Cryptocurrencies Price Prediction: Ripple, Uniswap & Cryptos – American Wrap 01 August

Ripple makes key announcement, fear among XRP traders as SEC cancels closed-door meeting

%2520%5B17.13.23%2C%252001%2520Aug%2C%25202024%5D-638581208598533523.png&w=1536&q=95)

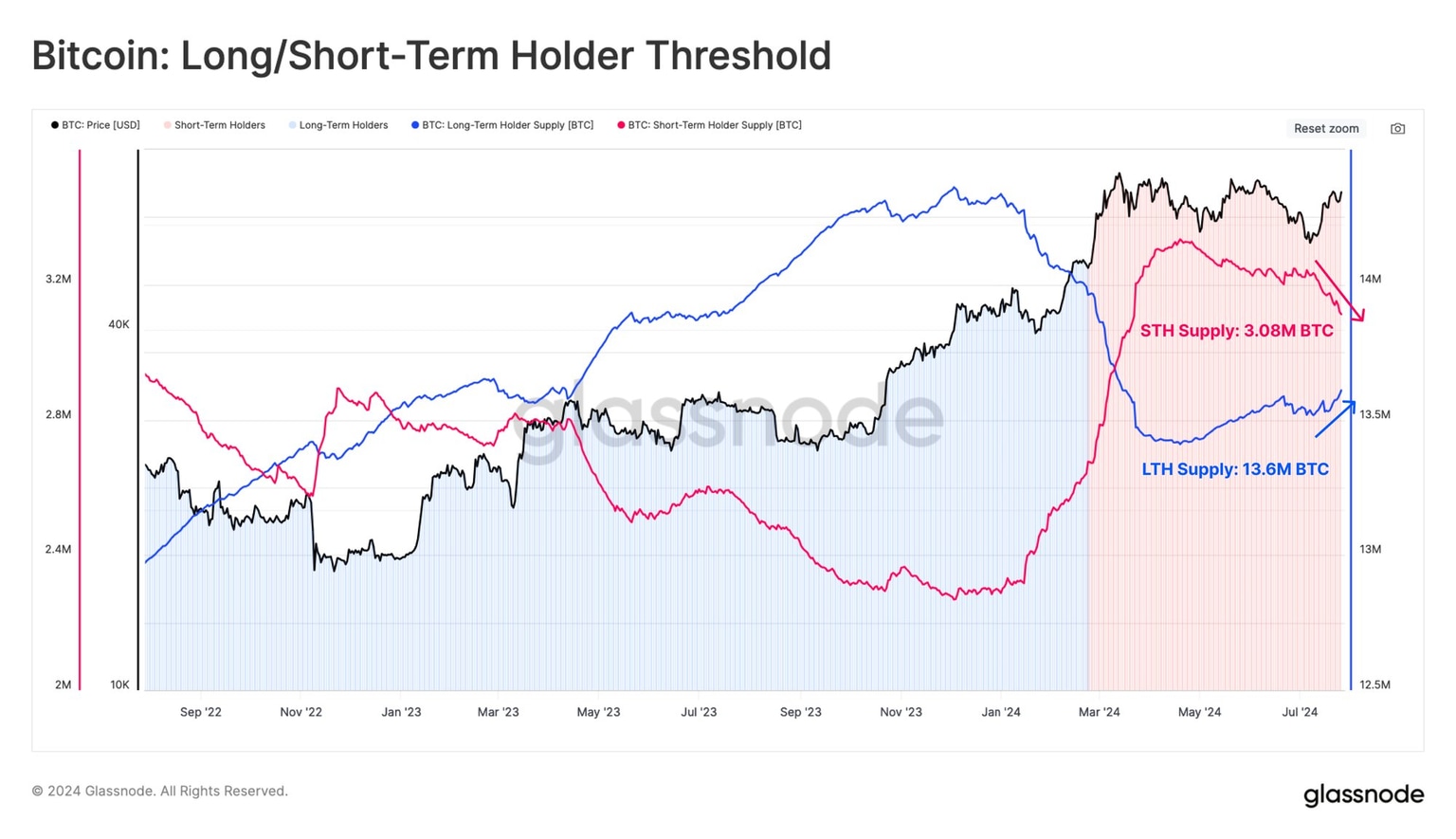

Bitcoin hovers around $65,000 at the time of writing. The largest crypto asset by market capitalization noted large swings in its price in response to US macroeconomic releases. Long-term holders have accumulated the asset consistently in the last two months.

Author

FXStreet Team

FXStreet