Cryptocurrencies Price Prediction: Bitcoin, Polygon & Hedera Hashgraph — Asian Wrap 14 March

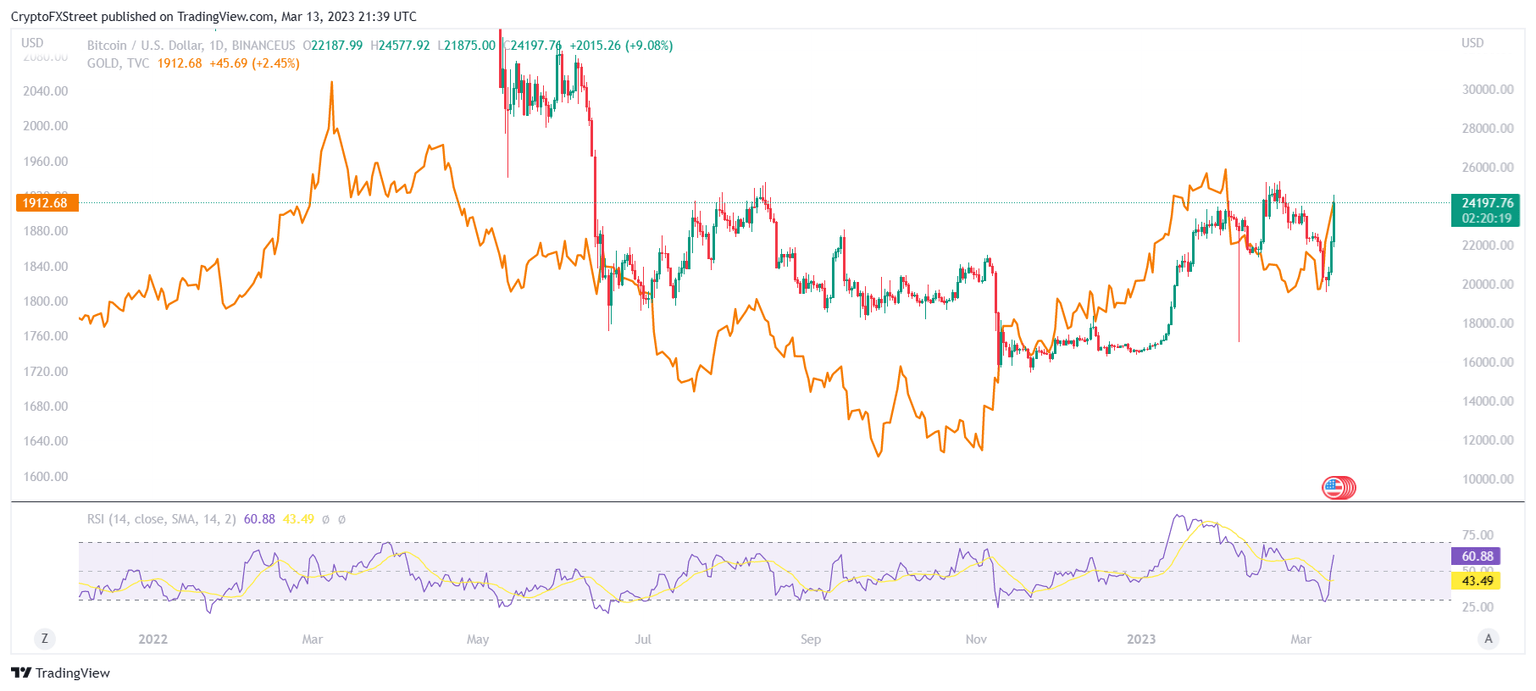

Is Bitcoin's safe haven narrative back as US banks start to go belly-up?

The shutdown of Silicon Valley Bank became one of the biggest bank failures in the history of the United States. But the impact of this event was not limited to just the financial sector as the crypto market took a hit as well. However, looking at the emerging pattern, it seems like Bitcoin price might have made it out unscathed, re-earning a much-talked-about tag.

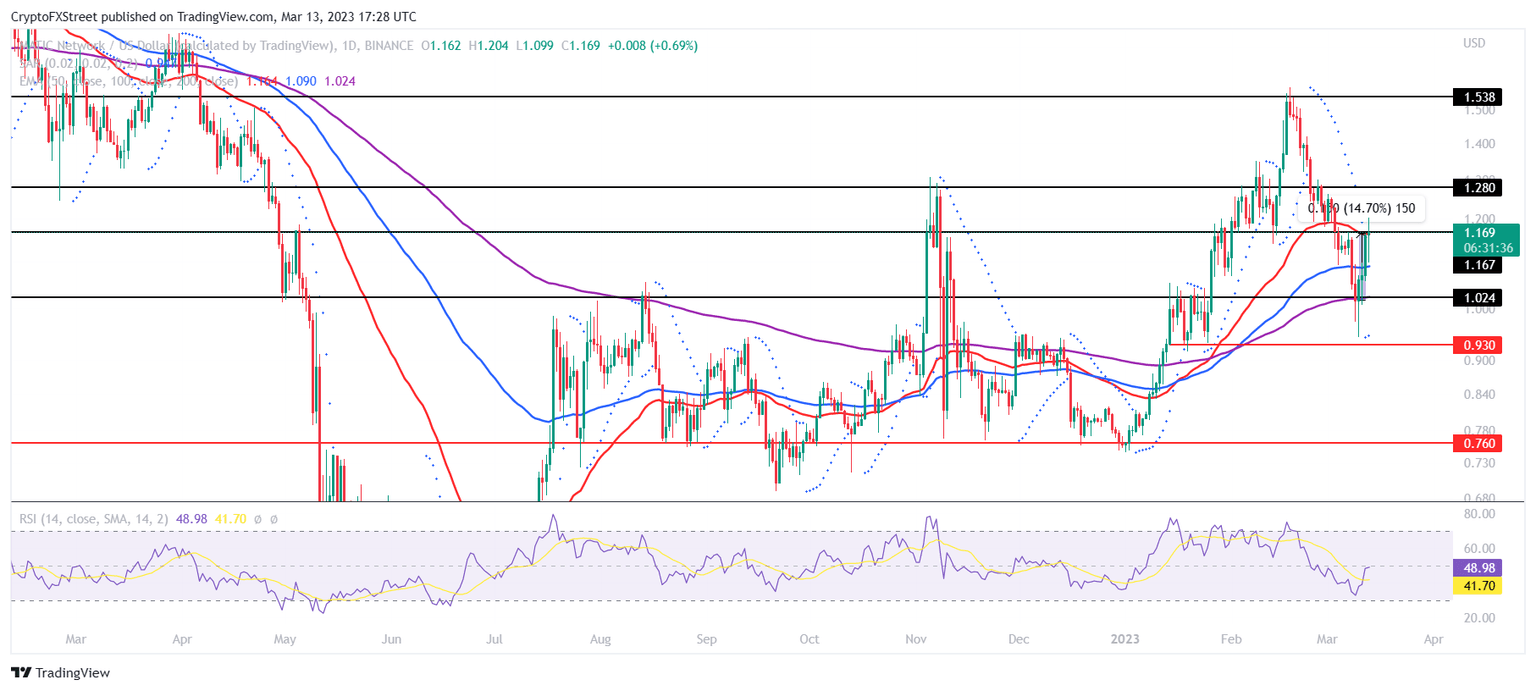

Polygon executive discusses future roadmap, Proof of Stake may not be long-term iteration for network security

Polygon has emerged as not only the biggest Layer-2 (L2) blockchain on Ethereum but in the world as well. However, the network is not yet done with scaling as over the next couple of years, Polygon intends on onboarding a billion people to blockchain.

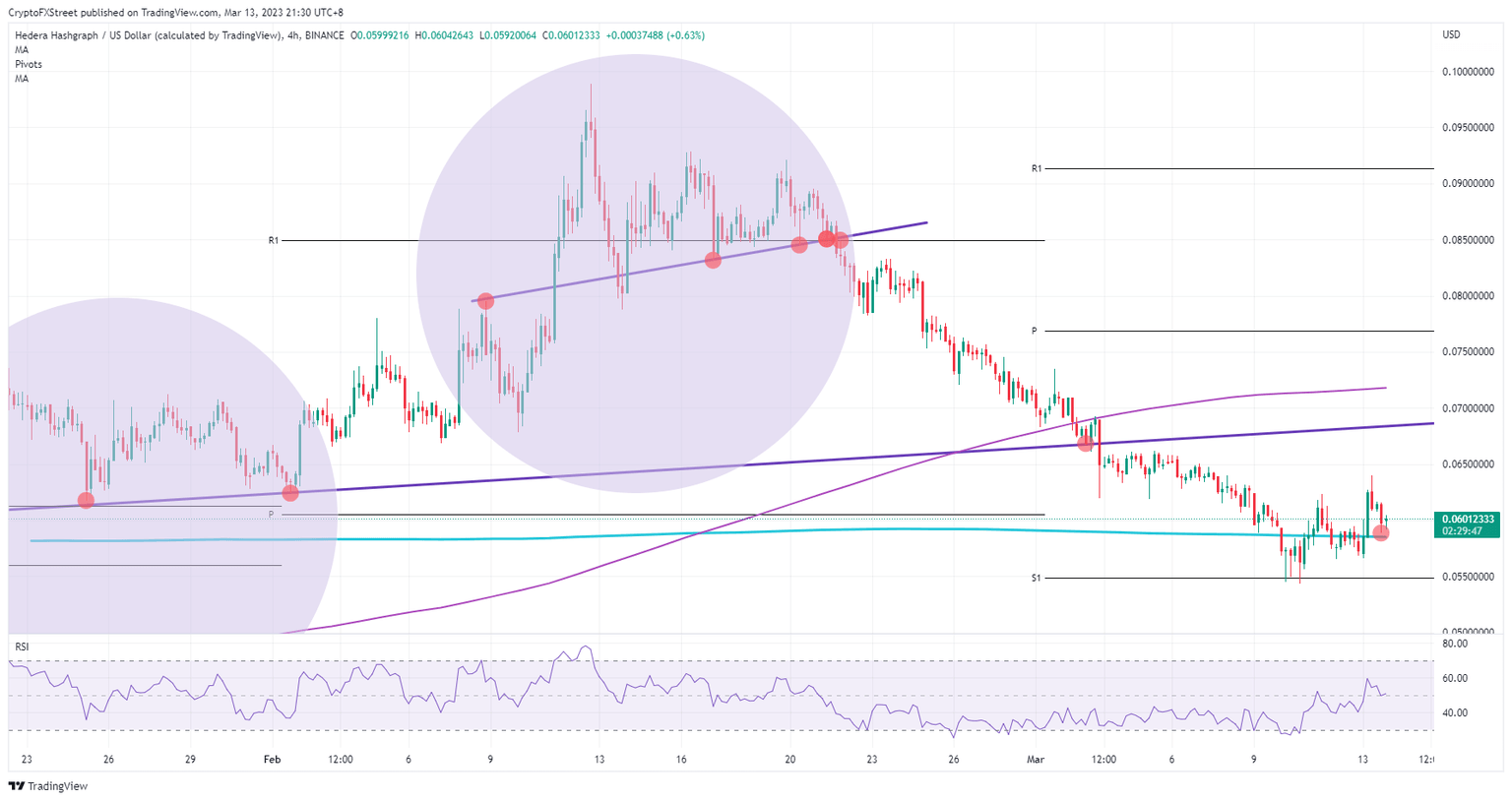

Hedera Hashgraph price pares back 10% gain as risk-off sentiment returns

Hedera Hashgraph (HBAR) price is showing whipsaw moves as bulls jumped on the positive vibe during the ASIA-PAC session as a rescue plan arrived on Sunday in the wake of the default of Silicon Valley Bank. As the fade nearly pared back all the earlier gains, the risk of a complete reversal grows by the minute.

Author

FXStreet Team

FXStreet