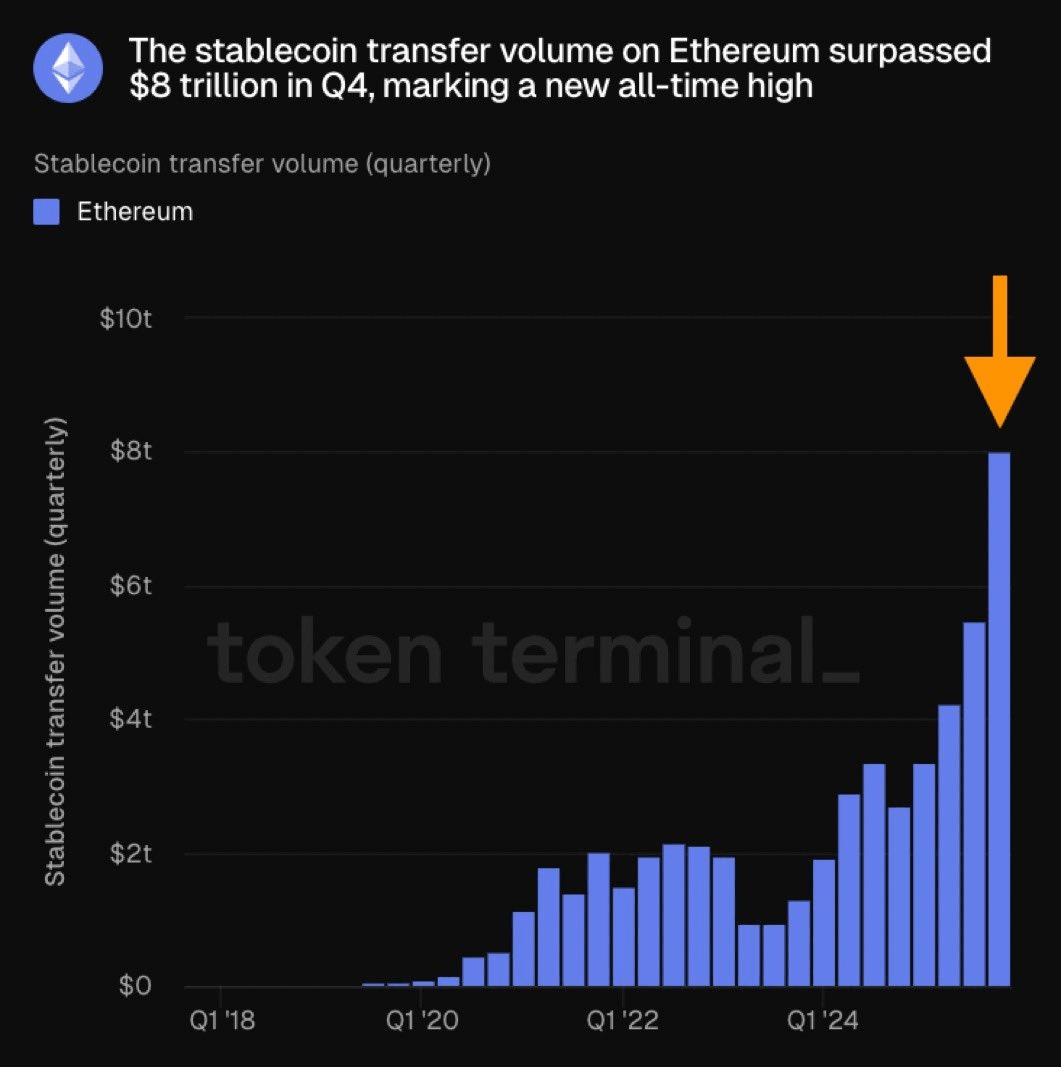

Ethereum powers $8T in stablecoin transfers in Q4, smashing record

Stablecoin transfer volume on Ethereum surpassed $8 trillion in the fourth quarter of 2025, marking a new all-time high, Token Terminal reported on Monday.

The $8 trillion milestone is almost double the transfer volume figure for the second quarter, which was just over $4 trillion, according to Token Terminal’s chart.

Stablecoin issuance on Ethereum increased by around 43% in 2025 from $127 billion to $181 billion by year’s end, according to BlockWorks.

“This isn’t speculation. This is global payments happening on-chain,” commented “BMNR Bullz” on X. “This is before SWIFT-style integrations, full RWA tokenization, and institutional rails going live.

“The rails are already built. Adoption is catching up,” they added.

Ethereum transactions and addresses peak

The milestone coincided with an all-time high in total daily transactions on the Ethereum network, which hit 2.23 million in late December, according to Etherscan. Ethereum daily transactions are currently up 48% since the same time last year.

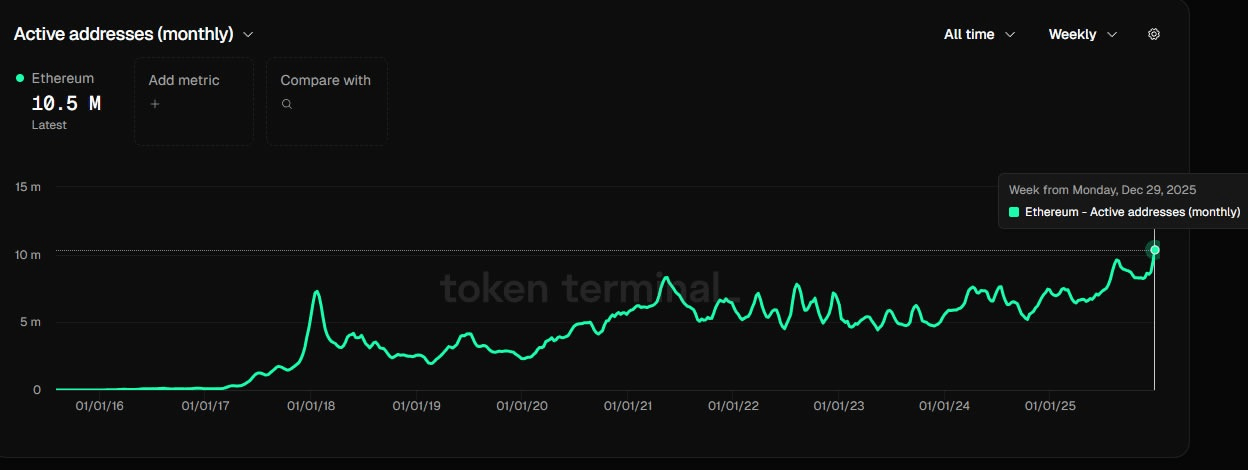

Token Terminal reports that Ethereum active monthly addresses hit an all-time high of 10.4 million in December.

There was also an increase in the daily number of unique addresses that were active on the network as senders or receivers, which topped a million in late December.

Ethereum remains king for RWA tokenization

The Ethereum network remains the primary settlement layer for stablecoins and real-world asset tokenization, with around 65% market share of total RWA on-chain value, which is around $19 billion, according to RWA.xyz.

That market dominance increases to over 70% when layer-2 and EVM networks are included.

Ethereum currently has a 57% market share of all stablecoins issued, with the Tron network in second place with a 27% share.

Tether remains the market leader in issuance with $187 billion, equating to 60% of the entire stablecoin market, and more than half of that is on Ethereum.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.