Compound Price Analysis: COMP to release new cross-chain protocol, as breakdown to $150 looms

- Compound to launch a new blockchain protocol and a token in the first quarter of 2021.

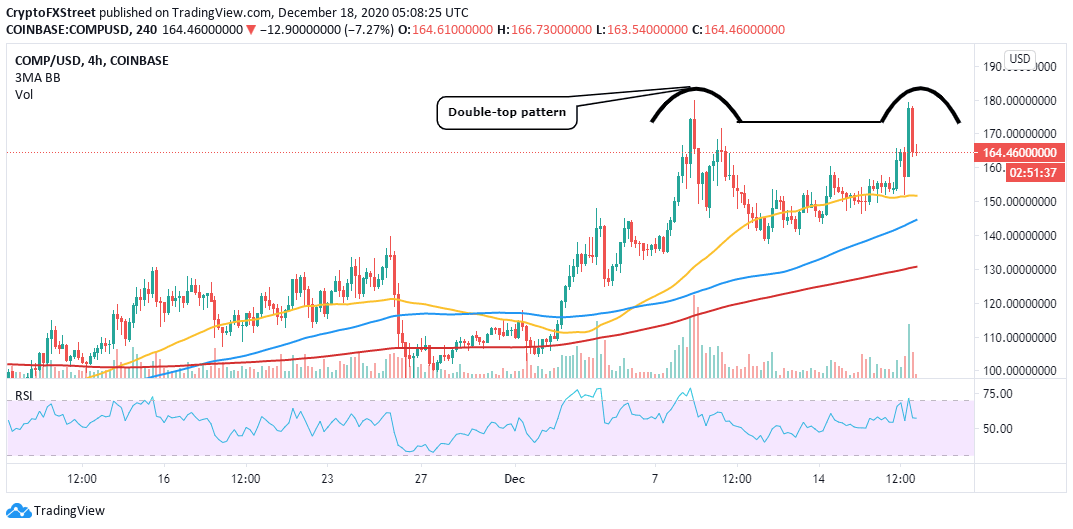

- COMP/USD falls under the impact of a double-top pattern aiming for support at $150.

Compound is holding firmly to the ground at $165 following an expected breakdown from $180, as discussed on Thursday. The bearish formation's impact appears to be getting stronger and could see COMP revisit support at $150 and $140, respectively.

The new Compound Chain will increase cross-chain asset support

Compound's development team has announced a white paper's release describing a new platform referred to as Compound Chain. According to the network, Compound Chain is a "distributed ledger" that will support the transfer of value as well as liquidity among peer ledgers. The new protocol aims to encompass more assets into the COMP ecosystem from multiple ledgers.

Compound Chain will allow users in the decentralized finance (DeFi) sector to borrow and lend from various blockchains while still on the same protocol. A new token will be launched native to Compound Chain called CASH.

The new token will be utilized in the payment of transaction fees on the platform. CASH and Compound Chain are expected to debut in the first quarter of 2021 after a limited-feature testnet has been developed.

Compound eyes retracement to $150

As mentioned earlier, COMP is trading at $165 as bulls hunt for a formidable support area. The 50 Simple Moving is in line to absorb the selling pressure around $150. Recovery from the current price level back to the double-top pattern at $180 is unlikely based on the low trading volume.

On the other hand, closing the day under $165 would trigger more sell orders as investors sell to cash out for profits. The breakdown may also revisit the primary support at $140 if the bearish momentum intensifies.

COMP/USD 4-hour chart

The IOMAP model by IntoTheBlock shows that resistance between $173 and $178 will continue to hamper growth in the near term. Previously, roughly 2,800 addresses bought about 133,000 COMP in the range.

On the downside, the most robust support lies between $147 and $157. Here, 7,600 addresses had previously purchased approximately 298,000 COMP. This shows that sellers have room to explore before recovery comes into the picture.

Compound IOMAP model

The bearish narrative will be discredited if it holds on to support at $ 165. Trading above the IOMAP resistance will place COMP on a trajectory to highs past $180, perhaps refresh the bullish outlook towards $200.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

-637438662485561518.png&w=1536&q=95)