Crypto Today: Bitcoin holders accumulate without fear, Ethereum struggles while XRP holds gains steady

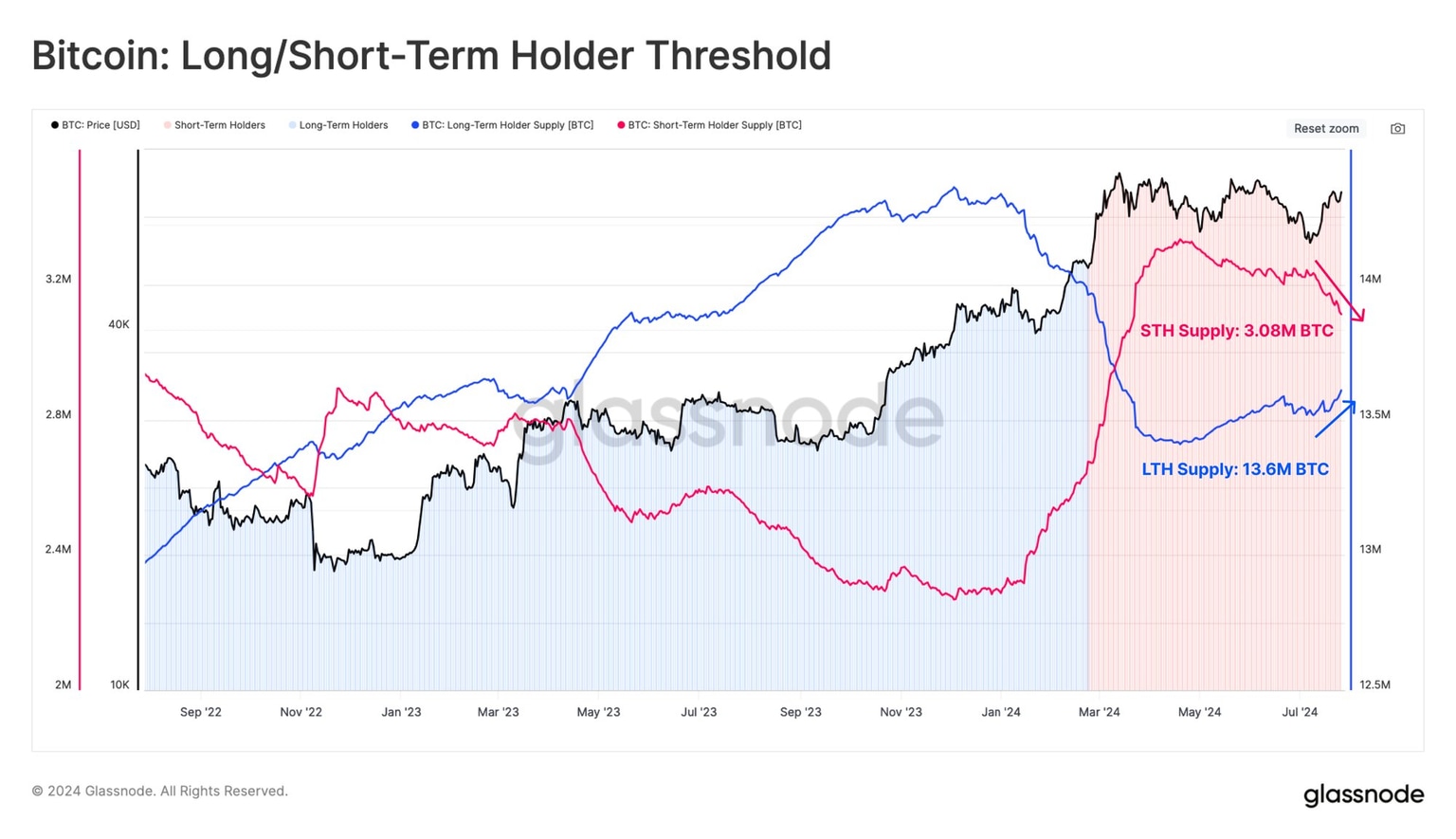

- Bitcoin long-term holders have continued to accumulate BTC consistently in the last two months.

- Ethereum hovers around $3,100, struggles to make a comeback to resistance at $3,500.

- XRP sustains above $0.61 despite market-wide correction in crypto.

- Curve DAO token CRV makes headlines as whale pulls over 20 million tokens off exchanges in three days.

Bitcoin, Ethereum, XRP updates

- Bitcoin hovers around $65,000 at the time of writing. The largest crypto asset by market capitalization noted large swings in its price in response to US macroeconomic releases. Long-term holders have accumulated the asset consistently in the last two months.

Bitcoin: Long/Short-term holder threshold data as seen on Glassnode

- Accumulation by long-term holders is bullish for the asset.

- Ethereum struggles to make a comeback above resistance at $3,500. The altcoin trades at $3,186 at the time of writing. Solana beat Ethereum in monthly DEX trading volume for the first time last month, per DeFiLlama data. Solana DEX trading volume was $55.876 billion against Ethereum’s $53.868 billion.

- Other high-performing chains include Arbitrum at $24.569 billion, Binance Smart Chain (BSC) at $17.888 billion, and Base at $15.554 billion in monthly DEX trade volume.

- XRP held recent gains and sustained above $0.61 as traders continue to anticipate Ripple win in the Securities & Exchange Commission’s (SEC) lawsuit.

Chart of the day

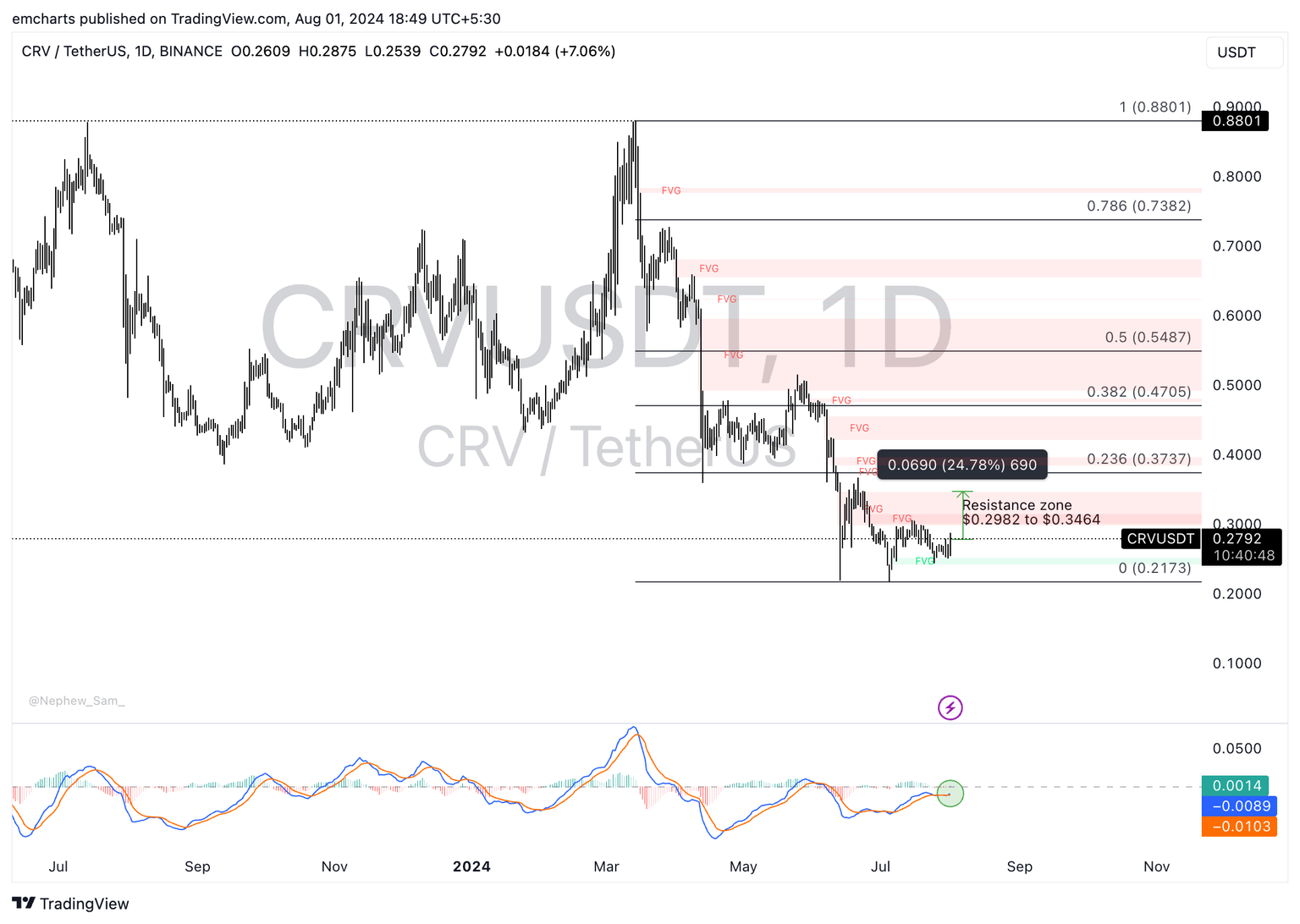

CRV/USDT daily chart

Curve DAO (CRV) could extend gains by nearly 25% and rally to the upper boundary of the Fair Value Gap (FVG), acting as the resistance zone between $0.2982 to $0.3464. CRV could find support in the Fair Value Gap (FVG) between $0.2425 and $0.2519, as seen in the CRV/USDT daily chart.

Early on Thursday, August 1, CRV extended gains by nearly 7%. The Moving Average Convergence Divergence (MACD) indicator supports recent gains as the MACD line crosses above the signal line. Green histogram bars above the neutral line support the bullish thesis for the Curve DAO CRV token.

Market updates

- Crypto data tracker Bubblemaps identified that a leading meme coin NEIRO allocated nearly 78% of tokens to insiders spread across 400 addresses. The meme coin was associated with a large number of Japanese influencers, and the overall profit of insiders exceeded 10,000 times the initial investment.

$NEIRO on ETH (@neiro_ethereum) is heavily controlled ⚠️

— Bubblemaps (@bubblemaps) July 30, 2024

78% of the supply was sniped at launch and spread out among many wallets.

Insiders already made $4.5M and still own 66% ↓ pic.twitter.com/dEwiuE3Gu2

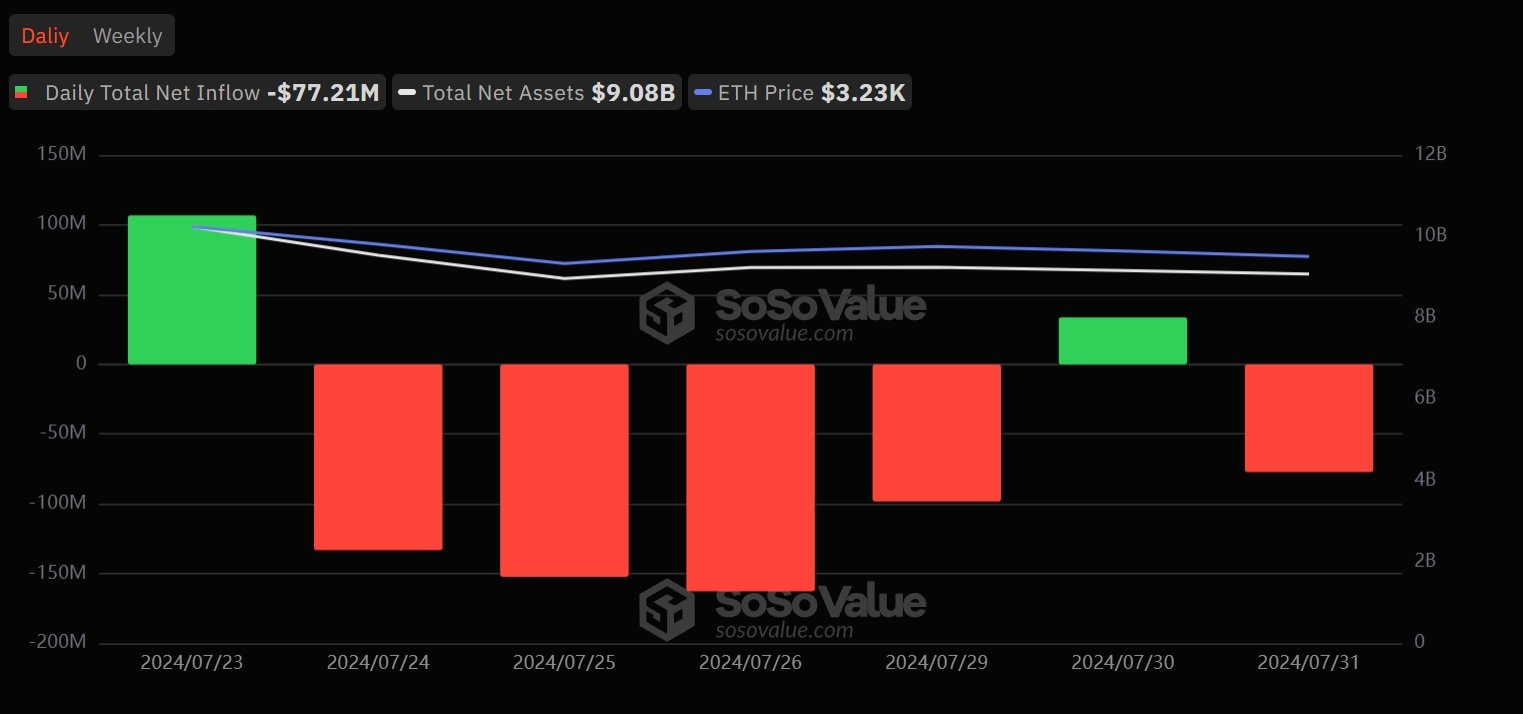

- Ethereum Spot Exchange Traded Funds (ETFs) noted a net outflow of $77.211 million on July 31, the altcoin struggled under resistance at $3,500.

Daily netflow of Ethereum ETFs on SoSo Value

- Following Mt.Gox payback on July 5, 16, 24, and 31, repayments have been made to over 17,000 creditors till date.

Industry updates

- Ethereum gas fees are at an all-time low, likely to drive the asset’s adoption.

#Ethereum gas fees are at all time lows...

— Crypto Rover (@rovercrc) August 1, 2024

You know what this means. pic.twitter.com/zaSyqUoTby

- Simonscat, an animated cat brand, has announced the launch of a meme coin in partnership with Floki. A portion of the supply is dedicated to FLOKI token holders.

- Bitcoin hash rate hit a new all-time high.

NEW: #Bitcoin's hash rate hit a new ATH pic.twitter.com/oKP6hs1yMN

— Bitcoin Magazine (@BitcoinMagazine) August 1, 2024

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.