Ethereum Price Forecast: BitMine acquires 102,259 ETH as price plunges 5%

Ethereum price today: $2,920

- BitMine purchased 102,259 ETH last week.

- The company's total holdings have reached 3.96 million ETH, worth nearly $12 billion.

- ETH could find support near $2,850 after seeing a 5% decline.

Ethereum (ETH) treasury company BitMine Immersion scaled up its digital asset stash last week after acquiring 102,259 ETH since its last update.

The purchase has increased the company's holdings to 3.96 million ETH, worth about $11.82 billion at the time of publication. BitMine aims to accumulate 5% of ETH's circulating supply.

"2025 saw many positive developments in digital assets including positive legislation passed by the US Congress and favorable regulations, [...] strengthening support from Wall Street," said BitMine chairman Thomas Lee in a statement on Monday. "These strengthen our conviction that the best days for crypto are ahead and why we continue to accumulate ETH toward our 'alchemy of 5%' target."

The Nevada-based firm also reported holdings of 193 Bitcoin (BTC), a $38 million stake in Worldcoin (WLD) treasury, Eightco Holdings and total cash of $1 billion.

BitMine's latest purchase strengthens its position as the second-largest crypto treasury behind Strategy and leading ETH treasury ahead of SharpLink Gaming.

Despite its lead, BitMine is sitting on unrealized losses of about $3 billion, according to data compiled by CryptoQuant community manager Maartunn.

The company's shares are down 9% at the time of publication on Monday.

Ethereum Price Forecast: ETH eyes support at $2,850 following 5% plunge

Ethereum has seen $174 million in liquidations over the past 24 hours, spearheaded by $141.8 million in long liquidations, according to Coinglass data.

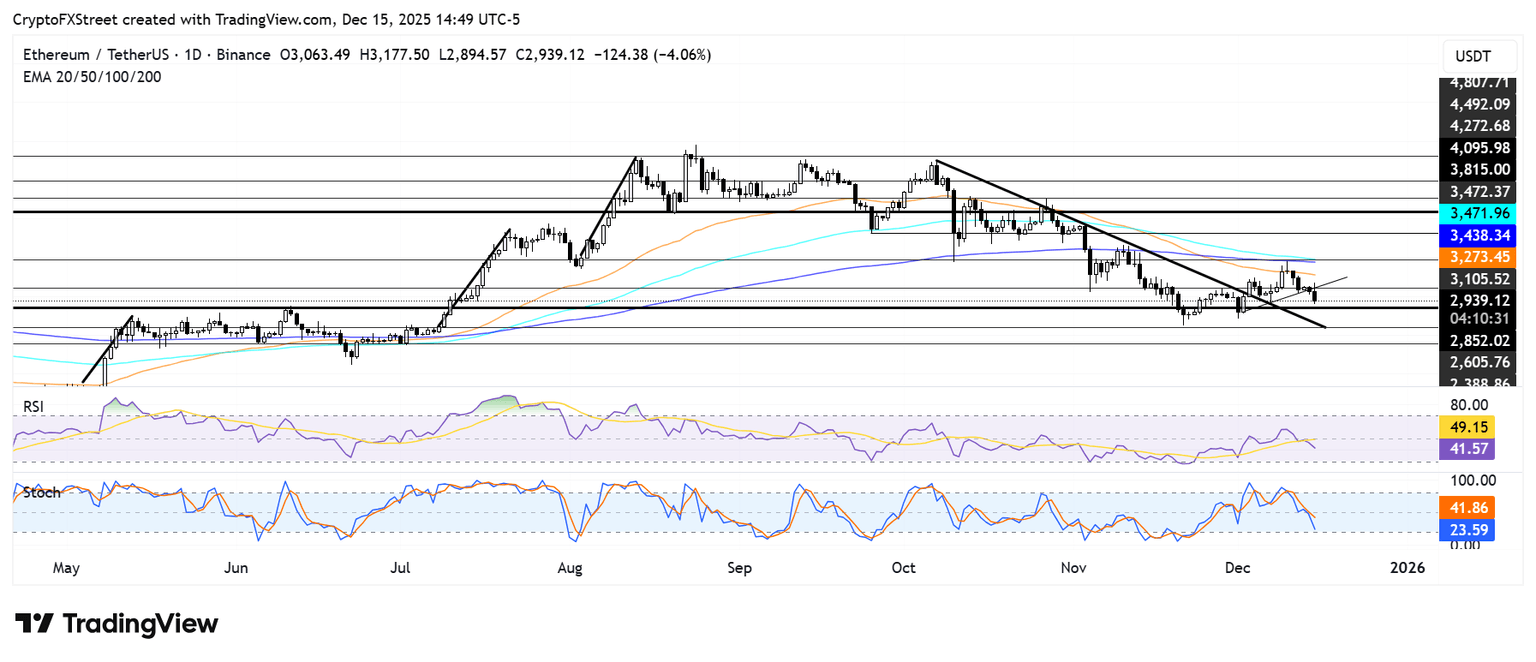

ETH faced a strong rejection as it attempted to recover the $3,100 level. Its price has declined by 5% on Monday and is approaching the $2,850 support level.

A failure to bounce at $2,850 could see ETH decline toward $2,600. Further down is the support at $2,380.

On the upside, ETH has to recover $3,100 and stage a move above the 50-day, 100-day and 200-day Exponential Moving Averages (EMAs) to resume an uptrend.

The Relative Strength Index (RSI) has declined below its neutral level, while the Stochastic Oscillator (Stoch) is approaching oversold territory. A decline of the Stoch into oversold conditions could spark a short-term reversal.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi