Possible legal filings could show how intertwined FTX and its sister company were, even as CEO Sam Bankman-Fried follows through on his promise to shutter Alameda.

Good morning. Here’s what’s happening:

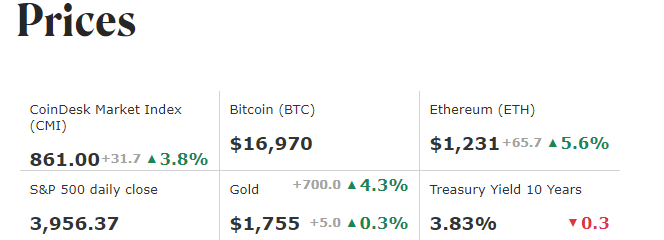

Prices: Bitcoin and other cryptos spent their day in the green as investors relished encouraging inflation data.

Insights: How intertwined were FTX and Alameda Research? The answer may soon be forthcoming.

Prices

BTC/ETH prices per CoinDesk Indices; gold is COMEX spot price. Prices as of about 4 p.m. ET

Cryptos See Deep Green as Investors Relish U.S. Inflation Report

by James Rubin

After rallying on Thursday amid encouraging U.S. inflation data, bitcoin found a happy nesting place above $17,000.

The largest cryptocurrency by market capitalization was recently trading near $17,000, a more than 4% gain over the past 24 hours as investors filled with new hope about the economic future returned to riskier assets. At one point, BTC rose more than 13% to trade near $18,000. A Wednesday plunge spurred by the ongoing FTX unraveling had sent its price to two-year lows.

Ether was recently changing hands over $1,230, up 5.6% from Wednesday, same time. Other cryptos in the top 20 spent Thursday well into the green. In an email to CoinDesk, 3iQ Head of Research Mark Connors, noted optimistically that the “one persistent development [distinguishing] the crypto winter from all others is the emergence of ETH dominance as measured by the ETH/BTC ratio.”

Other cryptos in the top 20 by market cap, spent the day in the green amid – at least temporarily – waning FTX and inflation fatigue. Even FTX’s beleaguered FTT token, whose accumulation by the exchange’s sister company Alameda Research ignited the current mess, was recently up over 20% to $2.90. Solana’s SOL, which also figured prominently on Alameda’s balance sheet, raising investor alarm, recently rose more than 6%.

On Thursday they had cause for optimism when an unexpectedly positive Consumer Price Index report indicated the U.S. Federal Reserve’s recent diet of hawkish, 75 basis point interest rate hikes were working towards reducing a year-long bout of high inflation.

The CoinDesk Market Index, a broad-based index designed to measure the market capitalization weighted performance of the digital asset market, was down about 3%.

Stocks soared, staging their biggest rally in two years as investors cheered the heartening price data. The tech-heavy Nasdaq rose 7.3%, while the S&P 500 and Dow Jones Industrial Average (DJIA) increased 5.5% and 3.7%, respectively.

In an email, Mati Greenspan, the founder and CEO of research and advisory group Quantum Economics, saw a positive in FTX's disintegration. "In a way, FTX collapsing is a self-inflicted wound by the crypto market intended to prevent bad regulation from killing our future," Greenspan wrote. "I don't think anyone, including CZ [Binance CEO Changpeng Zhao} wished their demise nor the contagion it caused. But frankly I'd much rather see the platform disappear into the void than jeopardize everything we're trying to build."

Insights

Joined at the Hip? Details About the FTX-Alameda Relationship May Soon Be Forthcoming

by Sam Reynolds

FTX’s Sam Bankman-Fried publicly claimed that Alameda Research was a “wholly separate entity” from FTX. All the evidence, including corporate filings, pointed to the contrary. The legal fallout from the exchange’s decline, including the increasing possibility of a bankruptcy filing, will clarify how intertwined the two entities have been.

Meanwhile, on Thursday, the 30-year-old former billionaire took to Twitter to say Alameda – his empire’s once mighty crypto quant shop and market maker – would go dark “one way or another.”

A CoinDesk scoop from last week revealed that a notable portion of Alameda’s balance sheet was FTX’s FTT token. Reuters reported Thursday that FTX used customer funds to prop up Alameda Research during market turmoil in May.

A filing from Singapore’s corporate registry has shown that Bankman-Fried and other FTX corporate executives retained key roles at Alameda’s Singapore subsidiary.

The filing listed Bankman-Fried as an authorized representative, alongside Constance Wang (Wang Zhe), FTX’s COO, and Darren Wong, FTX’s CMO. The other representatives on the filing are part of a corporate services firm that helped establish the entity.

This Singapore entity is wholly owned by Alameda’s British Virgin Islands parent. There’s also an Alameda Research entity in The Bahamas, as many of the staff are based on the island.

There’s no Alameda Research in Hong Kong, but rather a Cottonwood Grove which is controlled by Bankman-Fried (it shares the name with an entity in Antigua).

If FTX ends up filing for a U.S. bankruptcy, there will be a document dump, much like in the case of Three Arrows Capital, where all will be laid bare.

Meanwhile, the Financial Times has a first look at what it believes is the FTX empire and the results of their research is impressive.

Surely regulators like the CFTC wereaware of the Alameda-FTX relationship for some time, but this spectacular collapse of the two companies will force them to act.

The prevailing narrative of FTX-Alameda had been one of brazen corruption:

— jonwu.eth (@jonwu_) November 8, 2022

FTX gives Alameda priority orderflow, allowing its sister hedge fund to front-run other traders.

Taking a few privileged basis points on the 3rd largest exchange would be a perpetual money machine.

During the GameStop frenzy of early 2021, market maker Citadel Securities came under intense scrutiny for its relationship with brokers. Now imagine if Citadel and the New York Stock Exchange were one and the same. Regulators’ heads explode if Jeffrey Sprecher and Ken Griffin’s names appeared together on a list of a company’s directors.

And what do other crypto market makers think of all of this? They don’t like it.

One that spoke to CoinDesk on background clarified that market makers and takers (the counterparty) must have equal access to the exchange with no party at an advantage. Exchanges are also not supposed to co-mingle funds, something that Retuers reported FTX is guilty of.

We’ll learn a lot more if FTX ends up before a bankruptcy court. It’ll probably be the U.S. Bankruptcy Court for the Southern District of New York, which has heard many of the major crypto bankruptcy cases this year. And it might even be the same judge too.

Important events

Sharm El-Sheikh Climate Change Conference (Egypt)

DCL Metaverse Music Festival

11 p.m. HKT/SNST (3 p.m. UCT): University of Michigan Consumer Sentiment Index (Nov./preliminary)

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin price reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum price holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple price coils up for a move north as XRP bulls defend $0.5000.

Jack Dorsey's Block is under investigation by US Prosecutors for crypto lapses, says NBC

According to a report from NBC on Wednesday, former Twitter CEO Jack Dorsey's company, Block, is under investigation by the US federal government. The allegations against the company are charges of processing transactions linked to sanctioned countries and even terrorists.

Ethereum attempts comeback after Fed decision not to tamper with rates

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana (SOL) price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

Bitcoin: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s (BTC) recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.