observed considerable improvement, but it did not seem to have been a crucial part of the institution's portfolio. Throughout the past year, the altcoin noticed a series of inflows and outflows; however, by year-end, ETH registered inflows of $78 million, much higher than 2022’s $146 million outflows.

Institutional flows 2023

This contributed to the overall inflows marked by institutions in 2023, which sits at $2.225 billion, rising by 172% from $816 million in 2022. Thus, looking at their accumulation, it may seem like the investors are holding on to a bullish bet as we begin 2024. The Options market gives a different outlook as large wallet holders have shifted their stance.

What can crypto institutions do in 2024

The recent hoax of the SEC rejecting the applications born from a report from Matrixport resulted in the price of the cryptocurrency crashing over 6% in a day. But while this was an isolated incident of FUD in the crypto market, the concerning development comes from the Options market.

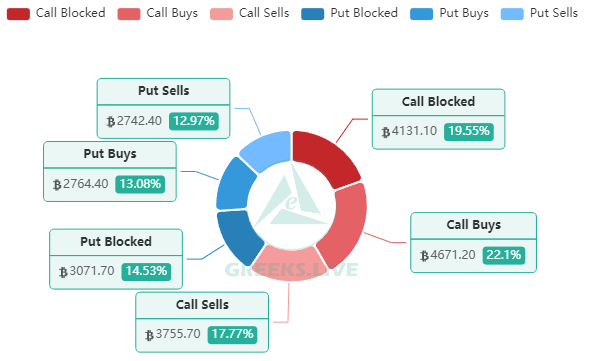

Institutions seem to be experiencing waning bullishness toward the BTC ETF market. At the money, Options Implied Volatility plummeted to 52% and under 65% for the January 12 expiration, falling back to last-year-end averages.

Options data

Furthermore, as noted by Greeks.Live, a professional traders team,

“Current month puts are now cheaper, and block trades are starting to see active put buying, with options market data suggesting that institutional investors are not very bullish on the ETF market.

This means that there is a positive change that institutional investors, a key group for the next rally, might step back or hold off pouring in their money until the market picks up post-ETF approval.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.