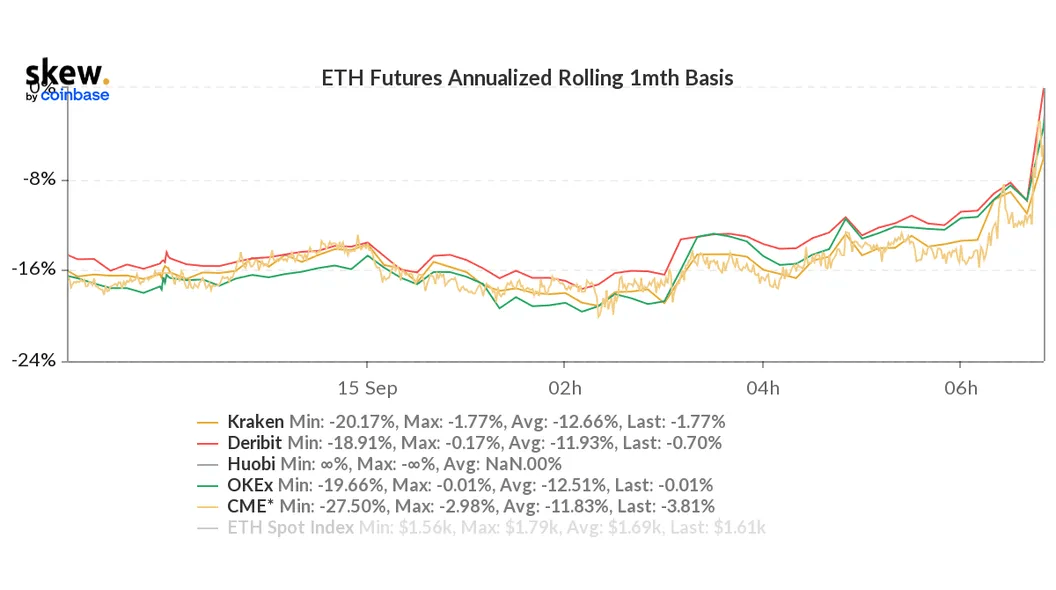

Ether futures market discount evaporates after the Merge

The month-long ether futures market anomaly that stemmed predominantly from traders looking to profit from Ethereum's technological change, the Merge, has reversed.

Ether futures have almost caught up with the cryptocurrency's underlying spot price following the historic overhaul of the way Ethereum verifies transactions.

The annualized rolling discount in one-month bitcoin futures listed on Deribit, the world's largest crypto options exchange, narrowed to 0.3% from 17.66% before the changeover, which went live at 6:43 UTC, according to data provided by Skew. Discounts in futures listed on Kraken, OKEx and the Chicago Mercantile Exchange also narrowed sharply.

The three-month futures traded at par with the spot price or with a slight premium on major exchanges, including Binance.

"The basis, or the difference between spot and the futures, was approximately trading at $20 and was a good indication of the potential value of ETHPOW," Deribit's Chief Commercial Officer Luuk Strijers said, referring to a possible token that would be created if the blockchain forks as a result of the change. "This negative basis (backwardation) has now been reduced to around 30 cents."

Strijers said Deribit and other platforms have taken snapshot of Ethereum at the time of the Merge to credit ETH holders with potential Ethereum fork token ETHPOW on a 1:1 ratio. Snapshots or records of content of the blockchain are commonly used to determine recipients of the planned airdrop – or free distribution of forked tokens.

Market participants, therefore, no longer have to hold ETH or take the so-called market-neutral trade of buying ether and selling short-term futures to collect ETHPOW tokens while bypassing risks from ETH price volatility.

As such, the record discount resulting mainly from the market-neutral trade has pretty much evaporated.

Traders began selling futures against ETH holdings early last month after some miners contested the Merge and proposed forking, or splitting, the Ethereum chain into a proof-of-work (PoW) chain and a proof-of-stake (PoS) chain. A potential Ethereum split meant ETH holders would receive a newborn PoW chain's native token, ETHPOW, for free.

That pushed futures into a discount of so-called backwardation, in which the futures trade at a lower price than the spot market. Futures typically trade at a premium to spot, representing the time value of money.

The anomalous condition of ether futures trading at a discount to spot prices has reversed. (Skew)

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.