Ethereum devs test a 4x increase in gas limit for Fusaka hard fork

Ethereum core developers are considering a four times increase in the layer 1 gas limit as one of the key features for the next hard fork after Pectra, known as Fusaka.

The devs are proposing to test a raise in Ethereum’s gas limit to 150 million by the Fusaka hard fork, according to Ethereum Improvement Proposal (EIP) 9678, introduced on April 23 by Sophia Gold, a developer on the protocol support team at the Ethereum Foundation.

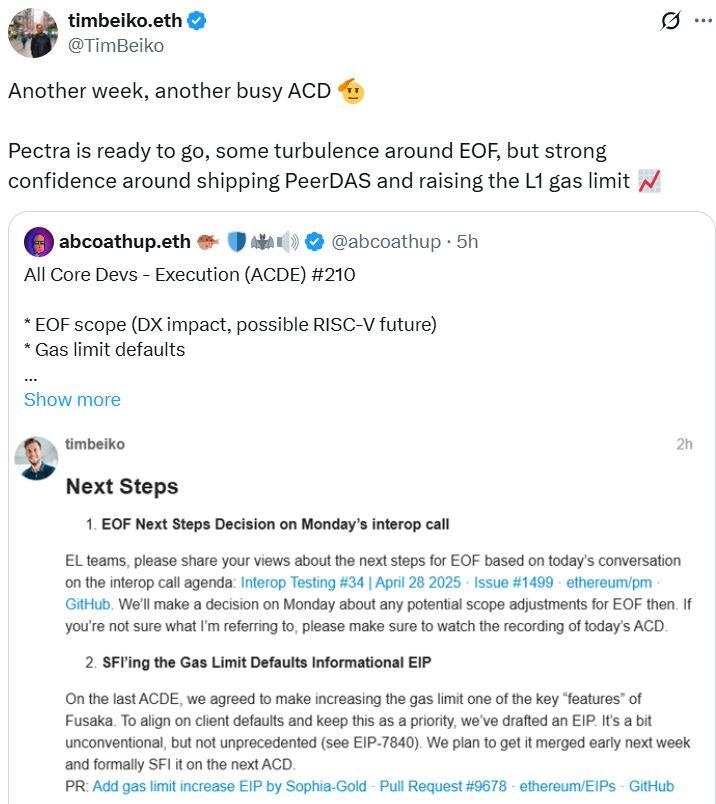

During the last All Core Devs Execution (ACDE) meeting, there were discussions to make the gas limit increase a “key feature” of Fusaka, Ethereum core developer Tim Beiko said in an April 24 meeting summary.

“To align on client defaults and keep this as a priority, we’ve drafted an EIP. It’s a bit unconventional, but not unprecedented (see EIP-7840). We plan to get it merged early next week and formally SFI it on the next ACDE,” Beiko said.

“As we continue this work, we expect to identify changes that need to be made in-protocol to support a higher gas limit. This implies adding more EIPs to Fusaka, even though the fork scope is final.”

Source: Tim Beiko

The next Ethereum upgrade, Pectra, is scheduled to go live on the mainnet in May. Fusaka has been flagged as possibly going online in late 2025.

Gas limit increase a priority ahead of Fusaka

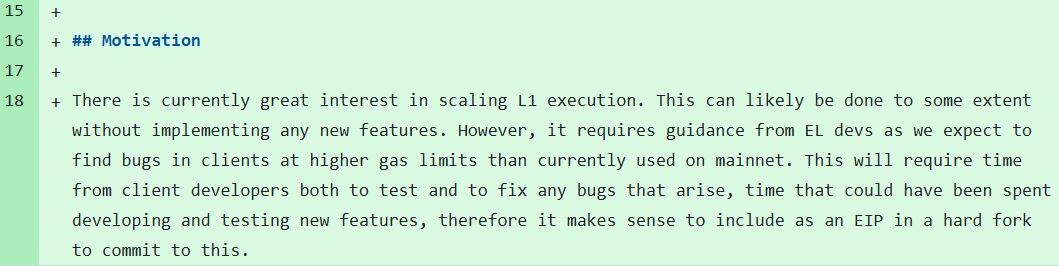

As part of the motivation for increasing the gas limit, the developers said there was great interest in scaling layer 1 execution and that it could likely be done by implementing any new features.

However, it requires guidance from execution layer developers because “we expect to find bugs in clients at higher gas limits than currently used on mainnet,” which will “require time from client developers both to test and to fix any bugs that arise, therefore it makes sense to include as an EIP in a hard fork to commit to this.”

The developers behind the EIP say client developers will need time to test and fix any bugs that arise while increasing the gas limit. Source: GitHub

“While the gas limit is ultimately set by validators, we agreed that having an EIP to coordinate client defaults would help keep this a priority and ensure all clients update their defaults by the time Fusaka goes live,” Beiko said.

The average Ethereum gas limit was around 30 million after increasing in August 2021, according to data on Ycharts.

Validators supported raising the network’s gas limit on Feb. 4, increasing the maximum amount of gas used for transactions in a single Ethereum block. It’s just under 36 million at the moment, Ycharts data shows.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.