Grayscale goes after SEC over leveraged ETFs, GBTC discount shrinks to 15-month high

- Grayscale filed a letter with the DC Circuit Court highlighting the discriminatory behavior of the SEC.

- The asset manager stated the 2x leveraged Bitcoin Futures ETF poses significantly more risk than average futures BTC ETF and yet it received approval.

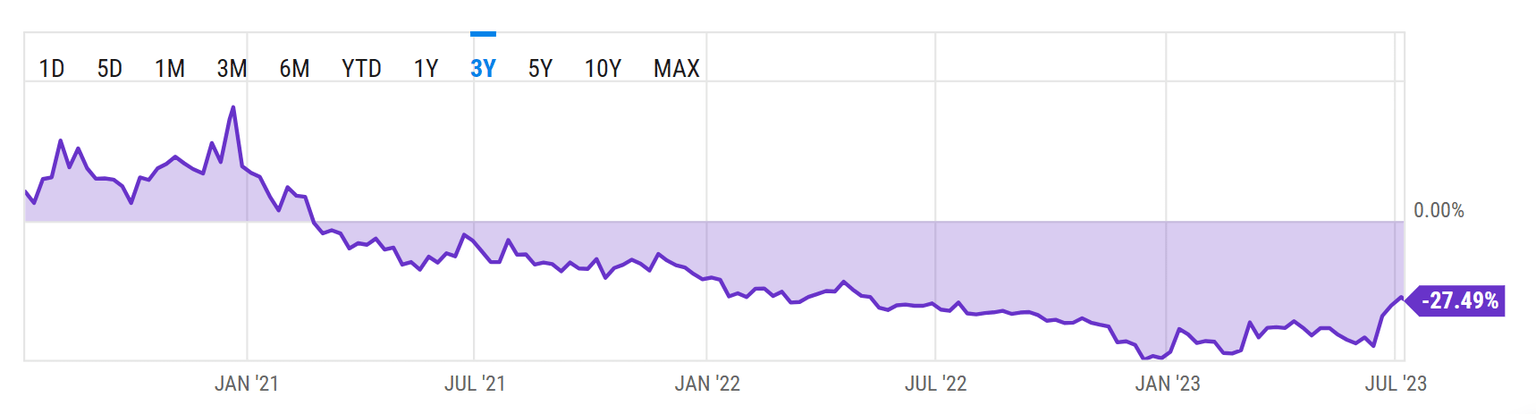

- Grayscale Bitcoin Trust (GBTC) over the past month has recovered by 17%, with the Trust now valued at a discount of 27.49%.

Grayscale has been fighting the Securities and Exchange Commission (SEC) just like a few of its other peers in the crypto space. Considered to be the pioneer of Bitcoin investment products with its Grayscale Bitcoin Trust (GBTC), the asset manager has always been vocal over regulations and is now directly taking a shot at the same.

Grayscale fights back

Grayscale announced that its attorneys filed a letter with the DC Circut Court on July 10. The letter brought to attention the discrimination exhibited by the regulatory body when it comes to approving Bitcoin ETFs.

Today, our attorneys filed a letter with the DC Circuit highlighting the disparity between the SEC’s approval of a leveraged #bitcoin futures ETF while continuing to deny approval of spot bitcoin ETFs like $GBTC. Let’s dive deeper. /6 pic.twitter.com/z7WyGBthhT

— Grayscale (@Grayscale) July 10, 2023

Pointing out a particular case of leveraged Futures Bitcoin ETF, the company stated,

“The 2x levered bitcoin futures ETF employs leverage with the goal of doubling the performance of the S&P CME Bitcoin Futures Daily Roll Index each day. This exposes investors to an even riskier investment product than traditional bitcoin futures exchange-traded products. (sic)

The letter from Grasycale was in response to the consistent rejections over spot Bitcoin ETFs and the recent objections raised by the agency when it received applications from BlackRock, Fidelity and more. It, at its core, states that this industry is observing a lot of interest from investors and should thus be given a fair opportunity to thrive before shutting it down over preconceived notions.

While there was no immediate impact observed on Grayscale Bitcoin Trust (GBTC), the investment product is currently recovering at a rather rapid pace. Still trading at a discount, the GBTC, in the past 30 days, has noted a significant increase in its value. The Trust is currently trading at a discount of 27.49%, up by more than 17% in the last month from 44%.

Grayscale Bitcoin Trust discount to NAV

Grayscale is expecting a final decision from the DC Circuit Court of Appeals as soon as possible. While it initially pegged the decision to be announced by Q2 this year, it has since been moved to the second half of 2023.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.