Compound’s compensation plan for liquidated users fails to reach consensus but COMP bulls remain in control

- Compound price remains inside an hourly uptrend despite the failed proposal.

- The plan aimed to distribute COMP to affected users in DAI liquidations.

Compound is a decentralized blockchain protocol that allows users to lend and borrow cryptocurrencies. On November 26, due to an error or a malicious attack, the price of the dollar-pegged stablecoin DAI jumped 30%, forcing the liquidation of under-collateralized positions. The most recent proposal intended to compensate COMP users after DAI liquidations, paying out a total of 6,817,632.51 DAI in COMP tokens.

Compound price stays bullish as proposal fails

The proposal received 212,952 votes in favor and 681,290 against, which means it has failed. The distribution would have represented around 0.55% of the fully diluted COMP supply. It seems that bulls have benefited greatly from the failed plan as it means less selling pressure in the short-term.

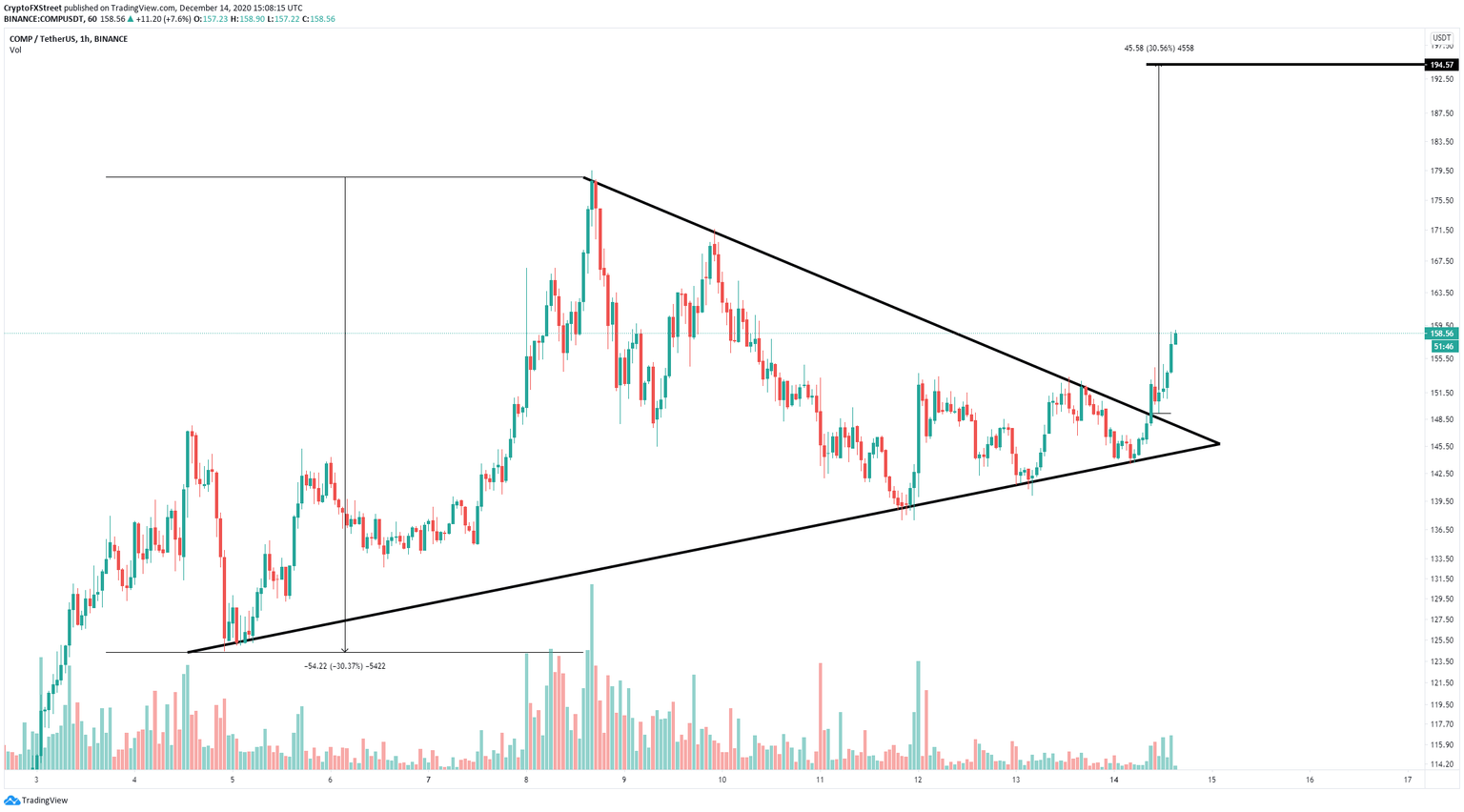

COMP/USD 1-hour chart

The digital asset is up by 5% in the past three hours and continues climbing higher. Compound price has climbed above a symmetrical triangle pattern on the 1-hour chart targeting a 30% rise to $194.

COMP IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows significant support below $158 and a strong resistance area between $158 and $163. A breakout above this point would quickly drive Compound price towards the next notable resistance area between $172 and $177.

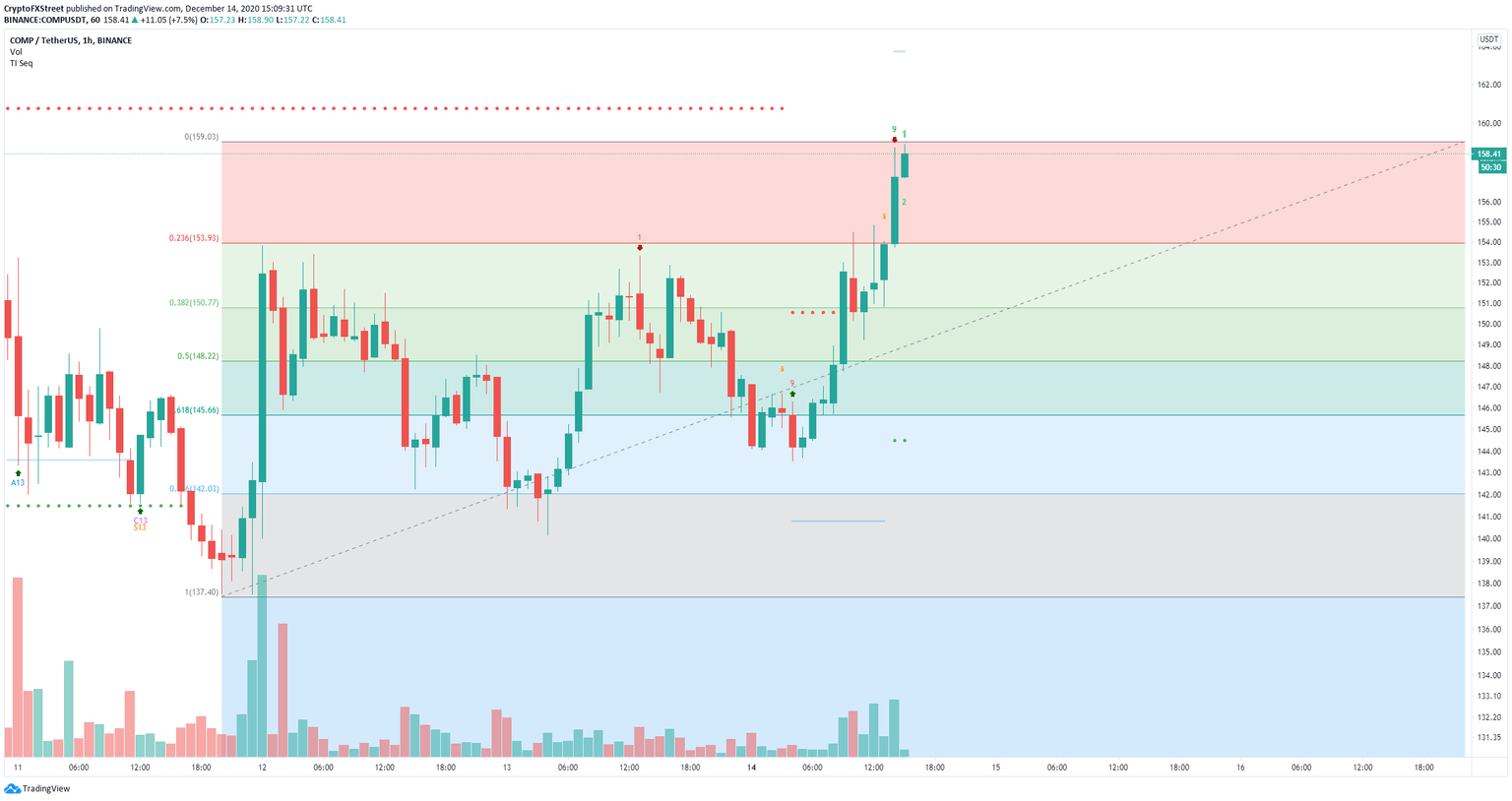

COMP/USD 1-hour chart

On the other hand, the TD Sequential indicator has just presented a sell signal on the 1-hour chart. Failure to hold the vital support area between $158 and $153 can push Compound price towards the 0.236 Fib retracement level at $153 and as low as the 0.5 Fib level at $148.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.