Ethereum Classic is in the crosshairs as the Merge in big brother Ethereum flops

- Ethereum Classic price drops 13% in just 36 hours of trading as the Merge triggers a sell-off

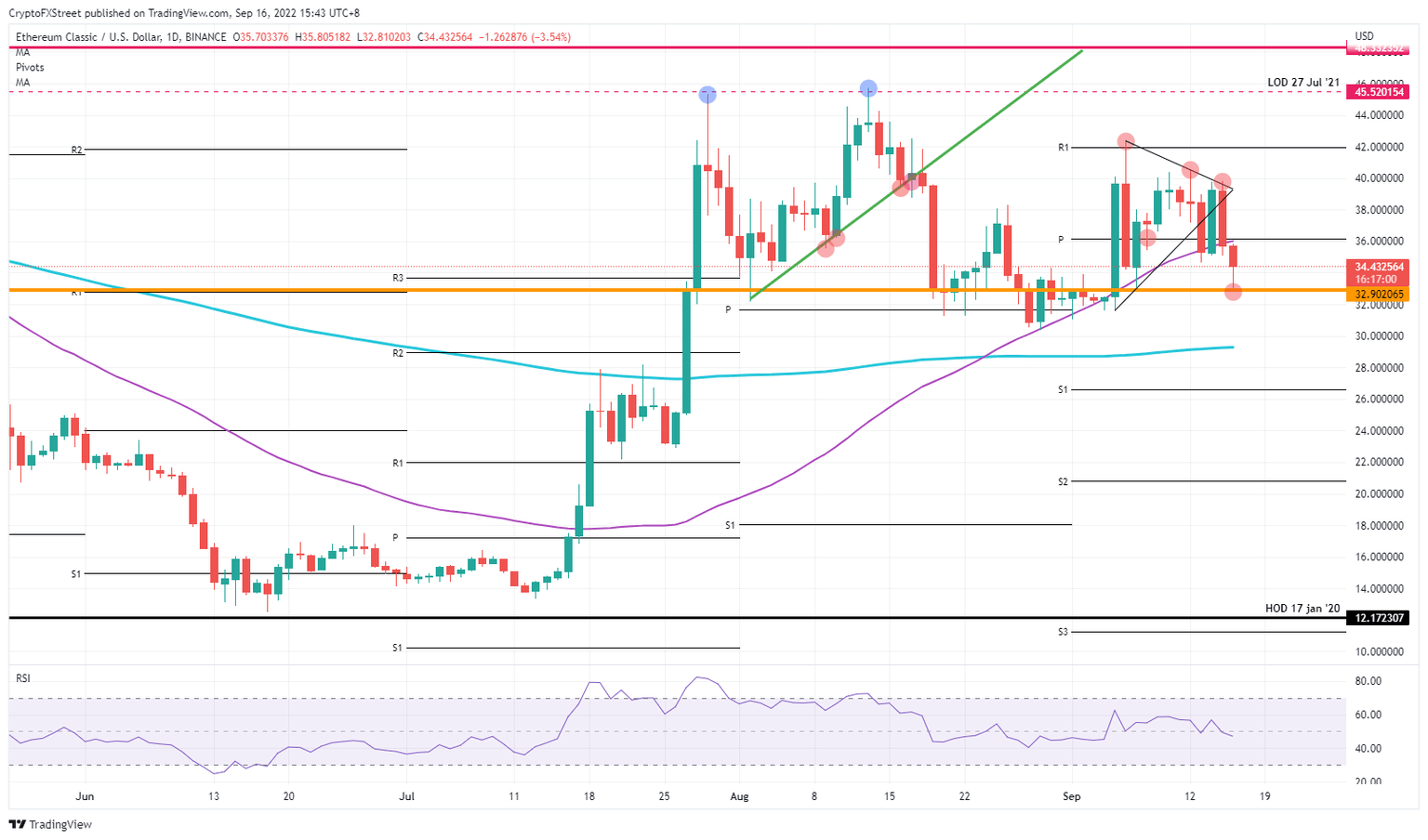

- ETC price bounces off a very important pivotal level, for now.

- Expect, with mounting sell-pressures from a stronger dollar and dropping equities, to see a possible breach towards $30.

Ethereum Classic (ETC) defaults on some very important levels in the aftermath of the software upgrade to crypto bigger brother Ethereum. With the Merge, Ethereum tried to brush up its green image by becoming more energy efficient. Unfortunately, the event became a pump-and-dump scenario with traders massively buying into the event, only to cash in when Merge was actually announced, in a classic buy-the-rumour-sell-the-fact sell-off.

ETC price breaks below supports

Ethereum Classic received a strong rejection from the upper border of a pennant price pattern, identified at the beginning of the week. What followed was a sell-off that pared back the recovery from Wednesday. This time, traders fully gave up on buying the dip, which led to further losses and price opening below the 55-day Simple Moving Average (SMA). This is perceived as a very bearish and negative sign in the markets. It led to further follow-through selling in the trading hours after, during the ASIA PAC session, and ETC price hit $32.90, a very important pivotal level.

ETC price is currently bouncing higher off that pivotal level and might look like a good moment to buy into, but it is probable another sell-avalanche is on its way. During the European session, the dollar gains again and strengthens its grip further on the markets, while equities are tanking across the board together with commodities. A sell-off looks set to kick in, meaning ETC price could break below $32.90 and drop 11% towards $30 with the 200-day SMA below, trying to provide support before going into the weekend.

ETC/USD Daily chart

An alternative scenario is that the current bounce in play could be enough to make price action close above $32.90 before going into the weekend. With the weekend, traders will have time for the dust to settle, and Monday trading could bring a new turnaround. That would mean ETC price could see itself clawing back above the 55-day SMA at $36 and trying to run up to $42 should next week's trading be positive throughout the week.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.