Ethereum Classic Price Prediction: A plummet in process

- Ethereum Classic price witnessed a 100% rally in one week.

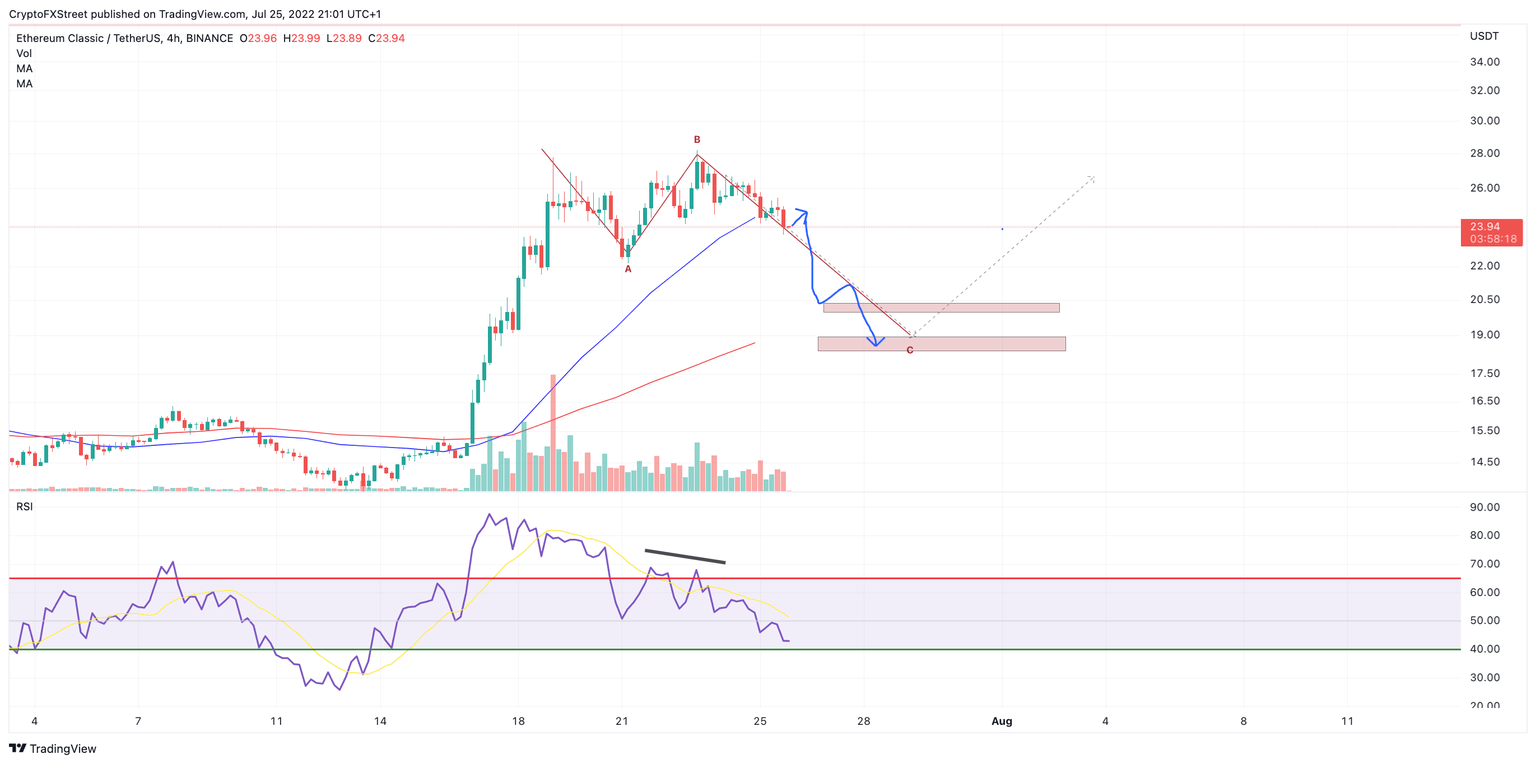

- ETC price shows prevalent volume within the current consolidation and bearish divergence on the Relative Strength Index.

- Invalidation of the downtrend scenario is a breach above $28.19.

Ethereum Classic price has wiggle room to fall. A retracement towards $18 is within reach.

Ethereum Classic price reroutes south

Ethereum Classic price showed an impressive 100% rally since July 13 into the newly marked highs at $28.19. A volume profile indicator shows significant bearish presence near the congestion zone which led to the final 20% increase during the recent bullrun.

Ethereum Classic price currently trades at $23.95 as the bears have established control over price action on the 8-hour chart. The recent breach below the $24 level may be a favorable entry and catalyst to induce a 20% decline towards $19. The Relative Strength Index confounds the bearish idea as divergence was witnessed between the highs established on July 21 and July 22 on the 8-hour chart.

ETCUSDT 4-Hour Chart

Invalidation of the bearish thesis is a breach above the swing high at $28.19. If the bulls can hurdle this barrier, they should be able to target $30, resulting in a 28% increase from the current Ethereum price.

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of inerest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.