How to position yourself for Algorand’s next 60% price move

- Algorand price has formed a reversal pattern around a stable support level, hinting at a massive rally.

- Investors can expect ALGO to tag the range high at $0.989 and make a run for the $1.20 hurdle.

- A daily candlestick close below $0.68 will invalidate the bullish thesis for ALGO.

Algorand price is setting the stage for a massive upswing with a bottom reversal pattern as it bounces off a stable support level. With the general market structure looking good, a resurgence in buying pressure is what investors can expect ALGO to experience. Therefore, an uptrend is likely on the cards for the altcoin and gains for patient holders.

Algorand price kick-starts its move

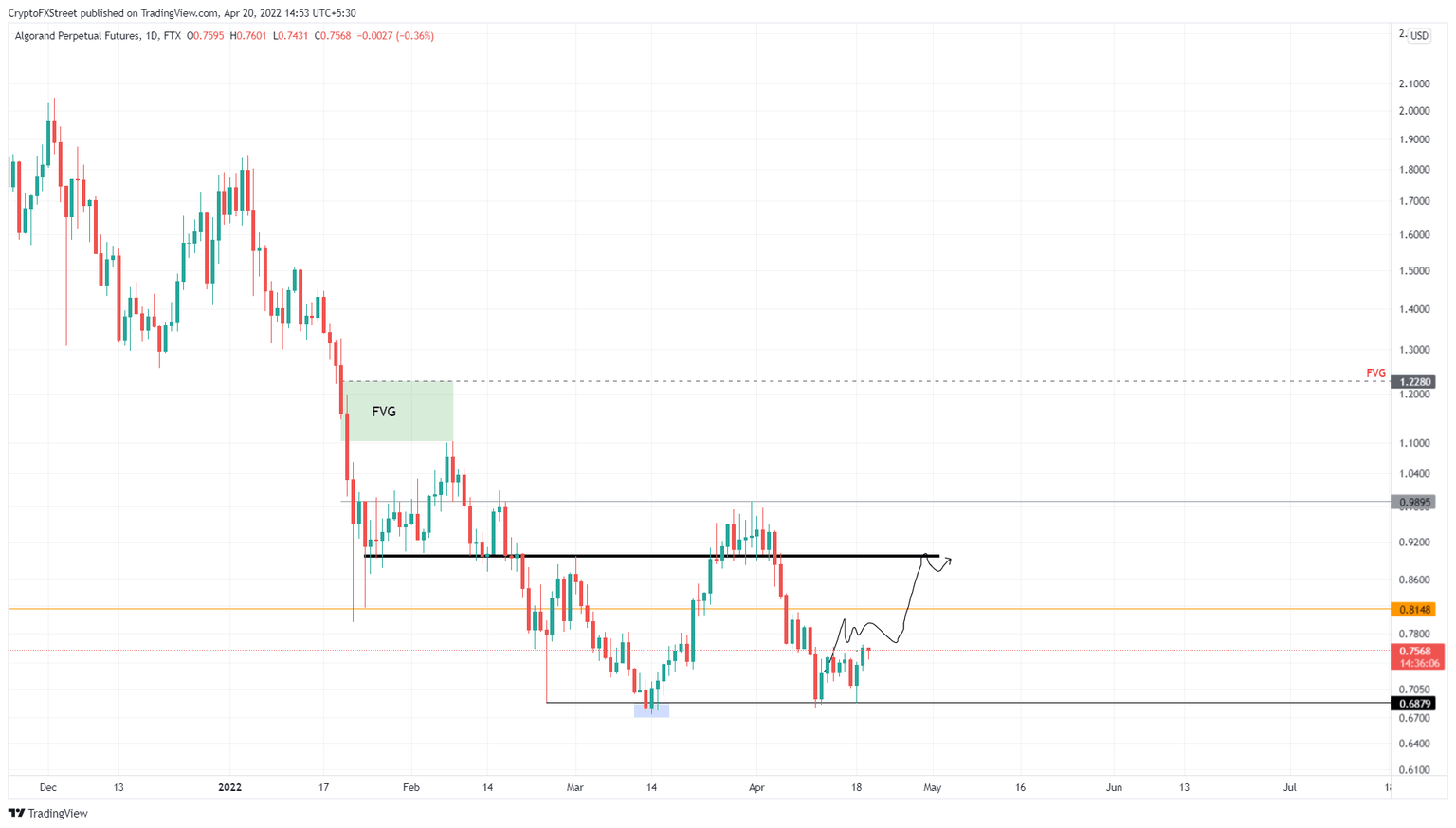

Algorand price has been stuck trading inside a range, extending from $0.687 to $0.897 since February 24. Although ALGO rallied above the range’s upper limit after a 45% upswing on March 14, it failed to stay there.

Profit-taking and bearish market structure caused Algorand price to correct 30% and sweep the range low at $0.687 again. Interestingly, ALGO has tagged this level thrice, giving rise to a bottom reversal setup. Therefore, investors can expect a resurgence of buying pressure to kick-start a massive move.

This bottom reversal pattern favors the bulls and is likely to kick-start a run-up to the range high at $0.897, which would constitute a 30% gain. However, from its current position at $0.751, this move would represent a 20% ascent.

However, investors can expect Algorand price to climb higher, but this scenario is dependent on how bulls react to the $0.989 hurdle. If the buyers band together and flip this barrier into a foothold, it will serve as a base for the next leg-up.

This development will allow ALGO to tag the $1 psychological level and also reach for the $1.228 hurdle, bringing the total gain to 63%.

This blockade is the only thing preventing Algorand price from rallying to $1.2 and clocking up a 67% gain from the current position - $0.73.

ALGO/USDT 1-day chart

A sudden surge in selling pressure that knocks ALGO to produce a daily candlestick close below $0.68 will create a lower low. Moreover, this development will put the bears in control and invalidate the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.