Ethereum miners raise gas limit to 15 million as on-chain activity increases

- Following the Berlin hard fork, Ethereum’s network is ready to raise its gas limit once again.

- The move can be considered a temporary solution to high gas fees and network congestion.

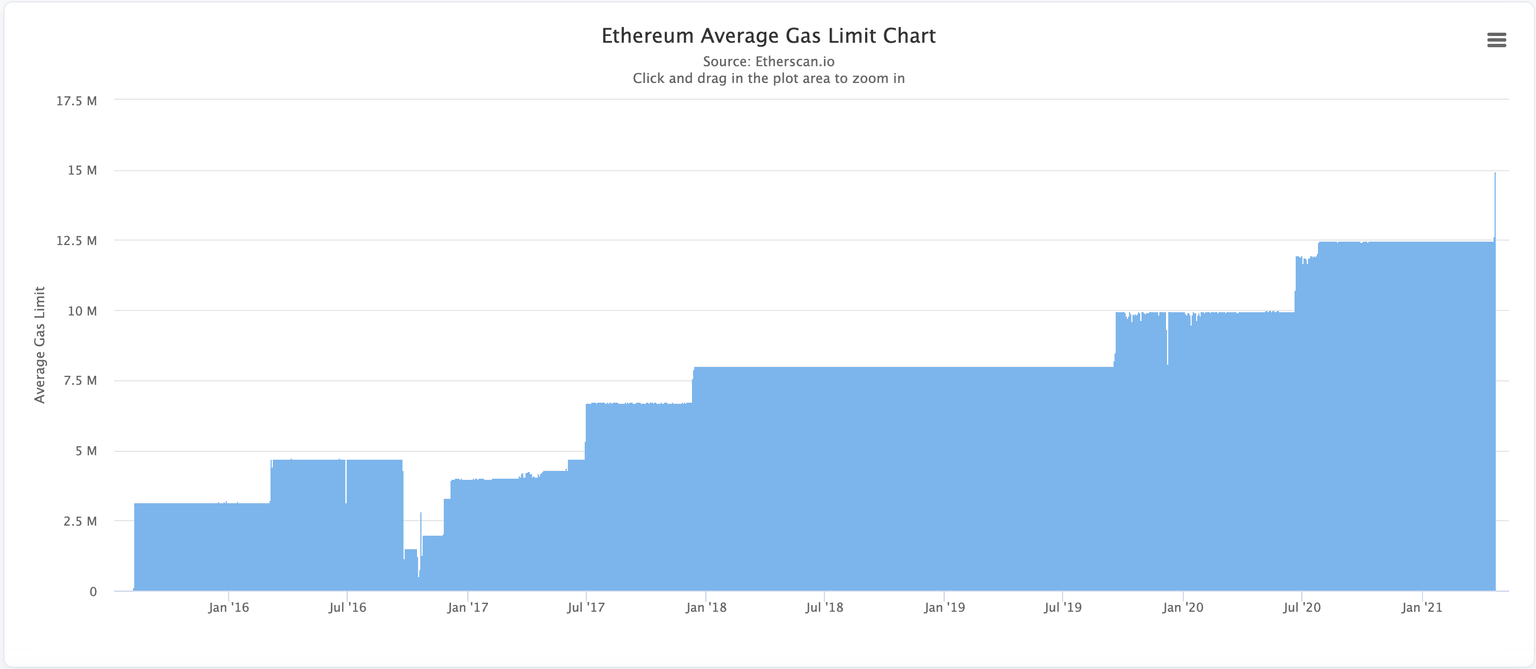

- This is the seventh time in history that Ether’s gas limit has been increased, as the utilization of the network rises with growing popularity around DeFi and NFTs.

The Ethereum network has been plagued with bottleneck scalability issues for the longest time due to increased usage. Given the nature of finite block space, miners have proposed to increase the gas limit to allow for more data to be included in each block.

Gas limit raised for the seventh time in history to reduce network congestion

Ethereum miners raised the gas limit to 15 million to relieve congestion as the network’s on-chain activity increased in tandem with Ether’s price.

Last week, Ethereum co-founder Vitalik Buterin suggested raising the network’s gas limit since recent code optimizations activated through the Berlin hard fork have made the chain safer.

Ethereum average gas limit

According to Buterin, increasing the gas limit on Ethereum makes every application cheaper.

Gas is the unit of which the amount of computational effort to execute operations, whether it be a transaction or smart contract. Miners are paid in an amount in Ether equivalent to the amount of gas it took to execute an operation.

The gas limit proposes a restriction to the amount of data and computational effort required by Ethereum miners to process a block on the network. Due to the influx of on-chain activity with the growing number of decentralized finance (DeFi), gas fees have been surging on Ethereum, with highs costing hundreds of dollars.

More data could be included in each block that is mined by increasing the gas limit, which could contain operations ranging from DeFi, transfers of Ether, smart contracts, or non-fungible tokens (NFTs).

Major mining pools, including Bitfly – the second largest Ethereum mining pool by hash rate – have indicated their intentions to raise the gas limit from 12.5 million to 15 million, citing the successful efficiency improvements from the Berlin hard fork.

Miners can collectively reach a consensus and slowly work towards moving the gas limit higher with each consecutive block. Ethereum’s protocol only allows the adjustment of block gas limits by 0.0976% from the previous block’s limit.

Earlier this month, DeFi’s total value locked reached an all-time high of $60 billion, suggesting that the industry is steadily growing. While high transaction fees and network congestion continue to be an issue, Ethereum 2.0, a parallel network, aims to provide solutions in the future.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.