Cryptocurrencies Price Prediction: Shiba, Bitcoin & Binance – European Wrap 12 April

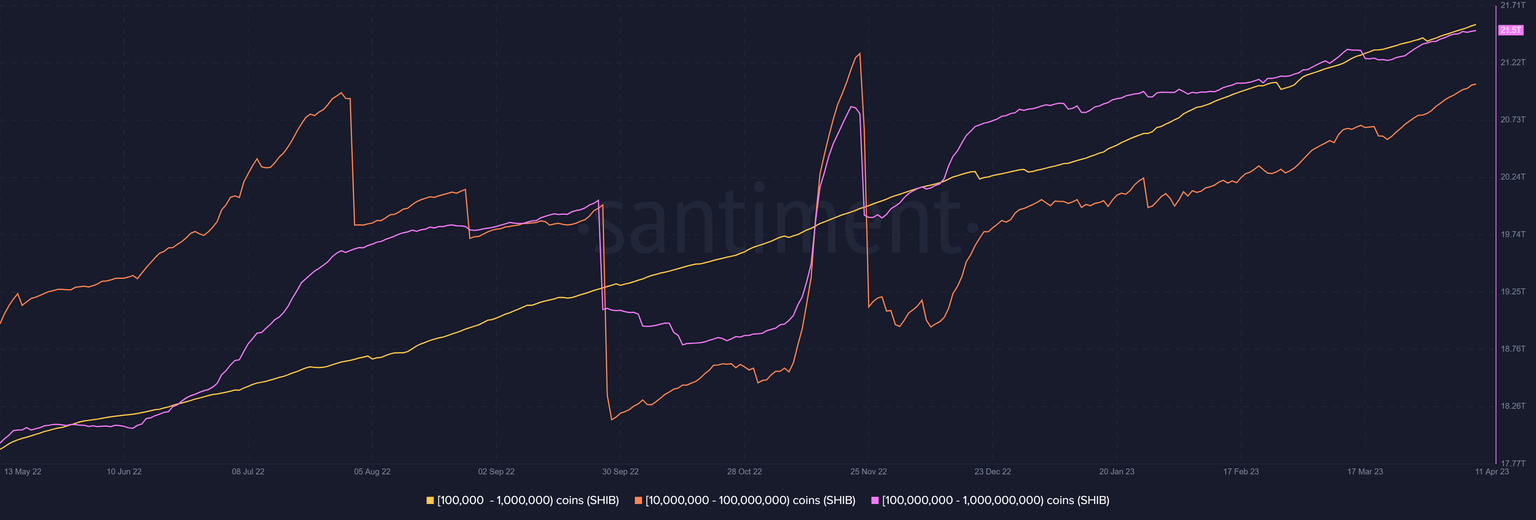

Shiba Inu might escape Dogecoin’s shadow as it makes efforts to become a real crypto ecosystem

Shiba Inu falling under the category of a “meme coin” certainly began as a mere joke, but the decision to develop it into an ecosystem is giving it an edge over other meme coins. While others continue to see influence from Dogecoin, Shiba Inu seems to be separating itself from that narrative.

Shiba Inu has been deemed the Dogecoin killer, and in some ways, its emergence has given DOGE quite the competition. Over the last year, on multiple occasions, the hype surrounding the Decentralized Finance (DeFi) capabilities of Shiba Inu and its entry into the Metaverse resulted in the SHIB flipping DOGE in terms of market capitalization.

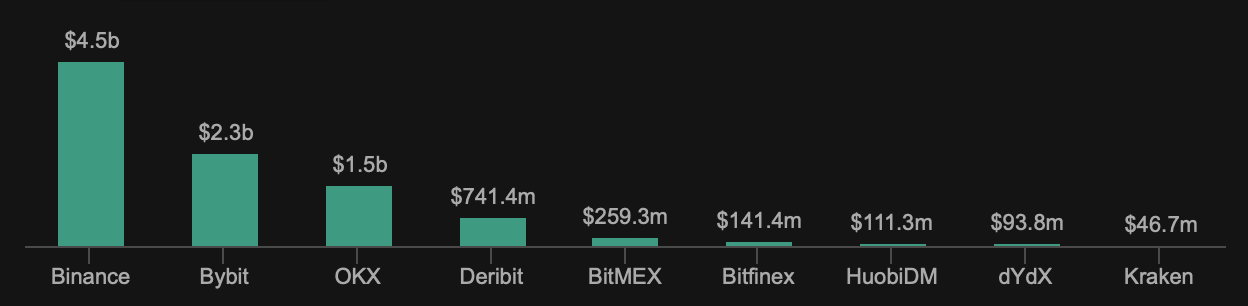

Bitcoin price rally likely to continue with open-interest hitting five-month peak

Bitcoin open interest across derivatives exchanges climbed above the $9.7 billion level based on data from crypto intelligence firm Coinalyze. Rising open interest coupled with the recent rally in the asset’s price indicates that the asset’s gains are likely sustainable.

Open Interest in Bitcoin hit a five-month peak, moving past $9.7 billion for the first time since the FTX exchange collapse. On derivatives exchanges, Open Interest is the total number of outstanding derivatives contracts, options or futures that have not been settled yet. Analysts keep track of all open positions in an asset through this metric.

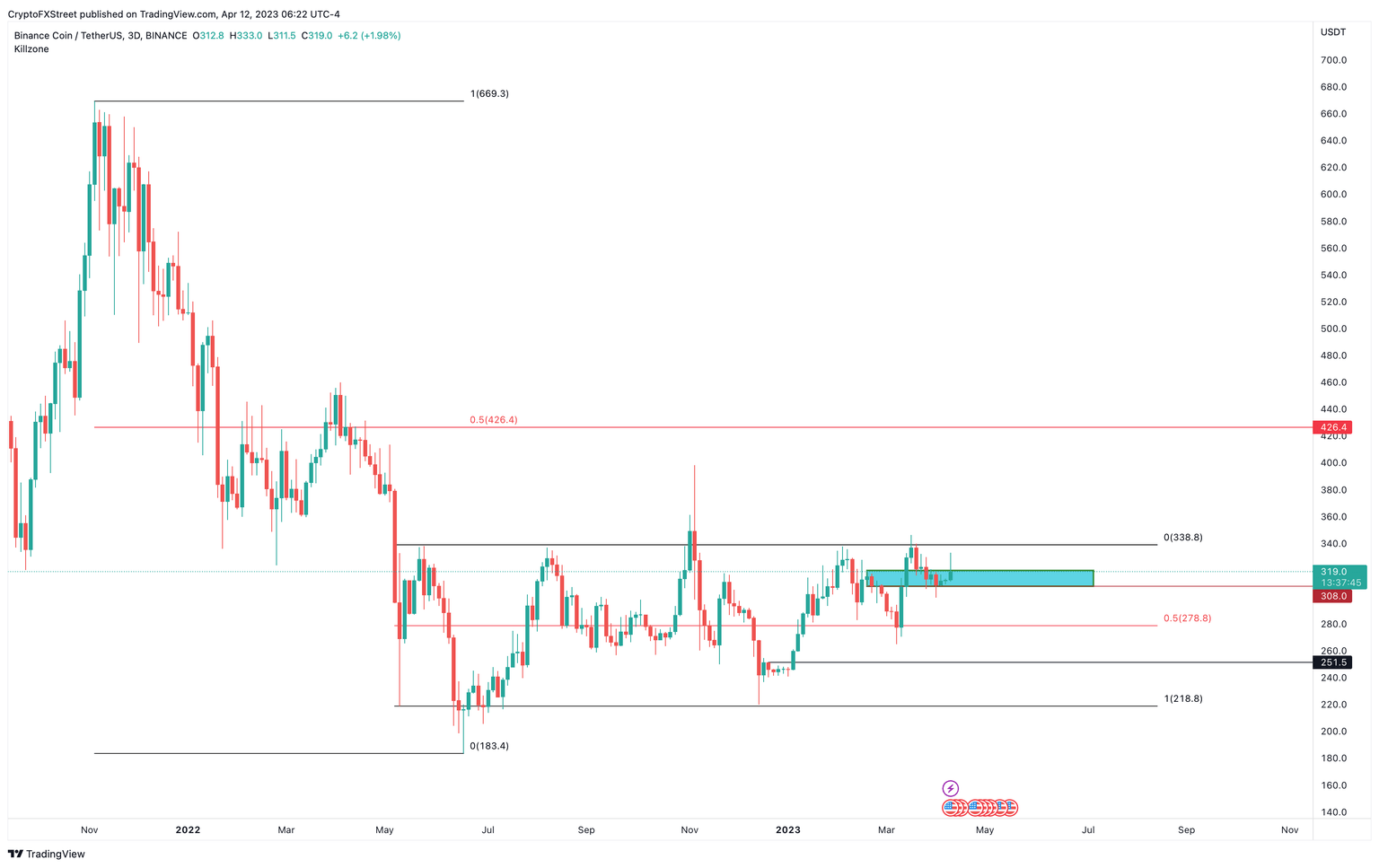

Binance Coin Price Forecast: BNB could rally 30% if this level holds

Binance Coin price is attempting to explore a high-timeframe range as it nears the extremes of a smaller zone inside. Sidelined buyers can take advantage of this opportunity to accumulate before BNB kick-starts its next move.

Binance Coin price has been hovering inside the $218.8 to $338.8 range for nearly a year after suffering a 67% crash in November 2021 and May 2022. As BNB approaches the upper limit of a smaller range, investors need to explore a breakout scenario.

Author

FXStreet Team

FXStreet