Cryptocurrencies Price Prediction: Bitcoin, Ethereum & Chainlink– Asian Wrap 14 Oct

Bitcoin Price Forecast: Analyst predicts an explosive Q4 based on on-chain metrics

Over the last seven days, Bitcoin jumped up from $10,600 to $11,500 as the premier cryptocurrency looks to trade above $12,000. However, BTC may be on the verge of a truly historic Q4. Analyst Chris Russi explained why BTC is on the verge of exploding in a series of tweets.

LookIntoBItcoin's 1Y+ HODL Wave chart allows you to look at the percentage of circulating supply that has not moved in over a year. As per the chart, 63% of all coins have not moved for over a year.

-637382406159572363.png&w=1536&q=95)

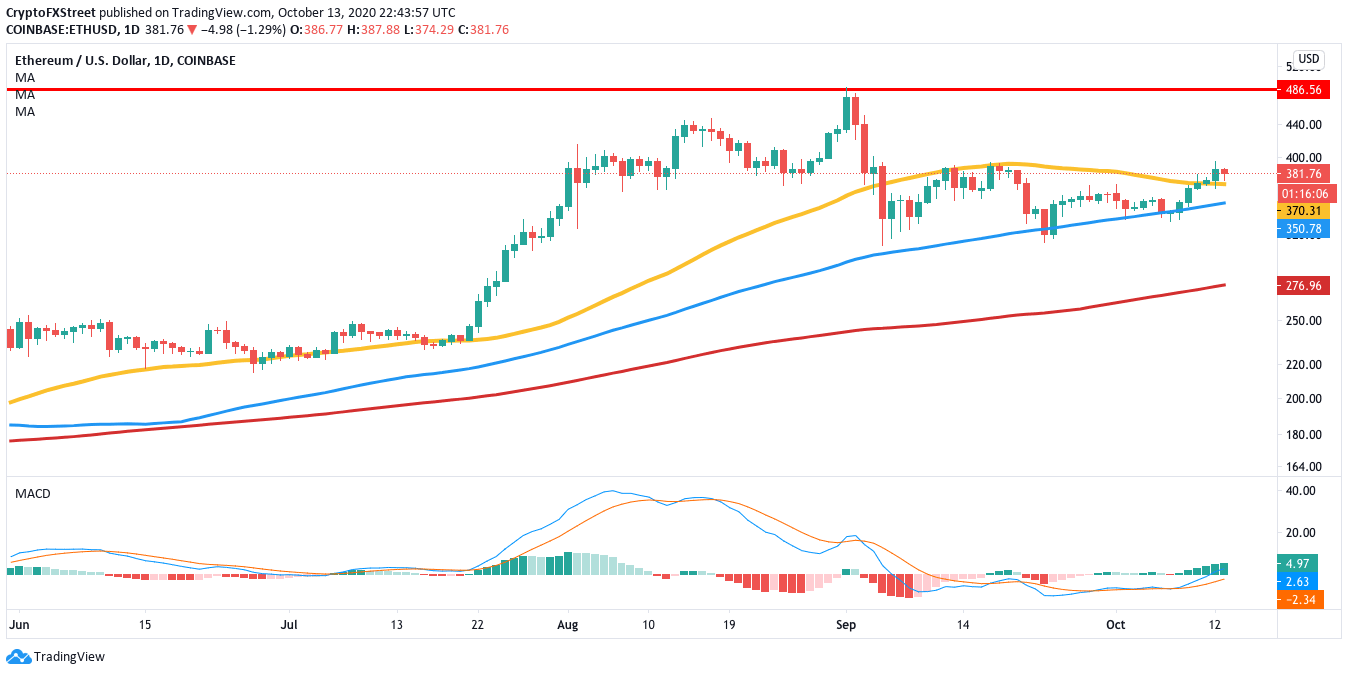

Ethereum Price Analysis: Whales prepare for ETH 2.0 network upgrade, bulls eye $800

The much anticipated Ethereum 2.0 upgrade has faced several challenges and delays, but it looks like they are finally on track. As previously reported, the smart contract giants previously launched a testnet named “Spadina,” which was supposed to be a “dress rehearsal” for ETH 2.0. However, it had a host of issues with its configurations, which prompted the need for a new testnet.

Zinken, a new shortened testnet, was launched on Monday, October 12, to allow the community validators to iron out issues and give them a chance to test out the genesis process before the mainnet launch.

Chainlink Price Prediction: LINK recovery hits pause amid hovering reversal to $10

Chainlink has printed a remarkable recovery over the last seven days. Bulls regained control of the price after LINK embraced support marginally above $7. However, they struggled at $9 before a breakout from a descending parallel channel came into the picture. At the time of writing, LINK/USD is trading at $11.2 after a shallow retreat from highs close to $12.

-637382436821420478.png&w=1536&q=95)

Author

FXStreet Team

FXStreet