Crypto.com’s CRO edges near calamity, but On-chain metrics suggest whales aren’t selling.

- Crypto.com price has fallen 20% since August 20.

- On-Chain metrics show a consistent reduction of CRO tokens on exchanges.

- The safest way to confirm an uptrend is a breach of $0.15 with an influx of volume.

Crypto.com price shows mixed signals going into the end of August. The technicals suggest bears are in control, but On-Chain metrics hint that the final bottom may be near.

CRO price could be near a bottom

Crypto.com price may be a token worth adding to your watch list as the digital exchange shows an interesting set of information. The technicals show a slight uptick in volume amidst the 35% rally this summer. On August 20, the entire crypto market witnessed a sharp sell-off. CRO price lost 20% of its market value; however, the volume shows a very sparse amount of transactions. This could indicate that smart money is holding the digital currency despite the sell-off.

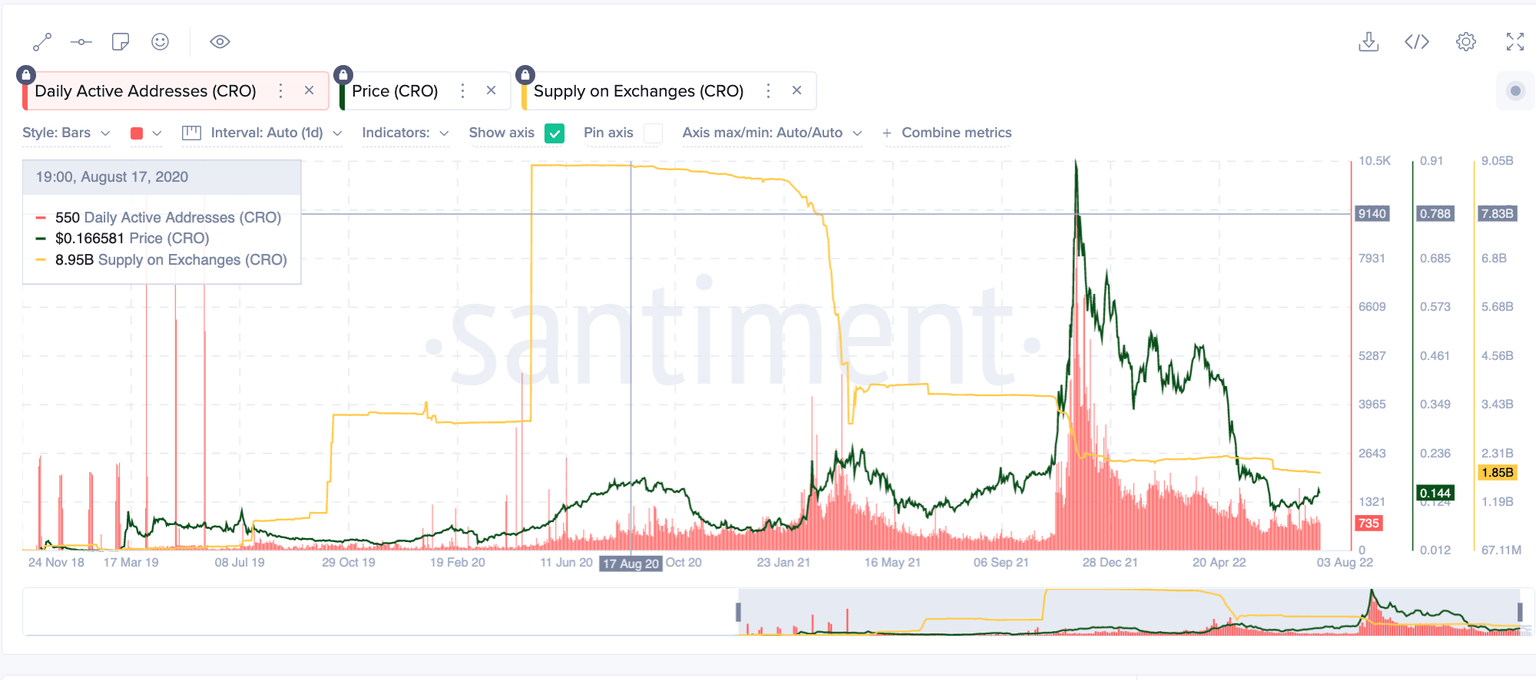

Crypto.com price currently auctions at $0.13. On-chain analysis tools confound the idea that CRO price may soon find a floor. Santiment’s daily active addresses have declined since the all-time highs occurred in December of 2021 at $0.59. Additionally, the Supply on Exchanges indicator shows a tapering effect as well. Currently, 1.85 billion tokens are on all exchanges, which is 8 billion less than when CRO traded less than a penny in 2020.

Santiment’s Supply on Echanges, Price, & Daily Active Addresses

When combined, CRO price could fool day traders in the coming days. Still, investors should consider a reactionary approach when dealing with the CRO price. The safest confirmation of gains will be a breach of $0.15. If the bulls can hurdle this barrier, they could induce a rally towards $0.26 in the short term, resulting in a near 100% increase from the current Crypto.com price.

In the following video, our analysts deep-dive into Bitcoin's price action, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.