Ethereum's native .ETH domain debuts on easyDNS ahead of the Merge, Ether price plunges

- The Canadian ISP easyDNS have added the native .ETH domain name for registrations.

- EasyDNS was the first ICANN registrar to provide Ethereum Name Service (ENS), linking to legacy IANA TLDs.

- Ethereum price plummets 9.2% to $1,515, wiping out all the gains accrued on Tuesday.

EasyDNS, a Canadian Internet Service Provider (ISP), has released the first ever Ethereum's native .ETH domain to cater to registrations on its platform. Interestingly, easyDNS was the first ISP to support the Ethereum Name Service (ENS) linked to legacy IANA TLDs .XYZ domains. According to a blog post outlining the development, ENS native domain services first began in 2018, but this will be the first time .ETH has come into use.

What does a native .ETH domain mean for Ethereum?

Over the years, easyDNS has made it easier for people and organizations to use .XYZ or .COM domains for Ethereum wallet addresses. This latest release infers that .ETH domain can be used for registrations at easyDNS.

.ETH is Ethereum's top-level domain that utilizes the Ethereum Name Service (ENS). It boasts over 1.5 million .ETH names since 2017. Some Twitter handles, for example, "vitalik.eth" are already using the new domain name.

Some Web3 platforms and devices also utilize .ETH names as login identifiers for Decentralized Apps (DApps). EasyDNS said that interested parties could find instructions on how to enable .ETH registrations on their platform.

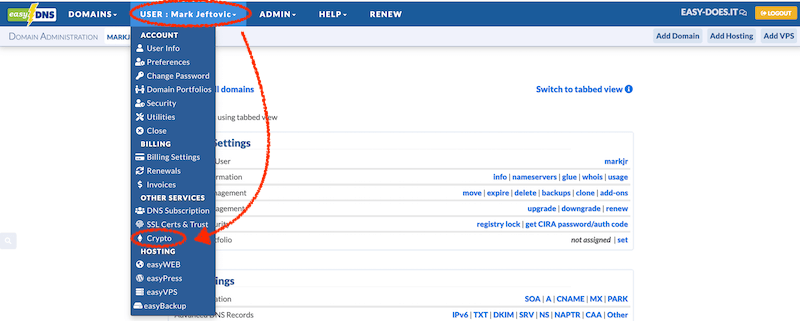

"There's a new crypto module in the control panel from where you can register and manage .ETH domains (and any conventional names with ENS linking enabled)."

EasyDNS hopes to add selected decentralized namespaces in the future – with .BTC domains likely to start. Services relating to .ETH domain name will be paid for using Ether, but users must have a Web3-enabled browser, for example, Metamask. Currently, the service fee has been set at 500 gwei – factored into the gas fee.

Ethereum Merge is closer now than ever

The upcoming Ethereum Merge will occur between September 13 and 15, according to the network's co-founder Vitalik Buterin. Nevertheless, the impending transition from a proof-of-work (PoS) to a proof-of-stake (PoS) consensus algorithm has elicited questions regarding ETH issuance. Two scenarios may play out, according to an analysis recently released by Glassnode – see chart below.

The chart below presents $ETH issuance under two scenarios:

— glassnode (@glassnode) September 5, 2022

$ETH issued on both PoW + PoS chains, with the EIP1559 burn (usually inflationary).

$ETH issued on PoS + EIP1559, simulating a Merge going live in Aug 2021, demonstrating a high chance of supply deflation. pic.twitter.com/1gHeoDgguw

The first option suggests that ETH be issued on both PoS and PoW chains alongside the EIP-1559 burn – making it an inflationary process. On the other hand, the second situation calls for ETH to be issued on only the PoS and via the EIP-1559 burn – presenting a higher deflationary bearing on the protocol.

Read more: Ethereum Price Prediction: With a 6% move, ETH price eyes $2,000 before the Merge

ETH/USD 12-hour chart

It is unclear how the Merge would play out and which of the two scenarios Ethereum developers will settle for. However, investors are concerned about the ongoing pullback to $1,510.

Support at the ascending trend line must hold to prevent losses from stretching to $1,400. Many expect the Merge to influence the price positively, but some say that the event may birth another crypto crash as investors sell the news.

Read more: Can Ethereum price reach $2,000 again before the Merge update?

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren