Dogecoin Price Prediction: Why the next pullback is a screaming buy

- Dogecoin price has rallied 55% since the June 13 sell-off.

- DOGE price has breached the $.07 barrier and could retest $.05 before continuation of the uptrend.

- Invalidation of the uptrend is a breach below $0.049.

Dogecoin price should be on traders' top 3 cryptos watch list for the coming week. Expect a volatile market.

Dogecoin price is top 3

Dogecoin price currently trades at $0.0735 this week as the notorious meme coin is following the technicals mentioned in the previous thesis to end the third weekend of June. The bulls are picking up steam as they have managed to reconquer the $0.07 zone, rallying 55% in the process since the June 13 sell-off.

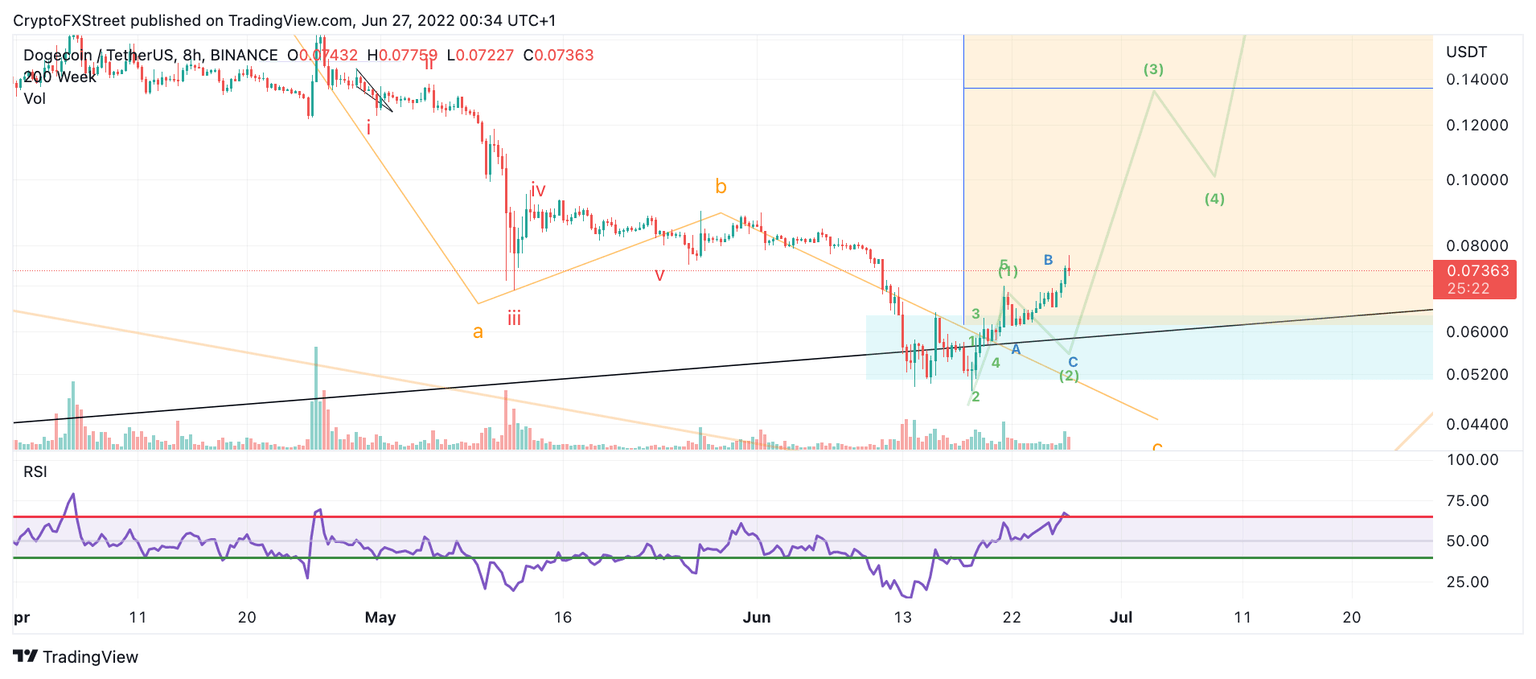

Dogecoin price could be presenting an early-entry setup to partake in a summer rally targeting $0.24 and higher. The current bullish engulfing candle that breached the $0.073 high may be a part of an expanding flat B-wave pattern which could lead to one more c-wave pullback into the $0.05 zone as early as Monday, June 26.

If the technicals are correct, the 2nd test of the $.0738 (after retracing into the $0.05 region) could be an excellent place to place a buy stop and aim for $0.10 in the short term.

DOGE/USDT 8-Hour Chart

Invalidation of the uptrend scenario will be a breach below the June 13 low at $0.049. If the bears manage to breach this level, they could trigger a cataclysmic sell-off into the $.02 level resulting in a 75% decrease from the current Dogecoin price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.