Hedge fund managers realize that having Bitcoin in their portfolios is a must

- A shifting paradigm begins as potential career risks await fund managers without Bitcoin in their portfolios.

- Technical indicators show that BTC price might take a nosedive while the long-term outlook remains bullish.

Some of the most prominent fund managers are starting to realize the consequences of not having Bitcoin in their portfolios. As the US dollar weakens because of the Fed's policy of printing money, the flagship cryptocurrency is thriving as a haven from inflation.

Institutional investors FOMO into Bitcoin

There seems to be an exciting twist of events in the financial scene as ownership of Bitcoin is slowly turning into a requisite condition for top fund managers. This change in narrative contrasts with the past, where wealth managers perceived investment in digital currencies as risky.

In an interview with CNBC, the CEO of Coinshares Danny Masters said that the absence of Bitcoin in any investment manager's portfolio has become a carrier risk.

"That is perfectly well-stated, you're not going to get fired anymore if you had some Bitcoin, but you might get fired if you didn't."

Indeed, Bitcoin's upside potential remains strong as it gains recognition among renowned institutional investors who are using it as a hedge against inflation. One of the many metrics that has caught the attention of enterprise market participants is the hash ribbon indicator.

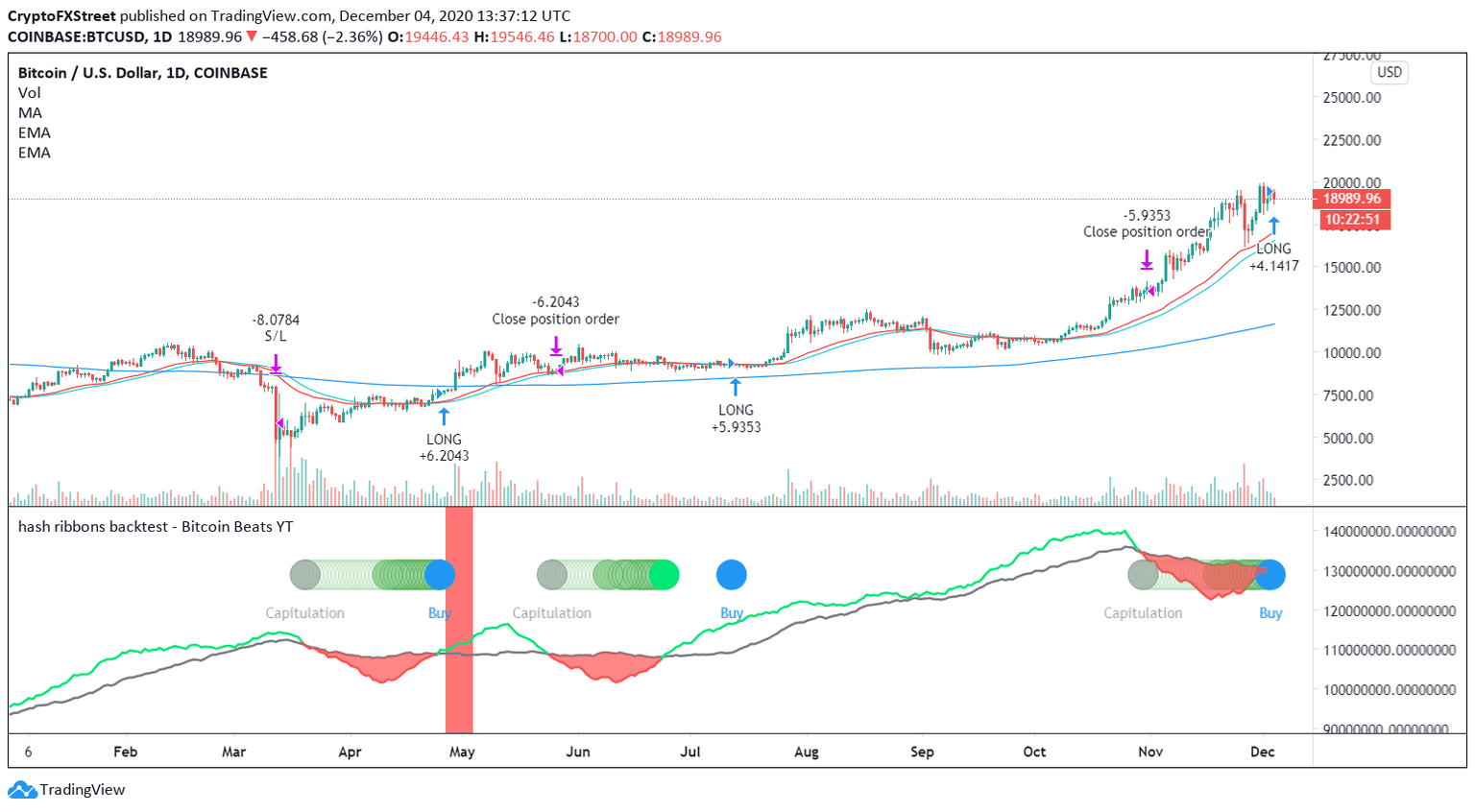

This on-chain index forecasts that BTC is about to enter a new parabolic advance. Accordingly, miners have capitulated because it is too expensive to mine more tokens relative to the cost of mining. When this happens, the momentum of Bitcoin price changes from negative to positive, indicating a considerable buying opportunity.

Hash Ribbon Indicator

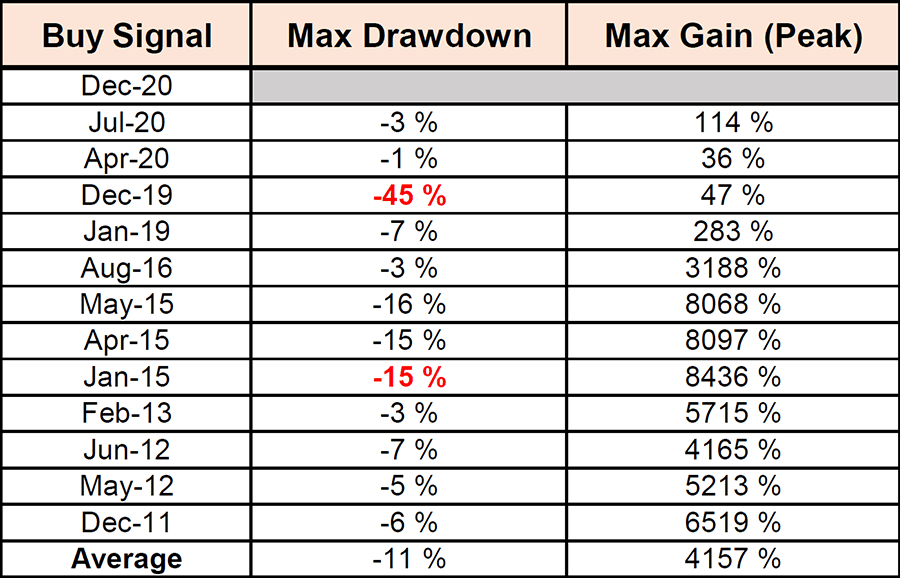

Historical data shows that Bitcoin price has always rallied after this indicator flashes a buy signal.

For instance, after the 30-day moving average of the hash rate crossed above the 60-day moving average in late April, BTC shot up by more than 36%. A similar price action took place in mid-July, which saw the pioneer cryptocurrency rise by more than 100%.

Hash Ribbon Indicator's Historical Data

Whether or not this bullish signal is a self-fulfilling prophecy, the rapid growth of miners and investors' participation is a clear sign that Bitcoin is set for new highs in the long term.

Author

FXStreet Team

FXStreet