The final testnet of Etherem 2.0 Spadina goes live; ETH reaction muted

- Ethereum developers launched Spadina, the latest test version of the blockchain.

- The market reaction is muted so far as ETH/USD has stayed unchanged.

Ethereum developers announced the launch of Spadina, the last test version of Ethereum 2.0. According to the announcement, it will be active for three days and serve as a general rehearsal before the Ethereum 2.0 goes live.

Spadina will allow deploying the network and the deposit contract. The previous testnet, Medalla, will continue working alongside Spadina.

Ethereum Foundation researcher Danny Ryan noted:

The main objective is to give us all another chance to go through one of the more difficult and risky parts of the process – deposits, and genesis – before we reach mainnet. If all goes well, it should give us greater peace of mind before we jump into the real deal later this year.

According to beaconcha.in, Spaidna passed phase 0, while the validators' involvement is about 45%, which is less than expected. However, the experts note that the same situation happened with Medalla.

Currently, 2656 validators staked 91 392 test ETH. Meanwhile, over 2 million test ETH have been staked in Medalla.

It should be noted that the process of moving ETH from one blockchain to another is complicated and tricky for all the parties involved, including investors, developers, and users. That's why ETH developers decided to launch another testnet and practice moving funds over to the Beacon chain.

ETH reaction is muted

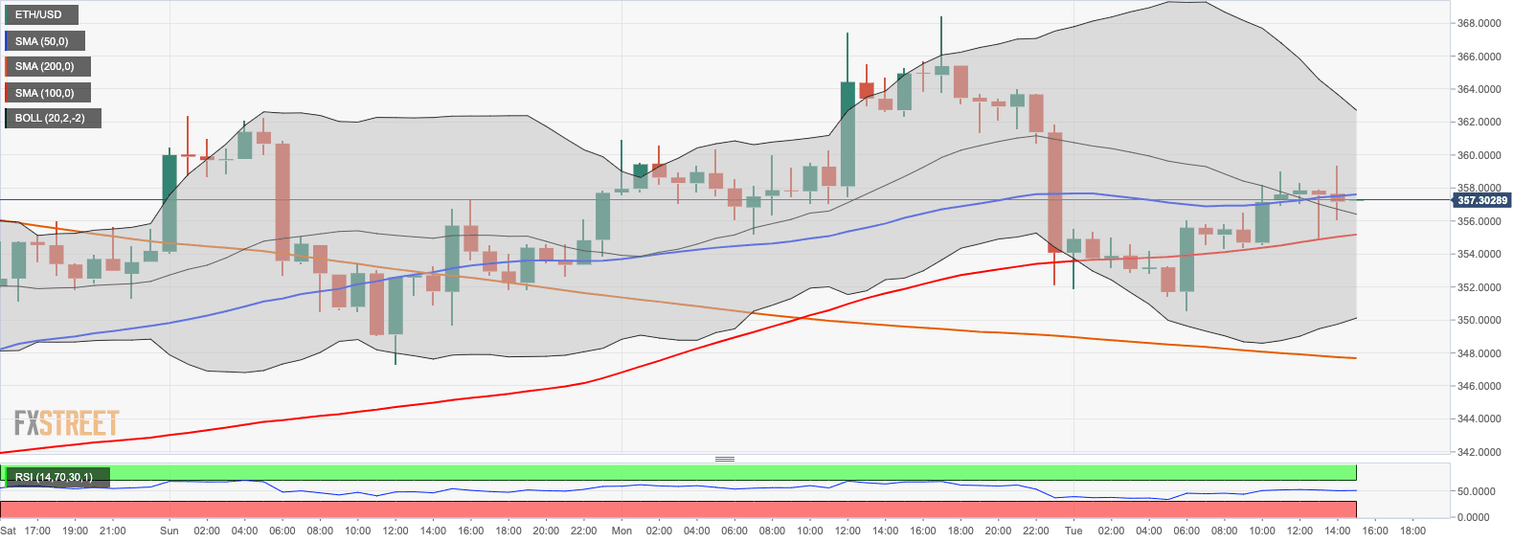

ETH/USD has barely noticed the announcement. The second-largest digital asset price jumped to $359 after the announcement only to retreat to $356 by the time of writing.

On the intraday chart, ETH/USD is moving along 1-hour SMA100 at $355. This MA survived several breakthrough attempts during the day and confirmed its status as local support. Once it is out of the way, the sell is likely to gain traction with the next focus on psychological $350 reinforced by the lower line of the 1-hour Bollinger Band, and 1-hour SMA200 at $347.

ETH/USD 1-hour chart

On the upside, a sustainable move above $360 is needed for the recovery to gain traction with the next aim at $360 and $362 (the upper line of the 1-hour Bollinger Band).

Author

Tanya Abrosimova

Independent Analyst